The whole meaning behind investment banking services often evokes Wall Street, billion-dollar deals, and the type of difficult financial talk. But investment banks do far more than just mergers and acquisitions for large corporations. They also play a vital role in raising capital, advising businesses, and even helping governments manage big financial projects.

In this guide, we’ll break down what investment banking services are, how they work, who uses them, and why they matter. At the end of it, you will understand how these services fit in with the global economy-and whether or not those services might be appropriate to your financial goals.

What Are Investment Banking Services?

Investment banking services are specialised financial services that help businesses, institutions, and governments raise money, make investments, acquire other companies, or sell parts of their business. Unlike regular banking, investment banks don’t deal with savings accounts or loans for individuals—they focus on high-value corporate transactions. At their core, investment banking services are specialised financial solutions that help companies, institutions, and governments. Their expertise helps companies navigate complex financial decisions, market volatility, and regulatory requirements.

These services are provided by major financial institutions such as:

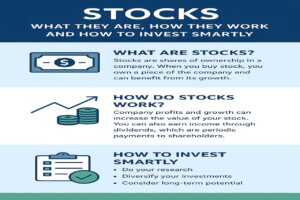

- Raise Capital – through equity (stocks) or debt (bonds).

- Advisory Services – offering strategic advice on mergers, acquisitions, and restructurings.

- Market Making & Trading – facilitating large transactions in securities and commodities.

- Research & Valuations – providing data-driven insights to guide investment decisions.

Retail banks deal with checking accounts and personal loans, and investment banks focus on large-scale financial transactions and long-term strategy.

Why are Investment Banking Services important?

Investment banks serve as a bridge between investors and companies seeking funding. Without them:

- Startups would struggle to go public.

- Corporations would face difficulties raising billions for expansion.

- Governments would lack partners for financing infrastructure projects.

In short, investment banking services keep the wheels of the economy moving by connecting capital with opportunity.

How Investment Banking Services Work

Investment banking acts as a bridge between investors and businesses. These banks help companies raise capital by connecting them with investors through equity, debt, and private investments.

Here’s a simple explanation:

- A business needs money to grow, expand, or acquire another company.

- Investment banks analyse the company, its market, financials, and goals.

- They recommend the best way to raise funds: stocks, bonds, loans, or selling ownership.

- They help structure the transaction, find investors, and negotiate terms.

- Finally, they put all that effort into making sure it is legal and goes as planned.

Think of an investment bank as a financial architect—designing the entire structure behind billion-dollar decisions.

Core Pillars of Investment Banking Services

The primary functions of an investment bank can be categorised into three main, high-stakes areas: Mergers & Acquisitions (M&A) Advisory, Capital Raising, and Securities Trading.

Mergers & Acquisitions (M&A) Advisory

The M&A division is arguably the most visible and complex area of investment banking. It involves advising clients on strategic transactions that fundamentally change the size, structure, or focus of a company.

Strategic Guidance for High-Stakes Deals

Investment bankers act as critical advisors throughout the entire M&A lifecycle, ensuring the client achieves maximum value and minimal risk.

- Buy-Side Advisory: When a company wants to acquire another, the investment bank identifies suitable targets, conducts detailed valuation analysis (like Discounted Cash Flow or DCF), performs due diligence, and ultimately negotiates the best purchase price and terms.

- Sell-Side Advisory: When a company wants to be sold, the bank prepares all marketing materials (the Confidential Information Memorandum or CIM), identifies potential buyers, manages the auction process to create competitive tension, and structures the deal to maximise shareholder returns.

- Deal Structuring and Negotiation: Bankers advise clients on the most efficient way to structure the transaction, whether as a cash purchase, all-stock swap, or combination. They lead negotiations between buyer and seller expectations.

Capital Raising and Underwriting Services

For companies that highly need large funding to expand, innovate, or just plain make debt payments, the investment bank’s role as a capital market intermediary is invaluable.

Providing Access to Global Funding

This service is all about connecting companies that need money (issuers) with investors who have money (institutions and the public).

- Equity Capital Markets (ECM): The best-known example is the Initial Public Offering (IPO). The banker acts as an underwriter, committing to buy the new issue from the company at a set price and then selling it to the public. They manage everything from pricing the shares to managing the roadshow with investors. They also deal with Follow-On Offerings (FPOs) for already public companies.

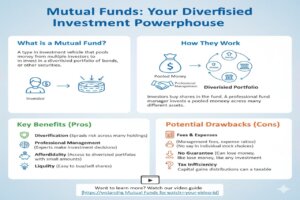

- Debt Capital Markets (DCM): This is helping clients to raise funding through debt issues, like corporate bonds. It includes advising DCMs on an optimal mix of debt, maturity dates, and coupon rates, which ultimately meets the company’s long-term financial strategy.

- Private Placements: For companies that are not yet public, investment bankers can arrange private funding rounds from specialised investors like private equity firms or venture capital funds.

Sales & Trading (S&T) and Research

While the advisory side focuses on transactional fees, the Sales & Trading division generates revenue through executing client orders and managing the firm’s inventory of securities.

- Market Making: Traders facilitate liquidity by standing ready to buy or sell securities, using the firm’s capital to bridge gaps between buyers and sellers.

- Institutional Sales: Salespeople connect institutional clients (like hedge funds and mutual funds) with the firm’s trading capabilities and new issue opportunities from the Capital Markets divisions.

- Equity and Credit Research: Research analysts play a crucial supporting role, providing in-depth analysis of companies, industries, and macroeconomic trends. Their reports are vital for the firm’s internal traders and are distributed externally to institutional clients, helping inform their investment decisions.

Beyond Transactions: Specialised Investment Banking Solutions

A modern investment bank offers an extensive range of advanced financial services to cater to specific corporate requirements, going far beyond basic M&As and fundraising.

Restructuring and Turnaround Advisory

When a company faces severe financial distress or even bankruptcy, investment bankers step in to provide critical restructuring advisory services.

- Debt Restructuring: Advising companies to restructure their existing debt by refinancing or reorganising to circumvent the default scenario, often involving a deal with creditors to change the repayment terms or convert some of the debts into company equity.

- Turnaround Strategy: Developing and executing a new operational and financial plan to restore profitability and stabilise the business.

- Debtor vs. Creditor Representation: The bank stands by the financially strapped company (debtor) in working out an amicable settlement arrangement or assists the creditors in recovering as much of the value as possible.

Financial Sponsor Coverage (Private Equity)

This specialised group within the bank focuses entirely on serving the needs of financial sponsors—namely, Private Equity (PE) firms. PE firms are constantly buying, optimising, and selling companies (portfolio companies).

Sponsor Coverage: Maintaining a high level of contact with PE funds to advise them mostly on potential acquisitions (LBO/Leveraged Buyouts), conduct the sale of their portfolio companies, and arrange the associated debt financing. The arrangements offer valuable recurring income to the bank.

Corporate valuation and fairness opinions

Accurate, objective valuation is foundational to nearly all investment banking activity, and sometimes it is a service provided independently.

- Independent Valuation: Banks are often hired to provide an independent assessment of a company’s or asset’s worth for tax, legal, or strategic planning purposes.

- Fairness Opinions: When it comes to contentious takeovers or large M&A transactions, the Board of Directors of a company may hire an independent investment bank to get a fairness opinion. This document says, whether from a financial angle, that the deal terms would be fair to the shareholders. This is viewed as legal cover and many due diligence measures.

The Essential Role of Risk and Compliance

One cannot talk about different investment banking services without recognising that risk management and regulatory compliance are the most fundamental requirements. As markets are highly regulated and very lucrative, these functions must be very robust, ensuring that the entire operation is supported.

- Risk Management: A division within the middle office that monitors and quantifies the financial risks associated with trading activities, underwriting commitments, and lending exposure. The department sets limits on capital exposure to prevent significant losses.

- Compliance and Regulation: Following the financial crisis of 2008, regulation has been on the rise. Compliance ensures that everything is in line with existing global regulations (such as the SEC in the US) and internal ethical standards, be this is with client transactions or public filings, or internal communication. They are the basis of information walling (or “Chinese Wall”) between internal M&A data and public-facing research to check any insider perceptions.

Who uses investment banking services?

Normatively, investment banking services are not aimed at the average saver:

The client base for Investment Banking Services is diverse and spans the globe.

- Corporations: Public and private companies of all sizes seeking to raise capital, pursue M&A, or manage their balance sheets.

- Governments: National, state, and local entities requiring financing for infrastructure or budgetary needs.

- Private Equity Firms: Companies that acquire and manage private businesses, operating largely through leverage and M&A.

- Hedge Funds & Institutional Investors: Getting the work done through the services of sales & trading, prime brokerage, and research.

The Role of Technology in Investment Banking Services

The industry has changed dramatically with fintech and AI:

- AI-driven analytics for faster valuations.

- Blockchain and digital assets are becoming part of capital markets.

- Automated trading systems for efficiency.

Investment finance is turning into a tech-driven industry, making services for its global clients faster, more accurate, and more accessible.

Pros and Cons of Investment Banking Services

Like any financial service, investment banking has strengths and challenges:

✅ Pros

- Access to large-scale capital.

- Expertise in strategic financial decisions.

- Global network of investors and opportunities.

❌ Cons

- High fees and commissions.

- Services tailored mainly for large corporations and institutions, not individuals.

- It can be complex and opaque for outsiders.

How to Choose the Right Investment Banking Services

If your business or institution is considering these services, here’s a checklist to guide your choice:

- Reputation & Track Record – Look at past deals and client success stories.

- Specialisation – Some firms are stronger in IPOs, others in M&A.

- Global Reach – Important if you operate internationally.

- Personalised Service – Customised advice beats generic strategies.

Top Investment Banks in the USA

Some of the most well-known investment banks providing these services include:

- Goldman Sachs

- J.P. Morgan Chase

- Morgan Stanley

- Citigroup

- Bank of America Merrill Lynch

These firms dominate global investment banking and are trusted by corporations and governments worldwide.

The bottom line

Investment Banking Services are the backbone of large-scale financial transactions, enabling companies to grow, industries to consolidate, and governments to fund essential projects. Through a combination of expert financial advisory, robust capital raising capabilities, and sophisticated market functions, investment banks remain integral to the functioning and evolution of global financial markets.

Investment Banking Services: (FAQs)

To clear some of the most basic doubts and concerns regarding the functions of an investment bank, we make an attempt to answer the most frequently asked questions.

Q1: How does an investment bank make money?

Investment banks make most of their money in the fee revenues generated by advisory services and commissions from trading.

Advisory Fees: These fees are charged for services in areas such as M&A, restructuring, and capital raising (for example, advising on an IPO). Such fees are usually charged as a percentage of the total transaction value.

Trading Revenues: These include commissions earned in executing trades for institutional clients (agency trading) and profits earned in trading for its own account (proprietary trading and market making).

Q2: What is the primary role of an investment bank in an Initial Public Offering (IPO)?

The main ones are underwriting and distribution. The investment bank acts as the underwriter when:

- Advisory: Advising the private company on valuation and timing.

- Structuring: Preparing the regulatory filings (S-1) and marketing materials (roadshow).

- Risk Acceptance: Buying the newly issued shares from the company (issuer) at a negotiated price and taking on the risk of selling them to institutional and retail investors.

- Distribution: Selling the shares to the public in order to allow the issuer to raise capital.

Q3: What is the difference between an investment bank and a commercial bank?

The core difference lies in their clientele and primary activities:

| Feature | Investment Bank | Commercial Bank |

| Clients | Corporations, Governments, Institutions | Individuals and Small/Medium Businesses |

| Main Activity | Advisory on complex transactions (M&A, IPOs) and capital raising. | Accepting deposits and providing loans (mortgages, business loans). |

| Goal | Facilitate large financial transactions. | Manage liquidity and credit risk. |

Q4: What does underwriting mean in the context of an IPO?

Underwriting is the process by which an investment bank undertakes the financial risk of a new security issue (like an IPO).

- The bank agrees to buy all the new shares from the issuing company at a predetermined price.

- Thereafter, the bank sells those shares to the public or to institutional investors.

This guarantees the company will receive a specific amount of capital, taking on the risk that the shares won’t be sold at the targeted price.

Q5: What is the difference between Equity Capital Markets (ECM) and Debt Capital Markets (DCM)?

The difference lies in the type of security issued to raise capital:

| Market | Security Type | Investor Relationship |

| ECM (Equity Capital Markets) | Stocks (Shares of Ownership) | Investors become part-owners; the company is not obligated to repay the capital. |

| DCM (Debt Capital Markets) | Bonds (Debt Instruments) | Investors become creditors; the company is obligated to repay the principal and interest. |

ECM raises equity (ownership); DCM raises debt (loans).

Q6: What is Leveraged Finance, and which type of client uses it most often?

Leveraged Finance is the area of investment banking which provides and arranges highly leveraged financing for a transaction, frequently described as a Leveraged Buyout (LBO).

- This area is predominantly used by Private Equity (PE) firms.

- PE firms use leveraged finance to aid in the acquisition of a target company, using a high amount of debt relative to equity to maximise their potential returns on investment.

Q7: What is the Fender Rule, and how did it change investment banking?

“Fender Rule” in banking regulation doesn’t really exist. The one that had a profound effect on the structure and risk-taking capacity of major investment banks after the 2008 financial crisis is the Volcker Rule (one part of the Dodd-Frank Act).

- Volcker Rule: Prohibits banks with retail deposits (insured by the FDIC) from proprietary trading-trading the bank’s capital strictly for speculative gains.

- Impact: Many investment banks were forced by this rule to either spin off their trading desks or severely reduce them, allowing them to refocus primarily on client-facing advisory and underwriting services.

Q8: What is the function of the “Sell-Side” vs. the “Buy-Side”?

Investment banks primarily represent the ‘Sell-Side, while their institutional clients represent the Buy-Side.

Sell-Side: Creating, underwriting, and selling securities (stocks, bonds) and advising companies.

Buy-Side: Buying the securities offered by the sell-side to manage investment portfolios.

The sell-side creates the products and advisory services; the buy-side consumes them.

Q9: Is a leveraged buyout (LBO) considered an Investment Banking Service?

Yes. A Leveraged Buy-Out (LBO) is a transaction in which the company is primarily acquired with borrowed money (debt). Investment banks play a major role in LBO transactions mainly in two ways:

- Advisory: They advise the Private Equity firm (the buyer) in the valuation and strategic fit for the target company.

- Financing: They arrange (underwrite and syndicate) the huge amounts of debt necessary to finance the transaction through their Debt Capital Markets (DCM) and Leveraged Finance groups.