If you’re looking to build long-term wealth or generate consistent passive income, understanding dividends is essential. Dividends are one of the simplest and most reliable ways for investors to grow their portfolios—without needing to trade frequently or take on high risk. In fact, dividend investing has been one of the most proven strategies for decades, helping people earn money even when the stock market slows down.

This guide breaks down everything you need to know about dividends: what they are, how they work, the different types, how companies pay dividends, and how you can build a strong dividend income strategy.

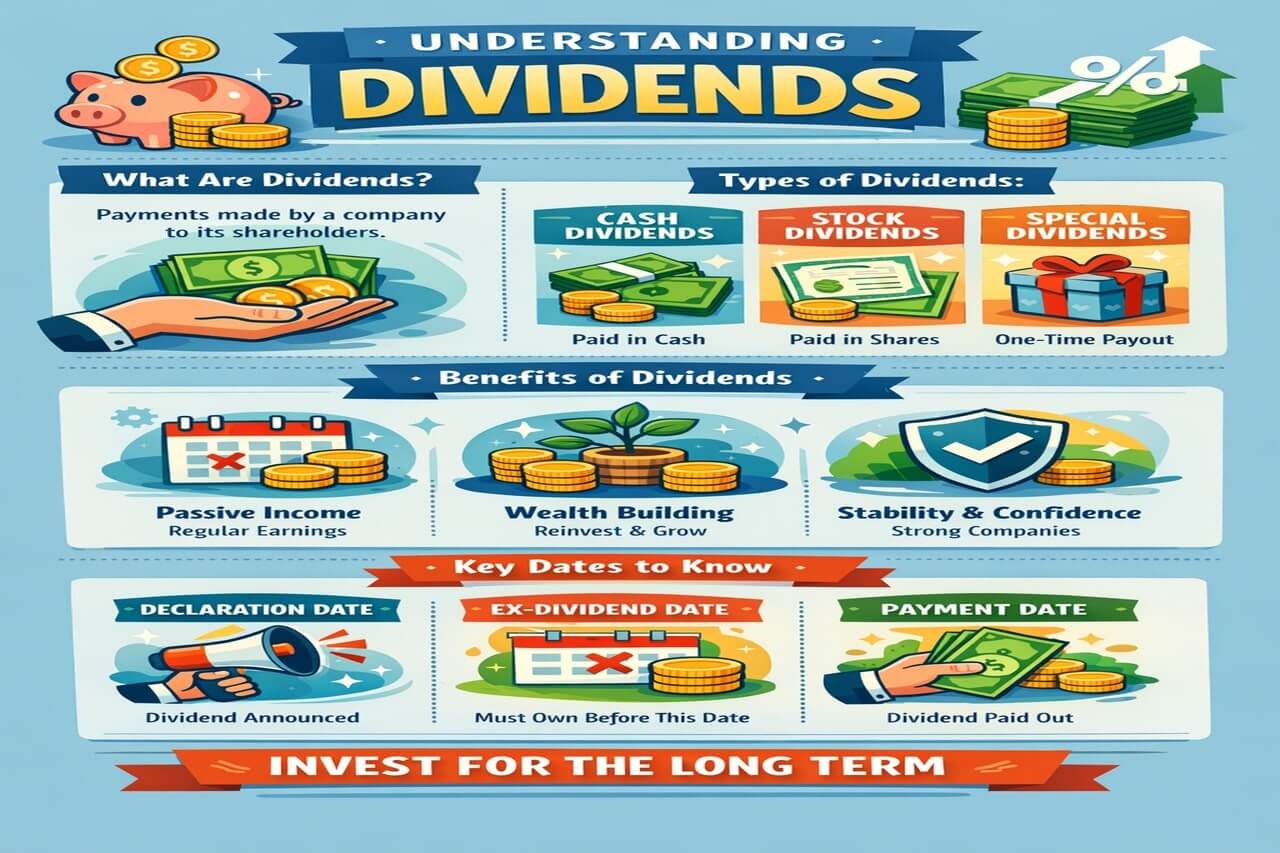

What Are Dividends?

Dividends are payments that companies make to their shareholders, usually from profits. Instead of keeping all the money they earn, some companies choose to share a portion with investors as a reward for owning their shares.

Dividends are most common among:

- Blue-chip companies

- Large, established corporations

- Real Estate Investment Trusts (REITs)

- Utility companies

- Finance and banking institutions

If you hold a dividend-paying stock, you can earn income without selling your shares—making dividends a powerful tool for passive income investors.

How Do Dividends Work?

To effectively invest in dividends, you must first understand their fundamental nature and the key dates involved in their distribution.

Dividends Explained: A Share of Profits for Shareholders

When the company makes a profit, the board of directors shall decide what to do with that money. They usually have two options:

Reinvest Earnings: Use the profits back into the business for growth (expansion, research and development, debt reduction).

Distribute to Shareholders: Pay out a portion of the profits to shareholders in the form of dividends.

Sign of Stability: Usually, companies with a record of paying dividends and increasing them are more established, are stable financially, and generate a regular cash flow.

Key Dividend Dates All Investors Must Know

It is necessary to understand the dividend timeline so that you’re certain of receiving this payment.

Declaration Date: The date the company’s board of directors announces the dividend, its amount, and the record date.

Ex-Dividend Date: This is the most critical date for investors. To receive the dividend, you must own the stock before the ex-dividend date. If you buy the stock on or after this date, the seller (the previous owner) receives the dividend. The stock price typically drops by the dividend amount on this date.

Record Date: The date the company’s records are checked to identify shareholders entitled to the dividend. You must be on the company’s books as of this date. (Usually two business days after the ex-dividend date).

Payment Date: The actual date on which the dividend is paid to shareholders.

Understanding Dividend Yield, Growth, and Types of Dividends

Not all dividends are alike. Intelligent dividend investing will involve looking beyond just raw yield.

Decoding Dividend Yield: Income vs. Risk

Dividend yield is a key metric, but it tells only part of the story.

Calculation: Dividend Yield = (Annual Dividend Per Share / Current Share Price) x 100

High Yield Trap: A very high dividend yield actually indicates a drop in share price reflection, and that usually indicates that the company is undergoing financial troubles that could lead to a dividend cut. Always investigate high yields carefully.

Sustainable Yield: Look for companies with a consistent reputation of making dividend payments with a fair payout ratio (dividends paid / earnings per share), which suggests that the dividend is sustainable.

The Power of Dividend Growth Investing

While a high initial yield is attractive, dividend growth often leads to superior long-term returns.

Rising Income Stream: Companies that keep increasing their dividend payouts to investors every day become a growing income stream, which keeps pace with inflation.

Sign of Health: A rising dividend signals management’s confidence in future earnings and cash flow growth.

Dividend Aristocrats/Kings: Companies that have increased their dividends for at least 25 or 50 consecutive years, respectively, are highly sought after for their reliability.

Types of Dividend Stocks for Your Portfolio

Different companies offer different dividend profiles.

Growth Stocks (Lower or No Dividends): Take the form of younger companies in fast-growing sectors (such as tech startups). Most profits are reinvested back into the business in order to fund growth.

Value/Income Stocks (Moderate to High Dividends): More mature companies and stable in well-established industries (utilities; consumer staples). They face fewer high-growth opportunities and so return more to the shareholders as dividends.

Dividend Growth Stocks: Companies that have a record of not just paying, but consistently increasing their dividends. Such companies usually have an income and appreciation component balanced.

Building a Dividend Portfolio and Tax Implications

Strategic portfolio construction and understanding tax rules are essential for maximizing your dividend income.

The Magic of Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) supercharge your compounding.

How it Works: Instead of receiving your dividend payment in cash, it is automatically used to buy more shares (or fractional shares) of the same company.

Compounding Effect: This accelerates the compounding process, as your future dividend payments will be based on a larger number of shares, leading to exponential growth over time.

Brokerage Option: Most online brokers offer free DRIPs for eligible stocks.

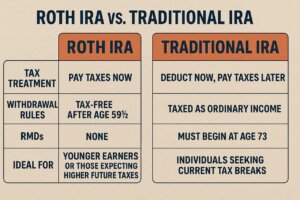

Tax Implications of Dividend Income

The way dividends are taxed depends on their classification and where they are held.

Qualified Dividends: These are generally from U.S. shareholders and held for a specific period. They receive preferential tax treatment for long-term capital gains at a lower rate (maximum 20%) compared to ordinary income tax rates.

Non-Qualified (Ordinary) Dividends: These include most dividends from REITs, some foreign companies, and those held for a period too short to qualify. They are taxed at your higher ordinary income tax rate.

Tax-Advantaged Accounts: Holding dividend stocks in a Roth IRA or 401(k) allows dividends to grow tax-free and be withdrawn tax-free in retirement. In a Traditional IRA or 401(k), they grow tax-deferred, meaning taxes are paid only upon withdrawal in retirement.

Building a Diversified Dividend Portfolio

A successful dividend portfolio requires diversification to manage risk.

Sector diversification: Don’t put all your dividend stocks in one industry. Diversify investments across sectors (utilities, healthcare, consumer staples, industrials, financials).

Company diversification: Hold stock in several high-quality dividend-paying companies.

Yield vs. growth balancing: Balancing high-yield income stocks with dividend growth stocks gives you a mix of current income and future appreciation.

Reinvestment Strategy: Adopt a clear view as to whether dividends will be reinvested for growth or taken as cash for income.

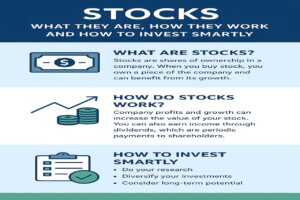

How to Start Earning Dividends as a Beginner

You don’t need thousands of dollars to get started. Anyone can begin investing in dividend-paying stocks by following a simple process.

1. Open a Brokerage Account

Choose platforms like:

- Robinhood

- E TRADE

- Fidelity

- Vanguard

- Schwab

2. Identify Strong Dividend Stocks

Look for:

- Consistent dividend history

- Low debt levels

- Healthy cash flow

- Dividend growth each year

3. Check the Dividend Payout Ratio

Payout Ratio = % of profits paid as dividends

A healthy payout ratio is 30%–60%.

Anything over 80% could be risky.

4. Diversify Your Portfolio

Mix different sectors such as:

- Real estate

- Utilities

- Tech

- Finance

- Consumer goods

5. Set up a DRIP (Dividend Reinvestment Plan)

Reinvesting dividends helps your portfolio grow faster through compound growth.

Benefits of Dividends

Dividend investing has many powerful advantages, especially for long-term investors.

- Consistent Passive Income: Just for holding shares, you earn money—no selling involved.

- Less Volatility: Dividend stocks are more or less stable and predictable.

- Support in Market Crisis: Dividends keep flowing even when ones go down.

- Aids in Retirement Planning: Many investors set up a portfolio that eventually pays their monthly expenses.

- Long-Term Wealth via Compounding: Reinvesting dividends gives a tremendous boost over time.

Disadvantages of Dividends

Dividends are good, but they are not perfect.

- Taxable Income: Cash dividends are taxed unless in a tax-advantaged account.

- Growth Slower Compared To Growth Stocks: Dividend companies may not reinvest themselves as aggressively.

- Dividends May Be Cut: Usually, if profits tumble, dividends are cut or suspended.

Are Dividends a Good Investment?

Yes, dividends are very good investments for anyone seeking to build long-term, steady passive income. They are extremely beneficial to:

- Beginners

- Retirees

- Long-term investors

- Individuals who require a reliable cash flow

Dividend investing blends stability, income, and long-term growth into one of the most effective wealth-building strategies in history.

Dividends vs Growth Stocks vs Bonds

| Feature | Dividend Stocks | Growth stocks (NVDA, TSLA) | Bonds |

| Average yield | 3–7% | 0–1% | 4–5% |

| Total return (10 yr) | 9–13% | 15–25% (if you pick right) | 3–6% |

| Sleep factor | High | Low | Highest |

| Income reliability | Very high | Zero | Guaranteed |

| Tax on income | 0–20% qualified | 20–37% short-term gains | Ordinary |

Bottom line

One of the wisest steps towards financial independence is understanding dividends. They offer a predictable source of income, diverse growth of one’s portfolio through price appreciation, and cumulative returns on investments in the long run.

Get into dividend investing, and your portfolio starts earning money while you sleep. It is a simple, proven, and stress-free way for beginners to start.

Investing in Dividends offers a very compelling way of creating long-term wealth by combining the regular income stream with opportunities for capital appreciation. By investing primarily in good companies that are financially sound, have a payout policy that is both sustainable and growing, and harness the power of reinvestment, you will be in charge of a durable portfolio designed to support your financial future.

FAQ on Dividend Investing

Here are quick answers to some of the most common questions regarding Dividends and building an income-related investment strategy.

Q1: What is a “Dividend Aristocrat” and why are they important?

A Dividend Aristocrat is a company in the S\&P 500 Index that not only pays a dividend but has increased that dividend every year for the last 25 consecutive years.

Importance: These companies show extreme financial stability and commitment toward keeping the shareholders happy through thick and thin, even during times of recession. They are often cornerstone holdings within the dividend-growth portfolio.

A “Dividend King” is an even rarer title for companies that have increased their dividend for 50+ consecutive years.

Q2: Does a high dividend yield imply a good buy?

No, an extremely high dividend yield (for ex., 8% or more) can be a red flag.

The High Yield Trap: A leap in dividend yield usually means a historic fall in stock price, and the significant drop becomes evident owing to concerns around potential insolvency, dwindling earnings, or heavy debt burdens.

Risk of a Cut: A high and economically illogical yield poses a higher risk of being cut or eliminated, something that almost always sends the stock price further down.

What to Check: Always look at the payout ratio and free cash flow to confirm the dividend is financially viable.

Q3: Qualified Dividends versus Ordinary Dividends: How are they taxed differently?

Tax treatment for dividends depends on classification by the IRS:

| Dividend Type | Tax Rate | Usual Source |

| Qualified Dividends | taxed at lower long-term capital gains tax rates(0%, 15%, or 20%) | Generally, shares of U.S. C-corporations held for the holding period required |

| Ordinary (Non-Qualified) | taxed at higher ordinary income tax rates(up to 37% | REITs, money-market funds, and dividends are held briefly. |

The tax burden on your dividend stocks will be nulled if held in a Roth IRA till tax-free withdrawal at retirement.

Q4: If I buy a stock on the ex-dividend date, will I receive the dividend?

No. To receive dividends, you must own the stock before the ex-dividend date.

The ex-dividend date is the cutoff. The dividend amount is not included in the stock price going forward. If you buy on or after the ex-dividend date, the previous holder gets the dividend payment.

Q5: What level of Payout Ratio is considered safe for a stable dividend-paying company?

The Payout Ratio (Dividends Paid / Earnings Per Share) is the percentage of earnings the company uses to pay the dividend.

Ideal Level: A stable, mature company with a payout ratio in the range of 40-60% is considered acceptable. This ratio indicates that earnings comfortably cover the dividend while still leaving cash for growth or a buffer of safety.

Red Flag: A payout ratio exceeding 80 to 90 percent on a sustained basis sends warning signals regarding the sustainability of the dividend, exposing it to cuts during economic downturns.