Long-term investments are a highly dependable method of developing financial assets through consistent growth over extended durations. It potentially has higher returns than the short-term investment options. Everyone needs to understand the best long-term investment strategy because this knowledge allows them to create financial plans for retirement, education expenses, or savings goals. The following explores twelve effective and best long-term investment strategies, detailing their productive elements and how to utilize them to reach financial ambitions.

Investment is one of the best ways to secure your financial future and the best long-term investment strategy you need to follow. You do not need to feel afraid when you start investing. You need to gather knowledge about what is the best long-term investment strategy. Patience, knowledge, and consistent effort can enable you to make your funds productive through the time effect. The following section examines the most effective investments that deserve consideration.

What is a long-term investment?

Long-term investment is usually a game of patience because you need to wait a long time to see your rewards. This strategy may be held for more than one year to five years. Investors must be able to take on risk while their assets grow during their time in the market for better returns.

What is the best long-term investment strategy?

To choose the best long-term investment options, you need to know about all of these strategies. Here are the 12 best long-term investment strategies:

1. Stock Market

The stock market presents itself as an enduring and lucrative market for long-term investment opportunities. When you buy company shares, you obtain ownership shares that produce profit growth benefits. The stock market typically delivers yearly returns ranging from 7% to 10%, considering inflation after historical analysis.

This strategy works well because the market performs consistent fluctuations that produce beneficial returns for investors who wait patiently.

To minimize risks, spread your investment funds into different business sectors while expanding across industry sectors.

2. Government bonds

Government bonds are a safe and reliable investment for long-term investors. Under low-risk investment options, government bonds stand as a solid and safe financial instrument. The government’s bonds deliver a dependable financial growth strategy with capital preservation benefits for people who are starting their investment journey or aiming to expand their portfolio.

Understanding the basic nature of government bonds makes the definition clear: financial loans to the government, which generate steady interest payments during established time frames. After the selected period of bond maturity, the investor retrieves their complete initial contribution free of any deductions. The government backing protects these bonds against significant losses, so they serve as a solid selection for investors who prefer safe investments.

Multiple government bonds exist, such as Treasury bonds, municipal bonds, and savings bonds, which have distinctive interest rates coupled with different periods of maturity. Government bonds provide the most suitable instrument for investors who need financing solutions for retirement planning and large purchases. Some government bonds include tax advantages along with their already attractive feature, which makes them desirable investments.

Government bonds are a low-risk investment option that offers steady income. Before investing in the stable financial assets of tomorrow, you should begin exploring bond options.

3. Corporate bonds

The market offers corporate bonds as an investment option, which could be considered a wise financial choice. Many investors who focus on stocks should consider corporate bonds as a reliable portfolio-diversification tool that delivers steady financial returns. A corporate bond acts as an investor loan that companies obtain by making regular interest payments and returning the initial loan sum when maturity arrives.

The investment in corporate bonds lets businesses secure funding for their growth and operational needs and debt restructuring through lower-risk instruments than stock market investments.

The main benefit of corporate bond investment relies on its established revenue stream. The stable fixed or variable interest payments on bonds attract investors interested in financial stability because stocks experience unpredictable value variations.

Each corporate bond possesses different characteristics due to varying conditions of investment. Corporate bonds include diverse risk categories, starting at highly-rated investment-grade bonds that fetch higher returns alongside their elevated risk exposure.

Potential investors need to analyze three primary elements for corporate bonds: company financial health combined with rates of interest, and credit ratings of the issuer. Proper research combined with diverse investments will result in steady returns while maintaining risk management solutions.

4. Growth stocks

Investing in growth stocks becomes a sound decision for creating future wealth because these stocks allow companies to grow, which drives stock prices upward.

The investment strategy of growth stocks delivers significant advantages for those who seek permanent enhancement of their wealth. International companies issuing their stocks offer investors the opportunity to participate in their rapid expansion, especially within technology-based and healthcare-based industries, as well as e-commerce markets. The earnings of growth stocks go back into company growth, which progressively raises the stock market value.

Growth stocks deliver significant investment returns to investors, yet they entail a certain degree of uncertainty. Investors depend on increasing stock values through these companies because the companies direct their profits toward reinvestment instead of dividend distribution. The companies Apple and Amazon, along with Tesla, began as growth stocks that supplied substantial profits to their initial shareholders.

Real investment success requires analysis of market developments alongside the financial stability of potential companies. The implementation of long-term investment strategies allows investors to mitigate volatility risks in growth stocks so they can achieve maximum profits.

All investors, including beginners, will probably benefit from including high-potential growth stocks in their portfolios, leading to future wealth accumulation. Read market data carefully and expand your investments across different assets so you can achieve optimal investment outcomes.

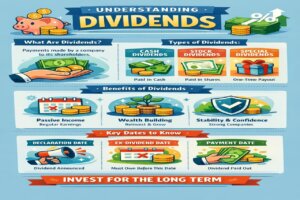

5. Dividend stocks

Dividend stocks are a smart way to build passive income for any investor with regular income in the form of dividends, making them an attractive option for long-term investors who want both income and growth. Your search ends here for wealth creation through passive income because “dividend stocks” represent an ideal investment option. The cash payments from “dividend-paying stocks” provide investors with financial rewards in addition to price appreciation, making them the preferred choice for long-term financial stability.

Organizations that distribute dividends displayed solid financial standing and consistent earnings records in the past. The utility sector, together with healthcare as well as consumer products categories, contains stocks that maintain steady profits, which investors can use to generate cash. The investment in “high-yield dividend stocks” enables shareholders to distribute their earnings through a “dividend reinvestment plan (DRIP)” while receiving passive cash flow from those dividends.

When selecting dividend growth stocks, investors must review the history of dividend growth at the company. The dividends paid out by reliable blue-chip stocks that maintain consistent payments deliver regular income, together with promising asset value increases. Your portfolio needs diverse stock investments because unsustainable dividend yields should be avoided.

Investors who want to build their retirement fund or increase their revenue can pursue dividend stocks as they provide reliable investment opportunities with minimal risk. You should begin searching for the top dividend stocks at this moment to build a secure financial future for yourself.

6. Stock funds

Making investments becomes challenging because numerous choices exist within the market. The simplest strategy for new investors is to use stock funds. Stock funds present investors with an approach to obtain stock market exposure by combining the benefits of convenience and affordability while avoiding individual stock selection.

A stock fund gathers funds from many investors to purchase investment stocks in a wide range of companies. Stock funds enable professionals to provide active management, or they follow indexes such as the “S&P 500” through passive tracking. By holding a fund of stocks, you automatically gain protection from exorbitant risks stemming from individual stock investments.

Investment options within stock funds operate through index funds, mutual funds, and exchange-traded funds (ETFs), which function according to different investment plans and risk tolerance systems. Every investment goal has its perfect fund match among the array of options available, which include growth stock funds along with dividend stock funds, also welcoming international market participants.

The process of investment into stock funds stands as one of the best decisions for bringing about sustained wealth generation. Through their offering, investors have quick access to stocks while providing expert management services combined with reduced risks compared to buying specific shares. Research the best stock funds at this moment to develop your financial assets effectively.

7. Bond funds

Bond Funds provide prudent investment opportunities that supply financial stability to investors. The investment option of bond funds presents a suitable choice when you want profitable money growth with minimized exposure to risks. Bond funds accept money from various investors to purchase diverse portfolios, which consist of bonds that serve as loans to governments along corporations. The stable and predictable returns that bonds offer, together with their steady cash flow, make them the preferred investment vehicle for both conservative risk-takers and people close to retirement.

The primary advantage of placing your money in bond funds is obtaining wider diversification. Bond funds contain numerous bonds that work together to mitigate the impact of any defaulting bond. The regular interest distributions from bond funds enable investors to obtain dependable cash flows.

Investors must check all relevant aspects, including interest rates and fees, as well as personal financial objectives, before making investment decisions. Bond prices react to interest rate changes; thus, your selection of a bond fund needs to match your risk tolerance level. Bond funds are suitable for both inexperienced investors and experts because they offer a balanced investment system for achieving long-term financial stability.

8. Real Estate

Real Estate Investment Trusts (REITs) stand as an intelligent system to acquire ownership of property. Standing as an alternative to direct physical property purchases, real estate investment exists. Real Estate Investment Trusts (REITs) provide people who want real estate benefits through easier and less complex methods. Regular investors can obtain property income by using REITs, although they do not need to handle real estate ownership personally. Income-generating properties, including apartments and office buildings, shopping centers, as well as hotels, are owned or operated, or financed by these businesses.

The significant benefit of purchasing REITs lies in their regular income distribution capability. Because most REIT organizations need to distribute 90% of taxable income through dividends, investors find them appealing for achieving a stable dividend yield. REITs provide ongoing income generation by investing their funds in various kinds of properties throughout different sectors, which diminishes risks.

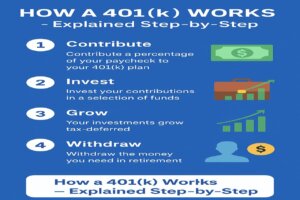

9. Retirement Accounts (401(k) and IRAs)

Contributing to a retirement account like a 401(k) or an Individual Retirement Account (IRA) is one of the smartest long-term investment strategies. These accounts offer tax advantages that help your money grow faster and save your money for your retirement.

Your retirement savings become simpler to grow over time by using an Individual Retirement Account (IRA). IRA stands as a tax-optimized investment vehicle made to enable individuals to save retirement funds. People at every stage of their careers should consider IRA investment as it establishes lasting financial protection in their retirement years.

IRAs exist in two primary categories, which include Traditional IRAs together with Roth IRAs. Traditional IRA participants can lower their current tax burden by contributing pre-tax income, although their withdrawal funds will be taxable during retirement.

A Roth IRA enables users to place post-tax dollar contributions into it because this allows tax-free growth while eliminating retirement withdrawal taxes. Your retirement planning benefits will differ depending on whether you select a Traditional IRA or a Roth IRA based on your unique financial needs and retirement ambitions.

The best part of an IRA does not require large sums of money. Several financial organizations enable account opening with minimal deposits from their customers. A consistent investment strategy allows you to establish a secure retirement fund through well-planned financial decisions.

10. Index Funds

Index funds are a type of mutual fund or ETF designed to track the overall performance of a specific index, like the S&P 500. They’re an excellent choice for investors seeking long-term growth with minimal effort. Index funds offer investors a basic yet efficient way to invest their finances.

People find investing difficult because numerous choices exist. Index funds demonstrate themselves as a basic and affordable solution to grow your money. When you invest in index funds, you gain exposure to both immediate market diversity and a wide spectrum of stocks or bonds that track a particular index, like the “S&P 500”.

Index fund investors experience two main advantages through their modest expense structure. Passively managed funds maintain low costs because fund managers do not need to spend money picking stocks from the index. The research shows that actively managed funds usually do not outperform the market, so index funds emerge as better long-term investments.

Another advantage of Index fund investment is that it distributes your capital across numerous businesses in the thousands, removing market exposure. Your investment success depends on using low-cost index funds because they consistently offer reliable returns in the long term, regardless of your savings purpose.

11. High-Yield Savings Accounts and CDs

While not as aggressive as other options, high-yield savings accounts and Certificates of Deposit (CDs) are low-risk investments that can still offer decent returns over the long term. These options are ideal for risk-averse investors looking for guaranteed returns.

12. Commodities and Precious Metals

Investing in commodities like gold, silver, and other precious metals can act as a hedge against inflation and market volatility. These assets tend to hold their value over time, making them a solid long-term investment and a safety net during economic uncertainty.

Essential Rules for Long-Term Investing

Investing for the long term is one of the most effective methods to build wealth and secure your financial future. However, it’s easy to feel overwhelmed when you’re just starting. The stock market, bonds, and other investment options can seem confusing at first. But anyone can become a successful long-term investor with the right approach, patience, and a solid strategy. By following the essential rules of long-term investing, you will help grow your wealth over time, minimize risk, and stay on track toward your financial goals.

1. Start Early and Be Consistent

Long-term investment produces compound interest as its most significant benefit over time. Your money accumulates substantially when you begin investing at an early stage because it operates for an extended period. The most important thing when starting with investing is maintaining regular contributions despite the initial investment amount. Investment account growth over time increases when you make regular contributions at any interval from monthly to annual. The duration of your investment directly relates to the strength of compounded interest accumulating in your account.

2. Diversify Your Portfolio

The core principle of investing requires spreading funds across different investment categories. Sustaining multiple investments among stocks, alongside bonds, real estate, and international markets, helps you decrease the potential dangers to your financial portfolio. Your monetary security remains uninterrupted by market performance because of investment diversification. A diversified investment portfolio allows you to withstand market changes better, thus maintaining your financial plan stability when economies decline.

3. Focus on Low-Cost, Long-Term Investments

For successful long-term investing, people must direct their attention to affordable investment vehicles. The expense of high fees will diminish the overall value of your investment, particularly for long-term investments. Your money should go into index funds together with exchange-traded funds (ETFs) or low-fee mutual funds, which give you wide market coverage. Index funds and exchange-traded funds (ETFs), along with low-fee mutual funds, let investors access numerous assets at prices better than what actively managed funds require. Some small cost savings combined throughout time create a substantial financial gain.

4. Keep Emotions in Check

Long-term investing requires patience. The desire to modify your portfolio becomes strong during market changes, yet these actions frequently trigger unsuitable decisions. Make a determined effort to keep your attention on your planned objectives instead of making quick emotional choices. Market volatility exists in short periods, yet the historical data reveal that it always increases with time. Your investment success will benefit when you stick with your established plan because emotional decisions might cost you money that would otherwise advance your investing goals.

5. Review Your Portfolio Regularly

Long-term investors need to check their portfolios occasionally, despite not needing daily monitoring. Your investment perspective alongside financial targets alongside life conditions will naturally change over time. The previous well-balanced investment portfolio requires periodic updates. Portfolio rebalancing helps you maintain proper asset distribution to reach your long-term financial objectives, either through bond investments during retirement or modifications for economic changes.

6. Stay Disciplined and Avoid Timing the Market

The mistake most investors commit occurs when they attempt to detect market conditions for buying or selling stocks in the short term. No one can successfully predict market movements predictably. Following your investment plan instead of market timing represents a better approach for investors compared to trying to predict market movements. Regular plan contributions through all market changes yield better investment results than attempting to predict upcoming market trends.

Tips for Long-Term Investment Success

- Start Early: The earlier you start investing, the more time your cash has to grow through compounding.

- Stay Consistent: Regularly contribute to your investments, even in small amounts.

- Diversify: Spread your investing throughout exclusive asset classes to reduce risk.

- Stay Patient: Avoid reacting to short-term market fluctuations.

- Seek Professional Advice: Consult an economic advisor for financial guidance.

FAQs:

1. What are the safest long-term investments?

Government bonds, as well as high-yield savings accounts and Certificates of Deposit (CDs), make up the list of safest long-term investment choices. Government bonds merged with high-yield savings accounts, while Certificates of Deposit (CDs) generate both stability and minimal risk.

2. Which investment is best for the long term?

Over time, the stock market, together with real estate property, has demonstrated the highest potential for investment return to long-term investors. Bond investments, together with savings accounts, provide lower risk than risky investment alternatives such as stocks.

3. How much should I invest for the long term?

Your investment amount should match your financial targets alongside your monthly earnings and tolerance for risks. You should allocate at least 15-20% of your monthly earnings for your retirement investments, along with other long-term targets.

4. Are index funds better for long-term investing?

Since index funds offer long-term investors the benefits of low costs and widespread diversity, they make an excellent investment solution.

5. Can I invest in real estate without buying property?

Real Estate Investment Trusts (REITs) enable investors to experience real estate market benefits through property investments without actual property ownership. The investment in Real Estate Investment Trusts gives access to real estate markets, combined with dividend payments.

6. Should I diversify my long-term investments?

Absolutely. Investment risk reduction happens through the diversification of assets into stocks, bonds, real estate, and commodities.

7. How do I choose the right investment for my goals?

Your investment decision should start with understanding your time frame and risk tolerance before establishing your financial outcomes. You should seek professional advice from financial advisors for clarification when needed.

Conclusion

The path of long-term investment requires both self-discipline and financial goal orientation with patient endurance. Early investment combined with portfolio diversification, along with low costs and controlled emotions during market movements and regular investment review, leads to future wealth creation.

The essential elements for investing success include persistence combined with a continuous approach alongside future-mindedness. Take action now to see your investment amounts expand throughout the years. Following these essential rules will allow you to receive greater benefits from long-term investing than you face difficulties. Happy investing!