When it comes to planning for retirement, there are few tools as powerful and flexible as an Individual Retirement Account (IRA). An IRA is a specialized investment account designed by the government to help you save for the future with significant tax advantages. Whether you’re just starting your career or already thinking about your golden years, it really pays to understand how an IRA works can help you build long-term wealth while saving on taxes. In this guide, we’ll break down what an IRA is, how it works, the different types available, and how to choose the best one for your financial goals.

What Is an Individual Retirement Account (IRA)?

An Individual Retirement Account (IRA) is a type of tax-advantaged savings account designed to help you save for your retirement. An IRA lets your money grow tax-deferred or tax-free, depending on the particular type. That means your savings can compound faster over time, helping you reach your retirement goals sooner. Unlike a 401(k), which is offered through an employer, an IRA can be opened by anyone with earned income — giving you full control over your investments.

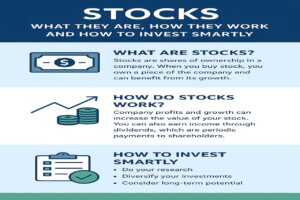

You can open an IRA with nearly any brokerage firm or bank then decide how it should be invested, which usually involves:

- Stocks and Bonds

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Certificates of Deposit (CDs)

Benefits of Having an IRA

There’s a reason IRAs are one of the most popular retirement tools in the U.S.:

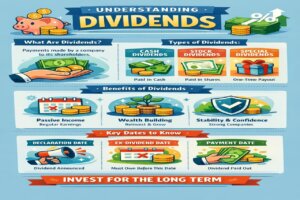

- Tax advantages – Grow your savings faster with tax-deferred or tax-free growth.

- Flexibility – Choose your own investments (stocks, ETFs, bonds, etc.).

- Control – Open an IRA with banks, brokers, or robo-advisors and tailor it to your strategy.

- Retirement security – Supplement your 401(k) or pension for a stronger financial future.

How Does an IRA Work?

Put money into your IRA account up until the IRS limits each year, invest that money in things like stocks, bonds, or mutual funds, then leave it there for it to grow over time until you’re in retirement and it is time to begin taking distributions, at which point all of the tax rules will apply.

Here’s a breakdown:

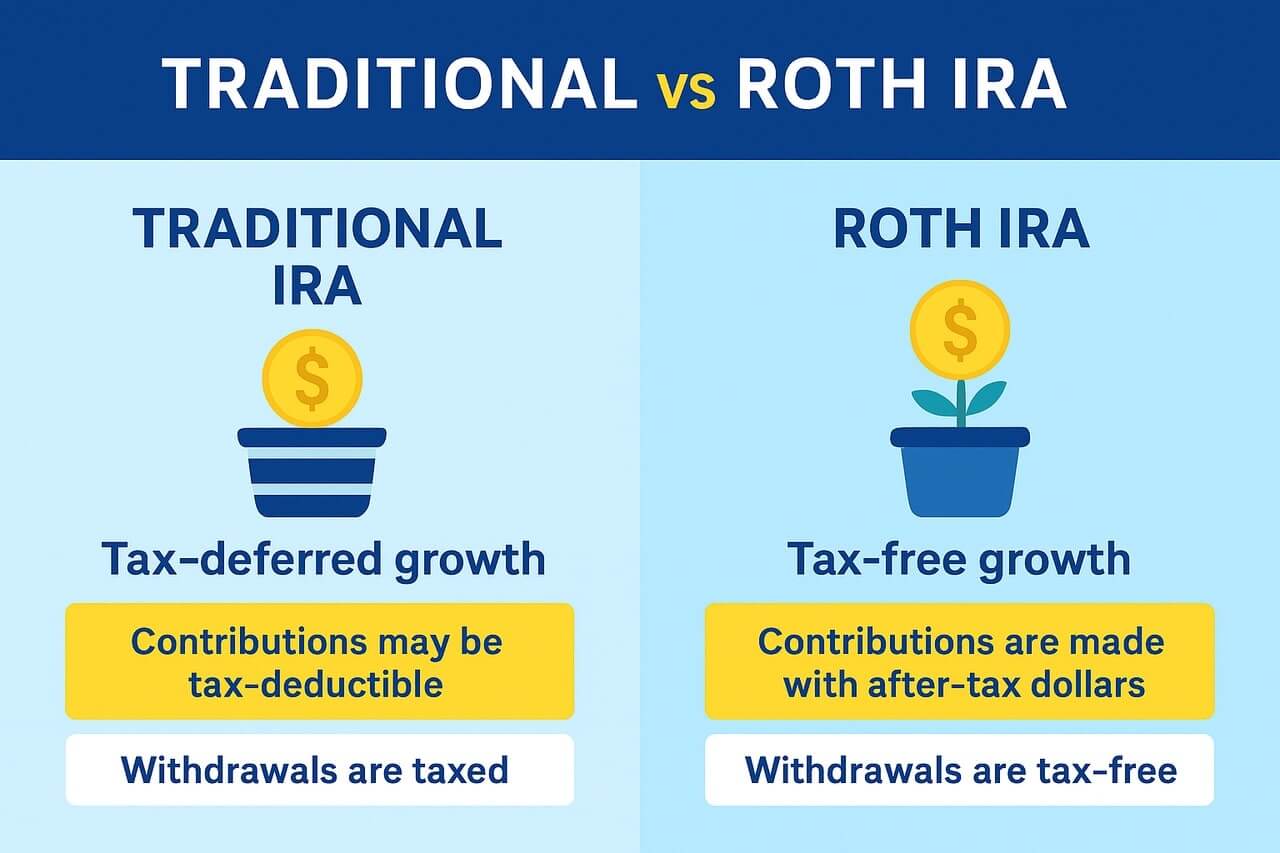

- Traditional IRA: Contributions are deductible from taxable income, but when withdrawals are made in retirement, the money will then be taxable.

- Roth IRA: On the other hand, you will pay taxes on your contribution now, but your withdrawals during retirement will be tax-free.

- SEP and SIMPLE IRAs: Such plans allow higher contributions and are specifically devised for small business owners and self-employed individuals.

The magic brought about by the IRA is compounded growth: the longer you wait and the more time you invest, the larger the multiplication of the money.

Types of Individual Retirement Accounts (IRAs)

There are four kinds of IRAs, each with different rules regarding eligibility, taxation, and withdrawals. These types include:

1. Traditional IRA

A Traditional IRA allows you to contribute pre-tax dollars, potentially lowering your taxable income for the year. Your earnings accumulate tax-deferred until retirement, when you’ll pay taxes on withdrawals.

Best for: People who expect to be in a lower tax bracket during retirement.

Key benefits:

- Tax-deductible contributions

- Tax-deferred benefit of additional growth assets

- Open wide access to investment options

2. Roth IRA

A Roth IRA flips the script — you contribute after-tax dollars, but your money grows tax-free, and withdrawals in retirement are also tax-free.

Best for: Younger savers or those expecting to be in a higher tax bracket later.

Key benefits:

- Withdrawals are tax-free during retirement

- There are no required minimum distributions (RMDs)

- Ideal for long-term growth

3. SEP IRA

A Simplified Employee Pension (SEP) IRA is for self-employed individuals or small business owners. It allows larger contributions compared to traditional IRAs.

Best for: Entrepreneurs and freelancers.

Key benefits:

- Higher contribution limits

- Easy to set up and maintain

- Employer-funded

4. SIMPLE IRA

A Savings Incentive Match Plan for Employees (SIMPLE IRA) is designed for fewer employees or small businesses.

Best for: Small business owners who want to offer a retirement plan without the complexity of a 401(k).

Key benefits:

- Employer and employee contributions

- Low administrative costs

Traditional IRA vs. Roth IRA: Which Is the Best for You?

When it comes to a Traditional IRA vs. a Roth IRA, it is partly a question of when you want to pay taxes: now or later. There is no cookie-cutter answer, so let’s break down the mechanics of both accounts.

The Traditional IRA: Pay Taxes Later (Tax Deduction Now)

The Traditional IRA operates on a tax-deferred model. This is generally the best choice if you expect to be in a lower tax bracket in retirement than you are right now.

- Tax Benefit Today: Your contributions may be tax-deductible in the year they are made, thus reducing current taxable income. This is a great way to lower your tax bill now.

- Growth: All your investment earnings grow tax-free. You don’t pay taxes each year on dividends, interest, or capital gains.

- Taxes in Retirement: When you withdraw the money in retirement (after age $59\frac{1}{2}$), the entire withdrawal—both your original contributions and all the growth is taxed as ordinary income.

- RMDs: You must start taking Required Minimum Distributions (RMDs) from the account once you reach a certain age (currently age 73).

The Roth IRA: Pay Taxes Now (Tax-Free Income Later)

The Roth IRA is the opposite, running on a tax-free model. This is often recommended if you believe you’ll be in a higher tax bracket in retirement than you are today.

- Tax Benefit Today: Contributions are made with after-tax dollars, meaning they are not tax-deductible. You get no immediate tax break.

- Growth: All your investment earnings grow 100% free of tax.

- Taxes in Retirement: Once you reach age $59\frac{1}{2}$ and the account has been open for at least five years, qualified withdrawals are completely tax-free and penalty-free. You pay zero taxes on decades of compounded growth!

- RMDs: The original owner of a Roth IRA is not subject to Required Minimum Distributions (RMDs) during their lifetime, allowing the money to grow tax-free indefinitely.

Navigating IRA Contribution Rules and Limits

The IRS has put very stringent rules regarding how much money you can contribute to an Individual Retirement Account in any one year. Quite evidently, these limits contribute to your overall contribution among all your Traditional and Roth IRAs put together.

Maximum Annual IRA Contribution Limits

For the tax year of 2024, the IRS set the maximum total contribution that can be made to your IRAs at $7,000 for an individual who is under 50 years of age.

- Catch-Up Contribution: If you are age 50 or older, you may make an additional $1,000 catch-up contribution, giving a maximum of $8,000.

- Earned Income Requirement: You must have taxable earned income (from a job or self-employment) that is at least equal to the amount you contribute. For example, if you earned $3,000, you can only contribute $3,000.

- Spousal IRA: If you and your spouse file a joint return, you may make the maximum contribution to an IRA for a spouse who has little or no compensation, even if they have no earned income, provided your combined taxable compensation is equal to the total contribution.

Income Limits for Roth IRA Contributions

Anyone with earned income can put money into a Traditional IRA. Still, Roth IRAs have specific income phase-outs depending on the individual’s Modified Adjusted Gross Income (MAGI) and tax filing status. If the income doesn’t meet the threshold, that will limit the contribution.

Why implement the limits? It is a government incentive for the massive tax-free benefits of the Roth IRA, largely focusing on the moderate and middle-income earners.

For High-Income People: If your income is too high for a direct Roth contribution, the “Backdoor Roth” can work. This involves making a non-deductible contribution to a Traditional IRA and immediately converting to Roth. (This is a complex strategy. Please consult a tax advisor.)

IRA Withdrawal Rules (Distributions)

The IRS lays out rules on when and how to access money because of these accounts’ generous tax benefits. The core rule is designed to keep the money locked up until you are retired.

The $59\frac{1}{2}$ Rule and the Early Withdrawal Penalty

Generally, if you take any distribution from any Traditional or Roth IRA before age $59\frac{1}{2}$, a 10% early withdrawal penalty applies to the taxable portion of that distribution, in addition to any applicable income tax.

However, there are several exceptions to the 10% penalty that allow you to access the money early:

- First-Time Home Purchase: Up to \$10,000 of the distribution can be penalty-free.

- Qualified Higher Education Expenses: For you, your children, or your grandchildren.

- Unreimbursed Medical Expenses: If they overstep 7.5% of your AGI (Adjusted Gross Income).

- Disability or Death of the IRA owner.

Roth IRAs’ Unique Contribution Withdrawal Perk

Another major benefit of a Roth IRA is that you may withdraw your original contributions at any time for any purpose without taxes and penalties. Since you already paid taxes when you deposited the funds, the IRS will make no stipulations on your accessing that principal. This makes the Roth IRA a great emergency savings account.

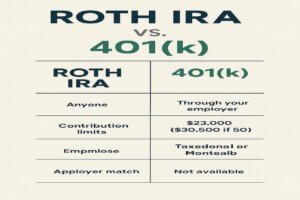

IRA vs. 401(k): What’s the Difference?

| Feature | IRA | 401(k) |

| Who offers it | Individual | Employer |

| Contribution limit (2025) | $7,000 | $23,000 |

| Investment choices | Flexible | Employer-selected |

| Tax benefits | Traditional or Roth | Traditional or Roth |

| Employer match | No | Often yes |

Both accounts can work beautifully together. Many people use a 401(k) for employer-matched savings and an IRA for extra tax benefits and flexibility.

The Ultimate Retirement Account Choice

Which is the best retirement account—Traditional or Roth? It comes down to anticipating your future tax bracket.

| Feature | Traditional IRA | Roth IRA |

| Tax Break | Tax deduction now | Tax-free withdrawals later |

| Contribution | Pre-tax or non-deductible | After-tax only |

| Withdrawals in Retirement | Taxed as ordinary income | 100% Tax-Free |

| Income Limit? | No limit to contribute | Yes, limits apply to contributions |

| RMDs | Required at age 73 | Not required for the original owner |

If you think your income will be substantially higher when you retire (higher tax bracket), a Roth IRA will generally be the clear winner. If you need a tax break now, though, and think your income will definitely be less later on, go with the Traditional IRA.

How to Open an IRA

Opening an IRA account will be one of the smartest financial moves you can ever make to start creating wealth. Don’t ever wait; even a small contribution, made consistently over time, can pile into a huge retirement benefit, thanks to tax-deferred compounding!

Opening an IRA is simple. Here’s how:

1. Choose a provider: Banks, online brokers, or robo-advisors.

2. Select your IRA type: Traditional or Roth, based on your tax goals.

3. Fund your account: Transfer money from your bank or roll over from another retirement plan.

4. Pick your investments: Choose from mutual funds, ETFs, stocks, or bonds.

5. Set up automatic contributions: Consistency builds wealth over time.

Smart Tips for Managing Your IRA

Start your investing as early as possible to maximize compound interest.

- Rebalance your investments annually.

- Take advantage of catch-up contributions after age 50.

- Avoid early withdrawals to protect your future savings.

- Consider consulting a financial advisor for personalized IRA strategies.

Final Thoughts: Why an IRA Is Worth It

An Individual Retirement Account (IRA) is one of the smartest tools to secure your financial future. Whether you prefer the tax-free growth of a Roth IRA or the tax-deductible benefits of a Traditional IRA, starting early and contributing consistently can make a massive difference by the time you retire.

Your retirement is your responsibility, and the best time to start planning is now. So, which type of IRA fits your financial goals?

Frequently Asked Questions (FAQs) About (IRAs)

Here are quick, concise answers to the most common questions people have when starting to use an Individual Retirement Account for the first time.

Q1: Can I have both an IRA and a 401(k)?

Yes indeed, and this is one of the best combinations for retirement savings! A 401 (k) is an employer-sponsored plan with large contribution limits, while an IRA is a personal account that you set up yourself with lower limits. You will want to maximize savings in the 401 (k) to get the full company match (if any), then any extra retirement savings go into the IRA, up to the limit for the year.

Q2: What is the Roth IRA “5-Year Rule”?

A Roth IRA 5-year rule says that after you open the Roth, it must be funded for at least five full years before any earnings may be pulled out income-tax-free and penalty-free. And this applies even if you pull out the earnings after age 59 1/2! The clock starts on Jan 1 of the tax year in which you make your first contribution (or conversion to a Roth). Note: Your contributions may be withdrawn without restriction.

Q3: What happens if I accidentally contribute too much money (an “excess contribution”)?

If you throw in more than the yearly limit, the excess amount is hit with a 6% excise tax by the IRS. This penalty is imposed for every year that the excess contribution sits in the account. You must remove the excess contribution (and any associated earnings) to avoid payment of that penalty by the tax filing deadline, including extensions, of that year.

Q4: If I leave my job, what should I do with my old 401(k)?

You can do a few things with your former employer’s 401(k):

Roll it into a Traditional IRA or Roth IRA: This is often the most accepted; it gives you more control over your investment choices and possibly lower fees. This is often called a Rollover IRA.

Keep it in your old employer’s plan: If the plan has great investment options and very low costs, you could take that route. Roll it over into your new employer’s 401(k) if your new plan permits incoming rollovers.

Q5: Can I contribute to an IRA for my child or grandchild?

Yes, so long as the child earns income (through a part-time job, self-employment, etc.) during the year, you may open a Custodial IRA on his or her behalf. The amount contributed cannot exceed the annual limit or the child’s total earned income for that year (whichever is lower). This is a great way to get them started tax-free!