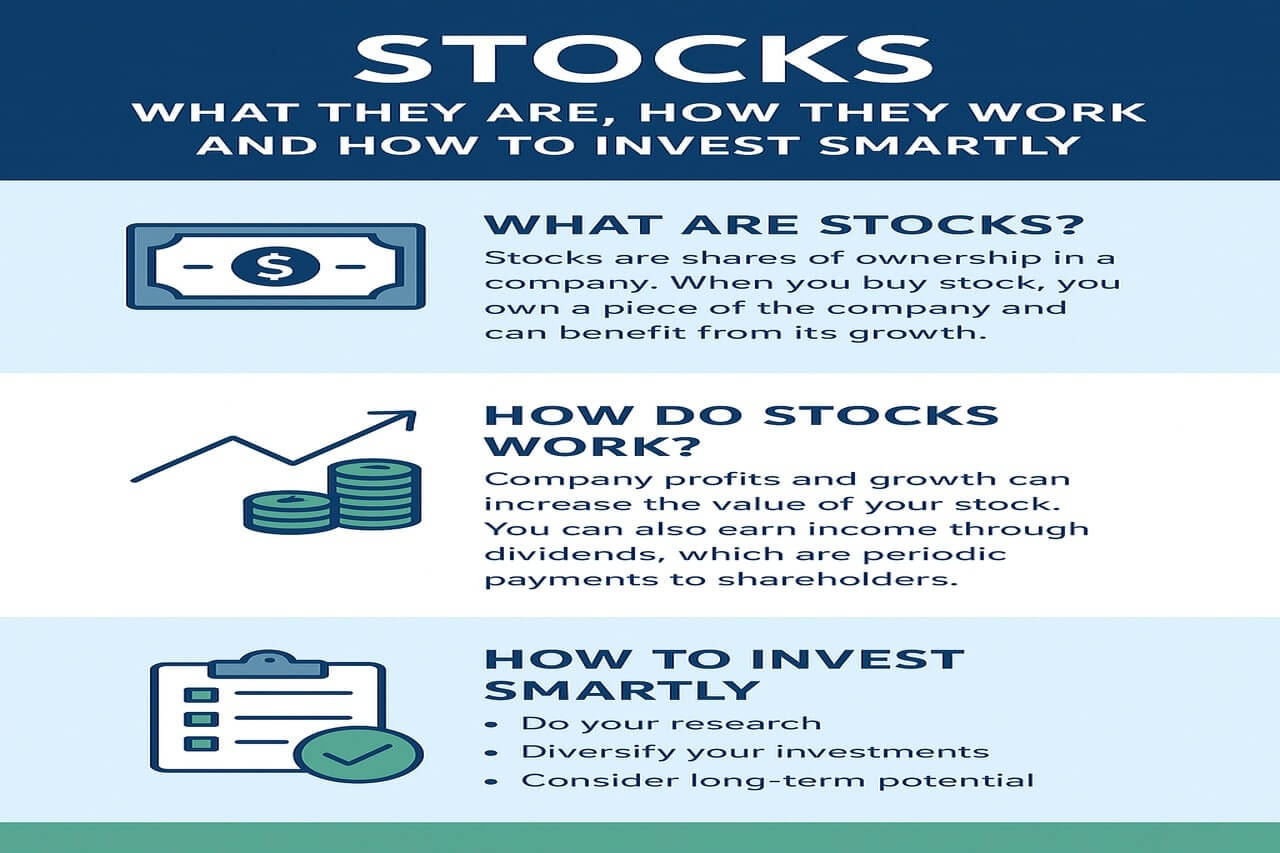

Investing in Stocks is the most direct and powerful way for any individual to participate in the growth and prosperity of the global economy. Basically, a stock, or share of equity, represents fractional ownership in a public company. When you buy stocks, you become a part-owner, gaining the potential to profit as that company grows, earns profits, and increases its value over time.

For investors seeking substantial long-term returns and wealth accumulation, understanding how to invest in stocks, the core types of stocks, and the risks involved is a fundamental skill for financial success. This comprehensive guide will walk you through the essential mechanics of stock ownership, analyze the key differences among various stock classifications, and prepare you to build a portfolio in which risk-proofing measures are combined with growth-focused strategies.

Stocks Explained – The Fundamentals of Equity Ownership

Before you place your first trade, it’s vital to grasp exactly what stock ownership entails and the two main ways you earn money from it.

1. What Exactly is a Share of Stock?

A share of stock is more than just a piece of paper or a digital entry in your brokerage account—it is a verifiable claim on the company’s assets and earnings.

Fractional Ownership: By owning one share, you gain a tiny stake in the entire company, granting you certain rights.

Limited Liability: As a shareholder, your liability is limited to the amount of money you invested. If the company incurs massive debt, you are not personally responsible for it.

Voting Rights: Usually, common shareholders possess rights that allow voting on comparable high-level decisions exercised by the company and board members during annual shareholder meetings.

2. The two ways to benefit from investing in Stocks

Investors primarily earn returns from stocks in two ways:

Capital Appreciation (Growth): In fact, this is the mode of return in most cases. Buy a stock at $50 and sell it later at $75 a share; then, you’ve increased your capital gain by $25. This happens when the company performs well, which increases demand for shares in the open marketplace.

Dividends: Distribution of earnings among shareholders through cash payments is a very typical consideration by mature, profitable companies for bringing shareholders into the picture. Thus, dividends allow this some kind of stability through cash flows.

Breaking down Stock Classifications (Market Cap and Type)

Not all stocks are created equal. They are divided by company size (market capitalization) and growth perspective, which determines their risk-and-return potential.

3. Stocks Categorized by Market Capitalization

This measure indicates the company’s size and maturity.

Large-Cap Stocks: Companies that have a market cap of above $10 billion (Apple, Microsoft).

Characteristics: Mature, stable, well-established, often pay dividends. Lower risk and lower growth potential than smaller companies.

Mid-Cap Stocks: Companies whose market caps are usually within the $2 billion-$10 billion range.

Characteristics: Generally experiencing strong growth yet balanced against stability, it registers with great growth potential.

Small-Cap Stocks: Companies with a market capitalization, typically, of between $300 million and $2 billion.

Characteristics: Young and very volatile; very much riskier but also the highest growth potential.

4. Common Stock vs. Preferred Stock

The vast majority of publicly traded shares are common stock, but preferred stock offers a different set of rights.

Common Stock: Standard ownership; carries voting rights and higher growth potential. However, dividend payments are not guaranteed, and common shareholders are last in line to be paid if the company goes bankrupt.

Preferred Stock: Proceeds no voting rights generally, but accords definite dividends (akin to a bond coupon). Preferred shareholders have a superior claim to the assets and earnings of the company compared with common shareholders, which offer higher safety but lower growth prospects.

5. Growth Stocks vs. Value Stocks

This discrimination dictates the basic investment thesis behind the stock.

Growth Stocks: An increase in earnings and revenue that takes place at a rate obviously above the average growth pace of the market.

Characteristics: Reinvest all earnings back into the business (no dividends), trade at higher valuations, and are associated with higher volatility (young tech companies).

Value Stocks: Companies that, as per market view, are undervalued in the market compared to what their intrinsic worth is (book value, earnings, dividends).

Characteristics: Mature companies, steady stocks, may pay dividends as well, and these are lower-risk, lower-volatility stocks (utilities or industrial companies).

Strategic investing in stocks and risk management

Discipline, diversification, and understanding market risk are the foundations of successful long-term stock investment.

6. Risk Minimization through Diversification

Diversification has established itself as the single best tool against the alleviation of risks present in stock investment.

What is Diversification? To spread your investments across different companies, sectors, and asset types, so that if one asset performs poorly, the severity of detriment to your entire portfolio is limited.

Avoid Single-Stock Risk: Always avoid investing all of your capital in just one or two companies. If the company were to fail, your portfolio would be wiped out.

Use Funds: Most investors achieve reasonable diversification by purchasing low-cost ETFs or Mutual Funds which hold hundreds, even thousands, of stocks (otherwise referred to as an entire stock market fund).

7. Risks of Investing in Individual Stocks

High returns are possible; however, so are acknowledged risks.

Market Risk (Systematic Risk): This is the risk that an entire downturn in the stock market occurs due to any factors such as economic recessions, wars, and pandemics. Such risk cannot be diversified upon.

Company Risk (Unsystematic Risks): This is the risk if a particular company runs into a situation and enters a danger zone of lawsuits or simply underperforms. Such risk can be diminished through diversification.

Volatility: Stock prices swing back and forth within a very short time, especially for small-cap and growth stocks.

8. A Long-Term Mindset for Investing

The most successful stock investors keep a long-term mindset to let time and compound work their gifts.

Time Horizon: Stock investing is for money that will not be required for about 5 years to 10 years.

Power of Compounding: When you reinvest dividends and capital gains into your investments, they begin to earn returns on their own, exponentially, over the decades.

Consistency over Timing: Putting a fixed amount of money into investments regularly (dollar-cost averaging) will generate steadily higher gains than trying to guess the best time to buy or sell the stock.

Way to Make Money from Stocks

There are two main ways to earn:

1. Capital Gains

When stock prices rise, your investment grows. Example: You buy at $50 → Stock rises to $80 → You earn $30 per share.

2. Dividends

A portion of the company’s profits is paid regularly. Dividends are great for:

- Retirement income

- Monthly cash flow

- Long-term wealth building

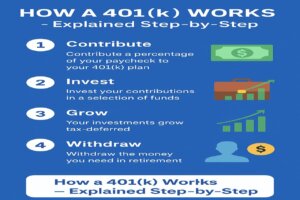

How to Start Investing in Stocks (Beginner Roadmap)

If you’re new to investing, follow this simple step-by-step guide:

Step 1: Open a Brokerage Account

Use platforms like:

- Charles Schwab

- Fidelity

- Robinhood

- E-TRADE

Step 2: Deposit Funds

Link your bank account and transfer money.

Step 3: Choose the Right Stocks

Look for companies with:

- Strong earnings

- Stable cash flow

- Low debt

- Positive long-term outlook

Step 4: Diversify Your Portfolio

Spread your money across:

- Different industries

- Growth and value stocks

- U.S. and international companies

Step 5: Invest Consistently

Use strategies like:

- Dollar-cost averaging

- Buying during dips

- Long-term holding

Risks of Investing in Stocks

All investments have some level of risk. Understanding them helps you make smart decisions.

- Market Volatility: Prices can rise or fall quickly.

- Company-Specific Risk: Poor performance or scandals can affect stock prices.

- Economic Risk: Inflation, interest rates, and recessions impact the markets.

- Emotional Investing: Fear and greed can lead to bad decisions.

- Solution: Stay informed, diversify, and think long-term.

Benefits of Investing in Stocks

Stocks are one of the supreme risk-mitigation tools. So despite the risk, investing in stocks has its benefits.

- High Growth Potential- Historically, stocks are expected to offer higher returns than Bonds, Savings accounts, CDs, Gold, etc.

- Ownership in a Company- You share in the successes of businesses in which you believe.

- Liquidity- You can buy or sell shares whenever the market is open.

- Passive Income- Dividend stocks are a constant source of income.

- Hedge against inflation- Return on stocks outpaces inflation.

How to Analyze Stocks Before Investing

Good research is key to smart investing. Use these tools:

1. Fundamental Analysis

Study the company’s:

- Revenue

- Earnings

- Profit margins

- Debt

- Management

2. Technical Analysis: Use charts and price patterns to predict movements.

3. News and Market Trends: Global events heavily influence stock prices.

Are Stocks Good for Beginners?

Absolutely-Stocks are accessible, cheap, and beginner-friendly. You fit the bill if you aim for:

- Long-term wealth

- Higher returns

- Passive income

- Financial independence

Start small, stay consistent, and grow your knowledge over time.

Common Stock Myths Busted

Myth 1: “You need $10k+ to start.”

Truth: Buy 0.01 share of anything.

Myth 2: “Stocks always crash.”

Truth: They always recover and hit new highs.

Myth 3: “You have to pick winners.”

Truth: Owning everything (VTI) beats almost all stock pickers.

Final Thoughts

Investing in stocks is not getting rich quickly; it is steadily building equity ownership in successful businesses. By understanding the fundamentals of equity, diversifying your holdings, and committing to a long-term strategy, you can harness the unparalleled potential of the stock market to achieve true financial independence.

FAQ on Investing in Stocks

Here are quick answers to the most common questions about Stocks and building an equity portfolio.

Q1. How to Buy Your First Stock in Under 10 Minutes?

- Open Fidelity, Vanguard, Schwab, or Robinhood (all free)

- Link your bank

- Search ticker (VOO, AAPL, JNJ, etc.)

- Buy whole or fractional shares ($5 or $5,000—doesn’t matter)

- Set up automatic investing ($50–$500/month)

- Turn on dividend reinvestment

- Go live your life

Q2. How many ways to Make Money with Stocks?

The Only 3 Ways to Make Money with Stocks:

- Price goes up (capital gains)

- The company pays you dividends (mailbox money)

- You sell shares later for more than you paid (the combo of 1 + 2)

Q3: What is the biggest difference between Common Stock and Preferred Stock?

The biggest difference lies in voting rights and dividend payment priority:

| Feature | Common Stock | Preferred Stock |

| Voting Rights | Yes, shareholders typically have voting rights. | No, shareholders typically do not have voting rights. |

| Dividends | Dividends are variable and not guaranteed. | Dividends are usually fixed and guaranteed (like bond coupons). |

| Liquidation Priority | Last in line to be paid if the company goes bankrupt. | Higher priority than common shareholders but lower than bondholders. |

| Growth Potential | Highest potential for capital appreciation. | Lower potential for appreciation; focused on stable income. |

Q4: What does Market Capitalization tell me about a stock?

The market capitalization, or Market Cap, measures the total market value of a company’s outstanding shares (calculated as Share Price multiplied by Shares Outstanding). Market Cap is the most important measure of a company’s size and level of maturity.

Large Cap (>\$10 Billion): These are generally considered stable, mature companies that have an established revenue stream. Generally, their risk is lower, but growth rates may be slower.

Small-Cap (<\$2 Billion): These companies are young and are expected to grow very fast. Highly volatile and risky, they are potential for higher returns.

Strategy: A well-diversified portfolio usually consists of a mix between large-cap (for stability) and mid/small-cap (for growth).

Q5: Why is diversification so critical when investing in individual stocks?

Consequently, diversification is important for protecting the portfolio against Company Specific Risk (Unsystematic Risk).

Suppose a major event impacts the price of the one company you own. The company has a big mishap or goes bankrupt. Your entire investment could be wiped out.

By diversifying your holdings across several industries, sectors, company sizes, etc., the poor performance of one stock can be compensated for by the good performance of others, which will stabilize your overall returns.

Q6: What is the major difference between a Growth Stock and a Value Stock?

The difference relates to the investment philosophies and what one expects from the company in question.

Growth Stocks: Corporations with high expected earnings prospect growth. They mostly pay low or no dividends since they reinvest all earnings into the business. Investors mainly seek capital appreciation as a form of return.

Value Stocks: Any corporation that, according to the market, appears to underperform on some key financial ratios mentioned (low P/E ratios, strong assets). They are mostly big, stable companies that might pay regular dividends. Investors seek return from a combination of dividends and eventual price correction.