What is a 401(k)?

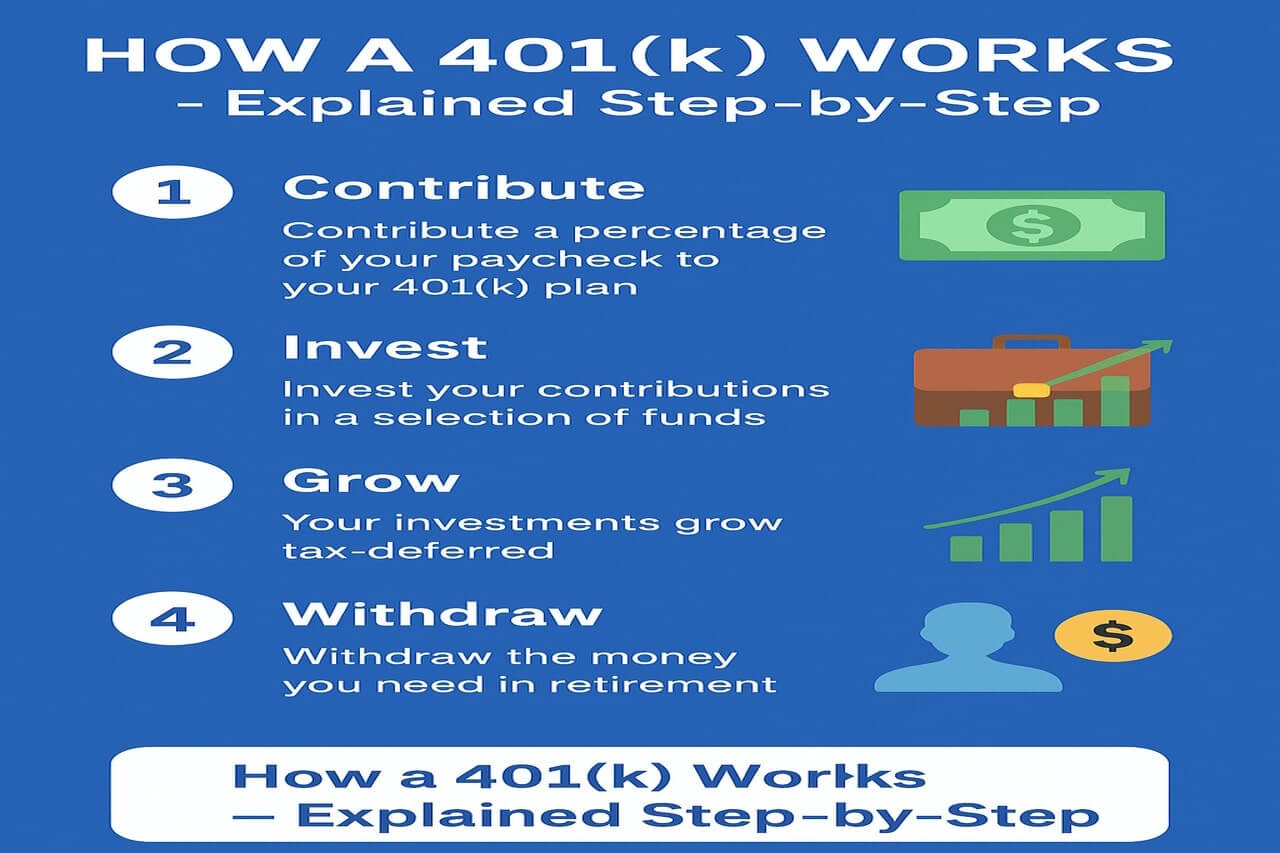

A 401(k) plan is a retirement savings account offered by employers in the United States. It allows employees to save and invest a portion of their paycheck before taxes are taken out, helping them grow their money faster over time. A 401(k) plan is an employer-sponsored retirement savings and investment account named after a section of the U.S. Internal Revenue Code.It is a defined-contribution plan in that the amount you have at retirement will depend on how much you (and possibly your employer) put into it and how efficiently your investments manage to grow. In simple terms, this is how it will work:- You decide how much of your paycheck you’ll be contributing, usually a percentage.

- Significant employers match a certain contribution for the worker.

- Invest through funds-for example, by mutual funds, ETFs, or bonds.

- Ultimately, you pay taxes whenever you withdraw money during retirement.

How 401(k) Work?

The brilliance of a 401(k) lies in its automated payroll deductions for contributions and its tax advantages in the contribution stages:- Automatic Payroll Deduction: Your chosen contribution value is automatically deducted from your paycheck. Therefore, you spend money before you even see it. Effortless and continuous saving.

- Tax Benefits: The value you contribute may, depending on the kind of 401k (Traditional or Roth), either lower your current taxable income or grow entirely tax-deferred.

- Tax-Deferred Growth: What sits within your 401k-stocks, bonds, and mutual funds grow, and you don’t pay taxes on the capital gains or dividends or interest until you take the money out in retirement. This is an enormous advantage that supercharges compounding.

Types of 401(k) Plans

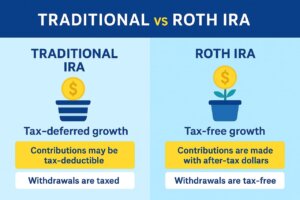

Generally, you need to select between two kinds of 401(k) at the time of enrollment, each of which has different tax benefits. The decision on the one that suits you best is primarily based on your opinion on the tax bracket you’ll be in when you retire. In fact, knowing the difference between Traditional and Roth 401(k) plans helps in boosting your decision-making capacities.1. Traditional 401(k)

- Current contributions to this are made before tax, thus lowering the taxable income in today’s terms.

- These taxes apply when one withdraws this money upon retirement.

- This type is appropriate if, in the future, you will be in a lower tax bracket.

2. Roth 401(k)

- Present contributions are post-tax, and no deduction is received at the moment.

- But then your withdrawals will all be tax-exempt when you retire.

- Great if you think you will be in a higher tax bracket in the future.

Traditional vs. Roth 401(k): Understanding the Difference

| Feature | Traditional 401(k) | Roth 401(k) |

| When Tax is Paid | When you withdraw the money in retirement. | When you contribute the money (you pay tax now). |

| Contributions | Made with pre-tax dollars (reduces your current taxable income). | Made with after-tax dollars (does not reduce current taxable income). |

| Withdrawals in Retirement | Taxable as ordinary income. | 100% Tax-Free (for qualified withdrawals). |

| Best For | People who think they are in a higher tax bracket now than they will be in retirement. | People who think they will be in a higher tax bracket in retirement than they are now. |

The Basic Building Blocks of a 401(k) Plan

A few key concepts govern how your 401(k) account is managed and how much of the money is truly yours.Maximizing Employer Matching Contributions (Free Money!)

Many employers offer to match a percentage of your contributions, up to a certain limit (matching 50% of your contributions up to 6% of your salary).The Golden Rule: Always put up at least that much to earn the match. There is free money-parents will give their children a 50 or 100 percent guaranteed return on that portion of their contribution.For example, if your employer were to match 100% of your contributions up to 4% of your salary, you would need to contribute $2,000 if you made $50,000, and then your company would match that with an additional $2,000, bringing your total to $4,000.Understanding Vesting Schedules

Your contributions are always 100 percent yours, but employer contributions (the match) may or may not be immediately 100 percent owned by you, since they may be subject to a vesting schedule. Vesting refers to the process of becoming entitled to the employer’s contributions in time.- Immediate Vesting: You own the employer match right away.

- Cliff Vesting: You are 0% vested for a fixed period (typically 1-3 years), and then you become 100% vested all at once.

- Graded Vesting: The percentage vested increases over time in an incremental manner. 20% vested after 2 years, 40% after 3 years, and so on, until you are 100% vested.

Understanding the Annual Contribution Limits

The IRS sets limits on how much you can contribute to your 401(k) each year. This limit is called the elective deferral limit.- Standard Limit: For 2024, the limit is $23,000.

- Catch-Up Contributions: If you are age 50 or older, you can contribute an additional amount (known as a catch-up contribution), which is $7,500 for 2024.

Making Investment Choices Within Your 401(k)

Your 401(k) is an account and not an investment per se. Hence, your task now is to choose where the money must go within the account. Most plans offer limited choices, usually within mutual funds.Most Investment Options

Target-Date Funds: Perhaps the easiest option. Just choose the fund with the closest year to your anticipated retirement (2055 Fund). The fund manager automatically adjusts the asset allocation from aggressive at first with more stocks, to conservative with more bonds as one approaches the target date.Index Funds: Funds with low fees that replicate a major stock index, such as the S&P 500. These provide an excellent, hands-off approach to long-term growth.Bond Funds: Invest in debt instruments that are lower risk, lower return, and suited for balancing a retirement portfolio. Action Items: Among the most vital things you can do is to log in and select your investments, especially after you finish enrolling. If you do not make investment decisions, you will probably default to the safest option: a money market fund. Defaulting to this option can seriously harm your return in the long run.When You Leave a Job

Leaving a job doesn’t mean leaving your retirement savings behind. You have four main options, known as a rollover:- Leave it: If the balance is above $5,000, you can leave it with your former employer. The money grows, but you cannot contribute to the account.

- Roll it over to a new 401(k): If your new employer offers a plan, you may consolidate the old funds there.

- Roll it over to an IRA: This is a great option, as you are generally afforded a wider variety of investment choices and less expense than in an employer-sponsored plan.

- Cash it out: Avoid this option! If you take a distribution before age 59½, you’ll generally pay income tax plus a 10% early withdrawal penalty. This is a major financial mistake that guts your savings.

Final Thoughts

A 401(k) is a tool that guarantees financial independence for you. Learn how a 401(k) plan works, make consistent contributions, and take advantage of the company match: that’s the formula for building a solid scaffolding for retirement security.The 401(k) plan is the cornerstone of retirement saving for most Americans. By understanding its mechanics—the tax benefits, the free money of the employer match, and the power of compound growth—you’re well-equipped to build a financially secure future. Don’t wait; start today, even with a small amount; the sooner, the better, so that you can give your money room to grow through compound interest.FAQs About Your 401(k) Plan

Here are quick answers to the most common questions participants have about their 401(k) retirement savings plan.Q1: What is compound interest, and why is it important in a 401(k)?Simply put, it is the interest on the money you earn from your principal investment, plus interest on the returns of prior periods. In a 401(k), the money you put in today earns interest, and next year you will earn interest on the contributions you made and the interest that you earned this year. Because this money grows tax-deferred for decades in a 401(k), compounding works continuously, thereby being the most potent agency of wealth generation for retirement.

Generally, no. Taking money out before age 59½ triggers a 10% early withdrawal penalty, according to the IRS (in addition to regular income tax). Nonetheless, there are some exceptions:

Financial hardship: Under certain situations, such as medical expenses, funeral costs, or to avoid eviction/foreclosure, some plans allow hardship withdrawals. These would generally still be subject to the penalty and income tax.

Separation from service: If you leave your job and are 55 or older in the year you leave (50 or older for public safety employees), you may take distributions from the plan without incurring the 10% penalty.

Loan from your 401(k): Some plans allow employees to borrow against their accounts, which must be paid back with interest.

A 401(k) loan allows you to borrow 50% of your vested balance (maximum $50,000) and repay it to your account, with interest.

The interest you pay goes back to your account. The downside: That money is no longer invested and therefore cannot participate in any market growth (the opportunity cost). Especially if you leave your job, the loan balance is due right away, or else it is treated as a taxable early withdrawal. Unless necessary, the consensus among financial advisors is to avoid a loan against your 401(k).

For most people, a long-term, hands-off approach works best. Excessive trading (timing the market) rarely pays off and often increases fees. Frequency of Review: At a minimum, review your 401(k) once a year (quarterly works better) to ensure that your contributions are being made correctly and that your investments are set to your target risk level. Rebalancing: Owing to the changing market valuations, your original allocation (80% stocks, 20% bonds) may start to deviate. You should rebalance back to your target allocation once every year or once every two years.

No, they are different accounts, though they share the “pay taxes now, withdraw tax-free later” structure: The difference really arises concerning: Contribution limits: A Roth 401(k) has the high annual elective deferral limit ($23,000 plus $7,500 catch-up for 2024), while a Roth IRA imposes much lower limits. Income limits: A Roth 401(k) has no limits preventing contributions based on income; a Roth IRA does impose such limits, beginning to phase out if income exceeds certain IRS thresholds. Withdrawal rules: In a Roth IRA, although not a Roth 401(k), funds can be withdrawn any time, tax and penalty-free, for contributions, but not earnings.