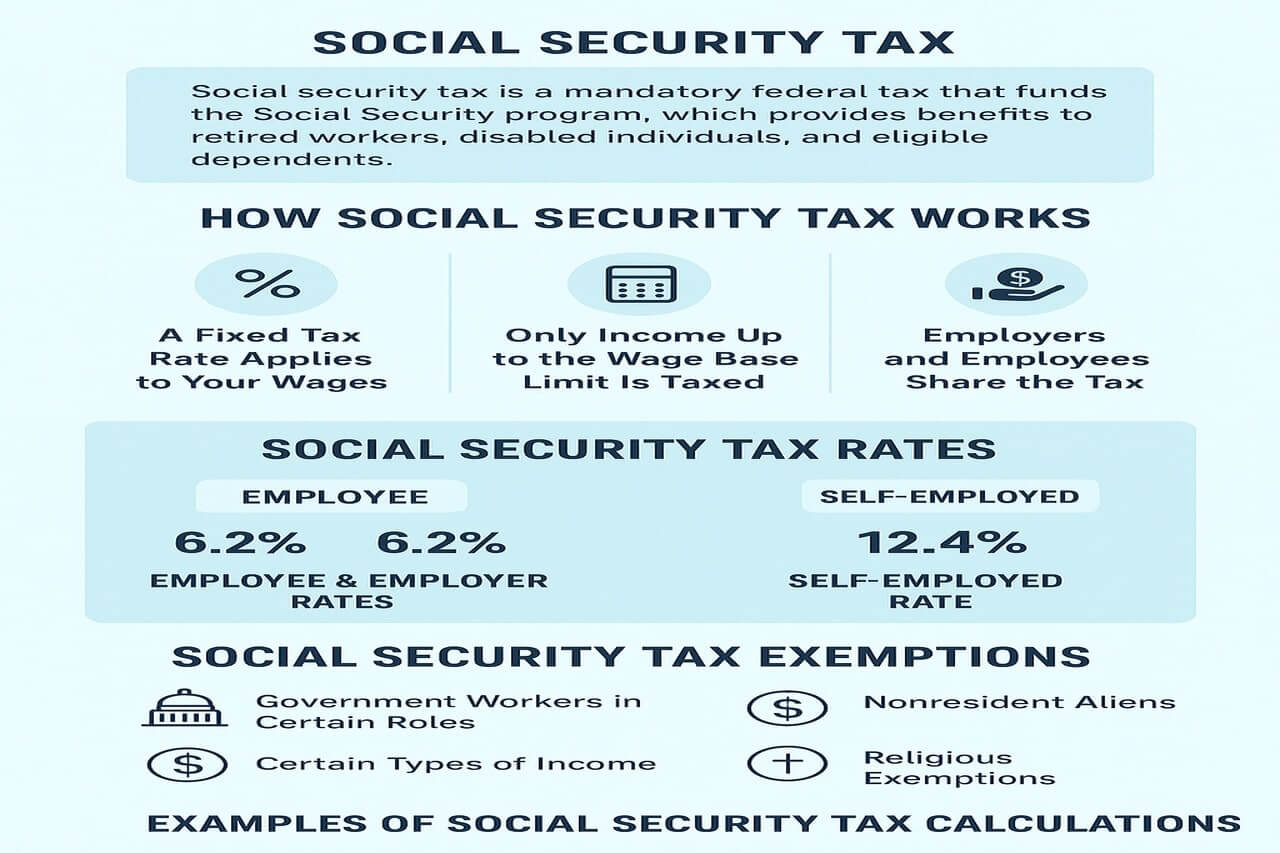

Social Security tax is a tax that includes employees, employers, and self-employed persons throughout the United States. It is an essential understanding of what it is all about for many people concerning taxes with regard to the United States. The Social Security tax funds one of the most important programs in the United States by providing the foundation for retirement income, disability benefits, and survivor benefits. This guide will break down what the tax is, how it works, current rates, exemptions, and give you clear examples to help you understand how it applies to your income.

What Are Social Security Taxes?

The federal social security tax is a part of mandatory federal taxation that funds the social security system and states benefits for retired workers, persons with disabilities, and their qualifying dependents. This tax is the employee part of the Federal Insurance Contributions Act (FICA) and the Self-Employment Contributions Act (SECA) for self-employed individuals.

Each pay period includes a deduction of Social Security tax. Employers contribute as well. There are self-employed persons and freelancers, and they pay their Social Security taxes through self-employment taxes.

In brief, these taxes all Americans, including you at retirement, to finance all those millions to achieve a sense of asset insulation.

Social Security Tax Definition and Core Purpose

The Social Security tax is a particular element of the federal payroll tax commonly referred to as the Federal Insurance Contributions Act (FICA) tax. This tax is earmarked directly for the Old Age, Survivors, and Disability Insurance (OASDI) program.

What Exactly is the Social Security Tax?

This tax is not optional; it is a mandatory contribution that directly supports millions of Americans.

- Mandatory Payroll Deduction: For many employees, it is automatically withheld from every paycheck.

- Pay-Cycle: Pay-as-you-go: newer workers fund retirees and other beneficiaries today.

Key Programs Supported:

- Retirement Benefits for eligible workers and their spouses/dependents

- Disability Benefits for workers who become disabled

- Survivors’ Benefits for surviving family members of deceased workers.

Tax Structure of Social Security

The law sets the Social Security tax rates, which are applicable only up to a certain income threshold.

- Employee’s share: From 2025, employees pay 6.2% of their gross wages.

- Employer’s Share: Employers also pay 6.2% of the employee’s gross wages.

- Total Rate: This makes for a combined 12.4% paid into Social Security for every dollar of eligible wages.

- Wage Base Limit (2025): There is a maximum amount of earnings subject to Social Security tax each year. For 2025, this limit is projected to be around \$174,900 (this figure is adjusted annually for inflation; the 2024 limit was \$168,600). Earnings above this wage base limit are not subject to Social Security tax.

How Social Security Tax Works for Employees and Self-Employed Individuals

Payments are made differently according to the type of employment status.

Social Security Tax for W-2 Employees

For most blank W-2 employees, 99% of the automatic process for social security tax deduction begins.

Shared Burden: Of the total 12.4%, half is paid by the employer, and the other half is paid by the employee. Example: If an employee earns \$1,000 in a pay period, \$62 (6.2%) is withheld from their paycheck, and the employer contributes another \$62.

Employers’ Liability: It is a legal obligation for employers to withhold the employee’s share and remit both their share and the employee’s share to the IRS.

“Reaching Wage Base Limit”: Once an employee’s total earnings for the year meet the annual wage base limit, Social Security tax is withheld from paychecks until the end of the year. Medicare tax (the other half of FICA) continues indefinitely.

Self-Employment Contributions Act (SECA) tax for the Self-Employed

If you’re working for yourself, you’re responsible for paying the “employee” and “employer” parts of the Social Security tax.

Combined Rate: Self-employed individuals are fully charged the 12.4% Social Security tax on net earnings from their businesses. This is commonly referred to as the SECA tax.

Deduction for One-Half: One-half of the SECA tax can be deducted from gross income before calculating AGI(Adjusted gross income) to the extent that self-employed individuals face some offset to this burden of paying both halves. The employer’s half is thus treated as a business expense.

Estimated Taxes: Self-employed individuals will remit SECA tax (along with income tax) throughout the year with quarterly estimated tax payments.

Important Exceptions and Considerations

However, most taxpayers are subject to mandatory provisions in certain situations that provide exemptions or special rules applying to Social Security taxes.

Common Exemptions from Social Security Tax

There are specific jobs or religious beliefs that might permit individuals to be “exempt” from the tax.

Religious Exemptions: Those who are members of certain recognized religious groups and are conscientiously opposed to accepting public or private insurance benefits (Social Security included) can apply for exemption from the SECA tax.

Non-Resident Aliens: Some specific types of non-resident aliens, especially those on certain visas (e.g., F-1, J-1, M-1, Q-1), are often not required to pay FICA taxes for earnings due to their visa status.

Certain Government Employees: Some federal, state, and local government employees are exempt from FICA taxes because they are covered by their particular retirement systems (and did not switch into Social Security).

Investment Income: Income that results only from investment (such as stock dividends, capital gains, or rental income) and not from any active trade or business generally is not included in income subject to Social Security tax.

The Wage Base Limit In Practical Examples

So this is how the wage base limit actually works in real life, especially in the case of high earners or multiple job holders:

Example 1: Single Job, High Earner:

- The employee earns $200,000 in 2025.

- The amount subject to Social Security tax is the first $174,900. The amount that is $25,000 ($200,000 – 174,900) is not subject to Social Security tax.

Example 2: Multiple Jobs (Overpayment Scenario):

- Person number A works for two jobs in 2025.

- Job A – $100,000; Job B – $100,000; Total income: $200,000

- Each employer withholds Social Security tax separately up to limits set above for $174,900, most likely resulting in overpayment in these circumstances (as both would withhold up to their respective limits until the employee hits the overall maximum).

To claim a refund for the extra Social Security tax deducted, the employee needs to ask for an excess tax on the federal return.

Benefits of Social Security Tax

As things currently stand, Social Security faces long-term financial issues as a result of generational changes (lower birth rates, longer lifespans).

Possible Modifications to Consider: When talking about future solvency, most people also talk about potential wage base changes (such as increasing it to bring more income into tax), changing the tax rate, or the full retirement age.

Retirement Planning Importance: Regardless of changes down the road, knowing what you are putting into and what you stand to get out of it is important to mastering the overall strategy for retirement planning. One can look up his individual Social Security statement on the SSA website to see his earnings record, as well as projections of future benefits.

The Social Security tax is the very core of the American financial landscape, affecting almost every paycheck of workers, and forms a cornerstone of the retirement and disability security plans. Knowing its definition, current rates, and how it applies throughout the earning spectrum allows one to navigate tax obligations while planning for their future.

Pros and Cons of Social Security Tax

Pros

- Guaranteed income after retirement.

- Provides financial protection in case of disability benefits.

- Provides support for beneficiaries and dependents.

- Employers share the burden of this tax with employees.

Cons

- Reduction in take-home pay.

- Pay the full 12.4 percent, unlike employed persons.

- The income cap means higher earners get proportionally less benefit.

- Not all contributions guarantee full benefits (it depends on work credits).

Bottom line

Understanding the context of the social security tax-its definition, rates, exemptions, and examples- economizes power in wealth management. Employee, employer, and entrepreneur alike need to understand how such a tax functions at a retirement income planning level, an accurate tax filing level, or for the avoidance of expensive mistakes.

FAQ on Social Security Tax

These are quick answers to the most common questions regarding the Social Security tax (OASDI part of FICA/SECA).

Q1: What is the official name for the Social Security tax?

Old-Age, Survivors, and Disability Insurance (OASDI) tax is the actual name of the Social Security tax. It is collected under the Federal Insurance Contributions Act (FICA) for both employees and employers, and the Self-Employed Contributions Act (SECA) for the self-employed.

Q2: What is the Social Security tax rate for an employee in 2026?

In the year 2026, the employee will pay a Social Security tax rate of 6.2 percent of his gross wages not exceeding the annual wage base limit. The employee will also pay an equal 6.2 percent, producing a collective contribution of 12.4 percent.

Q3: What is the Wage Base Limit, and why is it important?

The Wage Base Limit is the maximum amount of earnings to be taxed in relation to Social Security tax for a certain year.

Importance: Once an earner hits this limit (estimated to be around $174,900 for 2025), that individual pays no further Social Security tax on amounts made above that for the rest of the year.

Q4: What is the percentage of the Social Security tax that applies to me if I am self-employed?

Self-employed individuals pay the full 12.4 percent Social Security tax rate (the employee portion plus that of the employer) on their net self-employment earnings up to the wage base limit, as part of their SECA tax.

Tax Benefit: Self-employed individuals are allowed to deduct one-half (50 percent) of their SECA tax from their gross income on their tax return, reducing their taxable income.

Q5: What should I do if I pay too much Social Security tax by accident (I have 2 jobs)?

This happens when you have two or more jobs and the total earnings from the jobs exceed the Wage Base Limit. Each employer continues withholding the Social Security tax until the earnings at that specific job terminate, most of the time causing an overpayment for the employee.

You claim the excess Social Security tax paid as a refundable credit when you file your annual federal income tax return (Form 1040). Your employers cannot refund this money directly to you.