Strategically investing funds over long periods provides the best opportunity to develop wealth and attain financial safety with peace of mind for the upcoming years. The extended time funds remain invested in long-term investments, resulting in opportunities for major financial growth. This guide explores long-term investment and strategies with practical tips to enhance investment growth.

What is a Long-Term Investment?

Investors hold an asset or portfolio for three years or more as a long-term investment. By utilizing compounded interest together with market price growth, these investments will produce enhanced value over time. Long-term investment returns, dividend income from shareholding, and interest received on fixed deposits.

Benefits of Long-Term Investments:

Secure financial future:

Most investment assets demonstrate increased market value throughout the duration, which results in major profit generation. The reinvestment of earnings throughout multiple years produces an increasingly substantial return growth.

Less time-consuming:

Long-term investment is a less time-consuming strategy for your investment; here, you need not monitor markets for small fluctuations on a daily basis.

Lower tax rate:

Long-term capital gains create reduced tax burdens because they come with taxation rates lower than short-term profit rates.

The effects of market volatility become minimal through investing over long periods.

Types of Long-Term Investment Accounts

Investors must select their accounts carefully since this decision affects their returns significantly. Several common investment accounts exist for long-term investments.

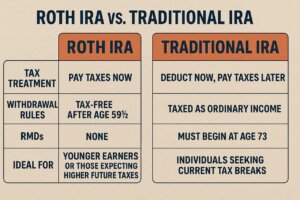

401(k) and IRA function as retirement accounts that provide tax benefits to investors.

Long-term investment through brokerage accounts provides freely selected investments without restriction on contribution amounts.

Health Savings Accounts (HSA) – These are Tax-advantaged savings for medical expenses with long-term growth potential.

The 529 College Savings Plans operate as dedicated investment accounts that assist educational funding purposes.

For more details, you can check the 12 best long-term investment strategies.

Top Long-Term Investment Options

There are several long-term investment choices, each with varying risk levels and return potential. Let’s explore some of the best options:

1. Stocks and Share Market Investments

A strategic stock selection between individual securities or a multiple-stock portfolio usually produces substantial long-term profit. The share market has delivered the most advantageous long-term investment growth opportunity throughout history.

Key Considerations:

- Invest in companies that maintain reliable financial records as blue-chip enterprises.

- Investors should extend their holdings across different industries to minimize their overall investment risk.

- Investors who reinvest their dividends will be able to maximize the power of compound returns.

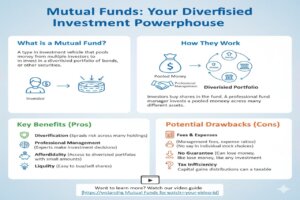

2. Mutual Funds and ETFs

Mutual funds combined with ETF investments permit investors to achieve diversification under the supervision of professionals for long-term benefits.

Key Considerations:

- Diversification works as a risk-reduction strategy that distributes investments across different assets.

- Fund managers, through professional management services, control how assets get allocated, along with maintaining the balance between the investment portfolio’s asset classes.

- Managed funds are suitable for long-term investors who want peaceful growth along with high returns.

3. Bonds and Fixed-Income Investments

Long-term investment bonds deliver better security than stocks because they give investors dependable income, together with predictable financial stability.

Key Considerations:

- Government bonds possess low risk because they are supported by national governments.

- Corporations issue bonds with greater returns than those from government bonds, although they pose a minor additional risk to investors.

- Municipal Bonds – Tax-free returns for investors.

4. Real Estate Investments

Real estate provides investors with strong long-term profit potential and brings extra benefits that result from property rentals along with property value growth.

Tips for Real Estate Investing:

- Investment opportunities should target locations that show significant signs of expansion.

- You should examine the opportunities that rental properties provide to generate continuous income streams.

- Look into owning real estate through Investment Trusts (REITs) as an uninvolved investment approach.

5. Cryptocurrency for Long-Term Investment

Strategically investing in stable crypto assets over long durations enables individuals to achieve substantial profits in digital assets, even though markets are very volatile.

Smart Crypto Investing:

- Select Bitcoin and Ethereum as your choices because they already have proven influence in the cryptocurrency market.

- To gain from crypto investments, diversify your portfolio through stablecoins, altcoins, and DeFi projects.

- Investors should maintain their assets for five years or more because market volatility decreases during this time frame.

Building a Strong Long-Term Investment Portfolio

Investors must hold various asset classes in their balanced investment portfolio, which extends over extended periods. Here’s how to create one:

1. Diversify Across Asset Classes

Spreading investments equally between stocks, bonds, real estate, and other investments is the way to construct a well-balanced portfolio. An effective risk reduction strategy involves equalizing investments between unsafe and safe assets.

2. Reinvest Dividends and Earnings

The process of compounding serves as an essential factor that drives substantial investment growth in the long run. Stick with investment options that produce dividends and use these dividends to buy more shares of the same stocks.

3. Stick to a Long-Term Strategy

You should ignore sudden changes in market values that disappear quickly. Keep to a system of discipline together with sustained investment in the market.

4. Monitor and Adjust Portfolio Regularly

Annual balance checks will preserve your asset distribution. Update investments according to market performance as well as meet specified financial objectives.

Long-Term Investing Tips for Success

New investors should follow these tested long-term investment recommendations for effectiveness:

- Your investment benefits will increase substantially by starting to invest at an early point in life.

- The higher profits that come from extended financial commitments require patients to tie up funds for multiple years.

- You should maintain consistent investments by following the dollar-cost averaging approach to cut down risks while increasing profits.

- Low-cost funds should be selected, as they help preserve your investment gains.

- Continuous market awareness is vital because it lets you track industry changes, together with economic developments and investment techniques.

- Phoenix Blueprint demands that investors establish specific financial targets for their investment planning.

Conclusion

The key to achieving financial success is maintaining investments over many years. When investing in stocks, bonds, real estate, or cryptocurrency, keeping both the time factor and a strategic plan becomes necessary. Financial security, along with high returns, is available through long-term investments, which require a commitment of funds for an extended period. Extending your investment to the right accounts alongside diverse portfolio selections will lead to continual market growth and financial security in your future.

The key to growing your wealth begins now when you remain financially invested until you observe results.