Do you feel like you’re doing everything right with your money, but your bank account balance never seems to climb? For most people, the problem isn’t about how much they earn, but about where their money goes. So learning how to create a simple budget is the single most powerful step you can take toward financial freedom.

What is a budget?

A budget is a plan for your money that shows how much income you have and how you’ll spend, save, and manage it over a certain period (usually monthly). It helps you track your earnings, expenses, and savings. Instead of money slipping through the cracks, a budget gives every dollar a purpose.

Think of it like a roadmap for your finances—instead of wondering where your money went at the end of the month, a budget tells your money exactly where to go.

A budget usually includes:

- Income (paychecks, side hustles, investments)

- Fixed expenses (rent, mortgage, car payment, insurance)

- Variable expenses (groceries, utilities, gas)

- Wants (entertainment, dining out, shopping)

- Savings & debt payments (emergency fund, retirement, loans)

Different Types of Budgets

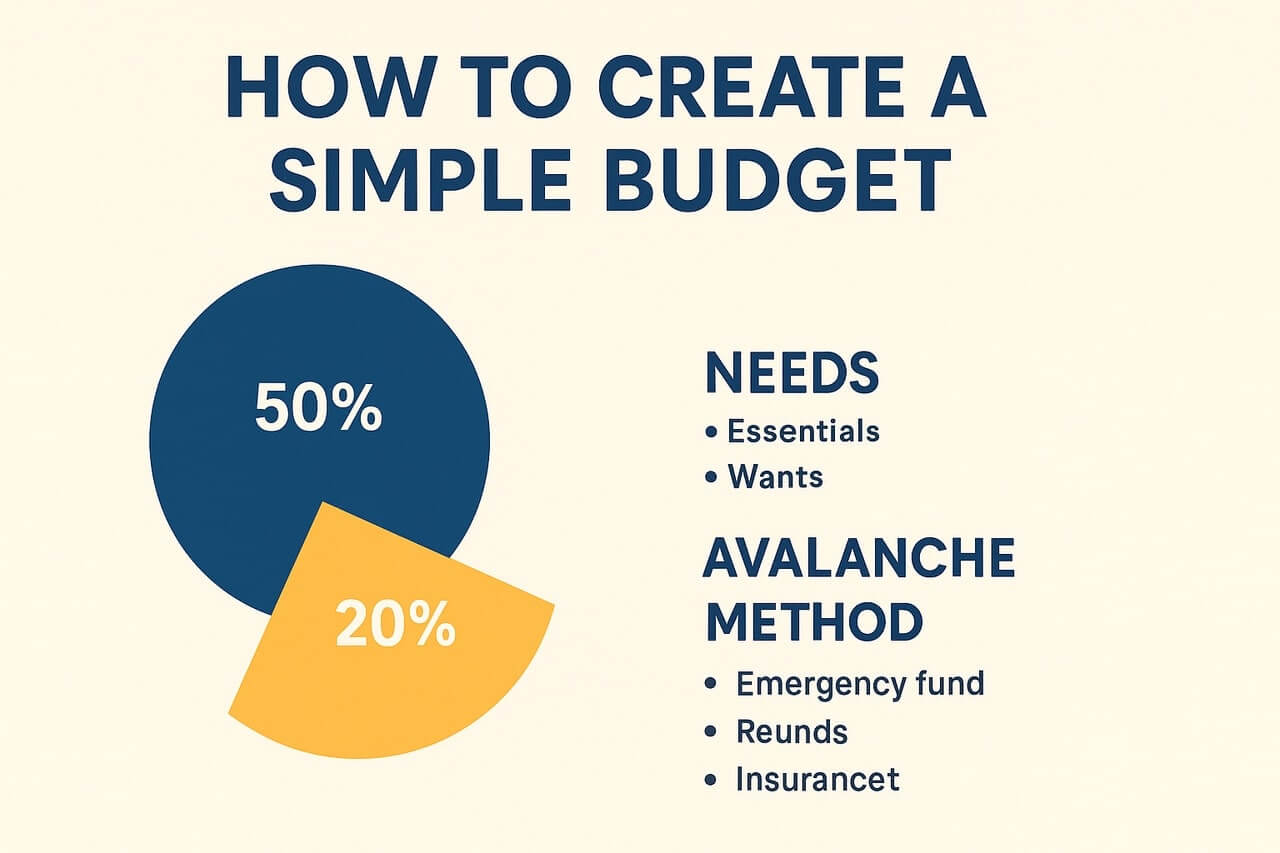

There’s no one-size-fits-all budget. Here are some common strategy:

- 50/30/20 Budget Rule: 50% needs, 30% wants, 20% savings/debt.

- Zero-Based Budgeting: Every dollar is assigned a job until nothing is left unplanned.

- Envelope Method: Cash-based budgeting where spending categories are physically separated into envelopes.

Why Budgets Matter?

Budget is not just a spreadsheet—it’s your financial game plan. Whether you’re saving for a house, paying off debt, or just trying to stop living paycheck to paycheck, budgeting is the first step toward financial freedom.

A budget shouldn’t feel like a restrictive diet; it should feel like a GPS for your money, guiding you toward your financial goals. You will transform your financial life and gain total control over your cash flow. With a budget, you decide ahead of time where your money should go, whether that’s bills, savings, or fun activities. Here are some benefits of budgeting:

- Prevents Overspending: You’ll know your limits before swiping your card.

- Builds Savings: Makes it easier to set aside money for emergencies or long-term goals.

- Reduces Stress: Financial clarity means less money anxiety.

- Helps Crush Debt: Directs more money toward paying down balances faster.

By organising your finances this way, you’ll see exactly where your dollars are being spent. In short, a budget helps you spend smarter, save more, and reach your financial goals.

5 Steps to create a simple budget from scratch

Forget complicated software and rigid rules. These five steps focus on clarity and honesty.

1. Estimate your monthly income

Before you create a budget, you need to know exactly how much money you have coming in each month. This is your starting point—your income baseline.

Gross vs. Net Income: You should always budget based on your net income, which is the money deposited into your bank account after taxes, insurance, and retirement contributions have been taken out. This is your true “take-home pay.”

Irregular Income: If you are self-employed or work freelance, you need to calculate an honest average. Look at the last three to six months of earnings and divide the total by that number of months. Use this conservative average to avoid shortfalls.

Actionable Tip: If you have multiple jobs or income sources, total them all up. This single number is the total money you have to work with for the month.

2. Estimate your monthly expenses

This is the step where most people get discouraged, but it’s the most important. You cannot manage what you don’t measure. You need to list all your spending data for the past 30 days.

Fixed Expenses: These are expenses that are the same every month and are unavoidable. For example: Rent/Mortgage, Car Payment, Insurance Premiums, Student Loans.

Variable Expenses: These change month-to-month and are where you have the most control. For example: Groceries, Eating Out, Entertainment, Clothing, Gas.

The Best Tools for Tracking: You have three great options to track monthly expenses efficiently:

- Bank Statements: Download the last month’s bank and credit card statements. Highlight every transaction.

- Budgeting Apps (Recommended): Apps like YNAB (You Need a Budget) or Mint link directly to your accounts and auto-categorise your expenses, making the process faster.

- The Old-School Spreadsheet: Use a simple Google Sheet or a free budgeting template to manually enter and categorise every spending.

Deep Dive Tip: Don’t judge your spending during this phase. Just record it honestly. This is a discovery process, not a guilt trip!

3. The Budgeting Blueprint: The “Zero-Based” System

Now that you know your income and your expenses, it’s time to assign every dollar a job. The goal of a zero-based budget is to:

$$\text{Income} – \text{Expenses} – \text{Savings} = \$0$$

You are essentially planning where every dollar goes before the month even begins.

- Subtract Fixed Costs: Start with your total income (Step 1) and subtract all your fixed expenses (Rent, Loans, etc.).

- Allocate to Savings and Debt: Dedicate a specific amount to savings (emergency fund, retirement) and debt repayment (Step 4). Pay yourself first!

- Allocate to Variable Costs: Divide the remaining money among your variable categories (Groceries, Fun). This is where you set your spending limits.

- The Final Check: If the math does not equal zero, adjustments need to be made. If you have a positive balance, consider putting the excess into savings or paying off debt. If you have a negative balance, you must reduce spending in your variable categories until you hit zero.

4. Taking Control: How to Manage Debt with a Budget

For many people, the primary motivation for learning how to create a simple budget is to get out of debt faster. Your budget is the perfect tool for this.

List All Debts: Create a simple list with the debt name, balance, interest rate, and minimum monthly payment.

Choose a Strategy:

Debt Snowball: Pay the minimum on all debts, but put any extra money toward the smallest debt first. Once it’s done, roll that payment into the next smallest debt. This builds psychological momentum.

Debt Avalanche: Pay the minimum on all debts, but put any extra money toward the debt with the highest interest rate first. This will save your money in the long run.

Budget the “Extra” Payment: Include your chosen debt repayment strategy as a mandatory “expense” in your zero-based budget. This ensures you consistently use extra cash to manage debt with a budget.

5. Review and Refine: The Monthly Budget Check-Up

A budget isn’t static; it’s a living document. The last step is the most important for ensuring long-term success.

Monthly Review: At the end of every month (or the start of the next), review your actual spending against your planned spending. Did you overspend in the “Dining Out” category? Did you underspend in “Groceries”?

Adjust for Reality: Don’t be afraid to change your budget based on the data. If you consistently spend \$600 on groceries but only allocate \$400, adjust the grocery category up to \$500 and reduce your “Entertainment” budget by \$100.

Identify Budget Leaks: Look for subscriptions you forgot about or small, recurring costs that are chipping away at your money. Cut them.

Bonus Tips for sticking to your simple budget

Use the Cash Envelope System: For variable categories (like dining out or clothing), take out the budgeted cash at the beginning of the month. When the cash is gone, the spending stops. This is particularly effective for visual spenders.

Set Realistic Goals: Don’t cut your spending by 50% overnight. Start small. A realistic budget that allows for some fun is better than a perfect budget you abandon after two weeks.

The 72-Hour Rule: If you see an expensive non-essential item you want to buy, make yourself wait 72 hours. This rule removes the impulse and often proves that you didn’t need the item after all.

By dedicating time to these five essential steps, you are guaranteed to gain clarity and control over your finances. Learning how to create a simple budget is truly the foundation of any successful financial life. Do it now, start today, and watch your bank account—and your confidence—grow!

Common Mistakes to Avoid

When learning how to create a simple budget, avoid these common mistakes:

- Being too strict – leave room for fun money.

- Ignoring irregular expenses – like car repairs or annual subscriptions.

- Not reviewing regularly – life changes, so should your budget.

- Forgetting savings – even $25/month matters over time.

Tools to Help You Budget Better

- Apps: Mint (free), YNAB (paid but powerful), EveryDollar.

- Spreadsheets: Google Sheets or Excel templates.

- Visual aids: Pie charts, infographics, or printable worksheets.

Videos and infographics make budgeting less intimidating. Consider following YouTube finance educators or downloading a budget worksheet to stay engaged.

Final Thoughts

Learning how to create a simple budget isn’t about cutting out everything fun—it’s about creating balance and direction for your financial goal. By tracking income, monitoring expenses, and setting realistic goals, you’ll gain financial confidence and reduce stress. Remember, a budget is not about perfection, but progress. Every step you take toward financial clarity is a win. So, are you ready to sit down today and build your first simple budget?

Frequently Asked Questions (FAQ)

Q: Why should I budget based on my Net Income instead of my Gross Income?

A: You should always budget based on your Net Income (take-home pay) because that is the actual amount of money you have available to spend, save, and pay bills each month. Gross income represents what is earned before deductions for taxes and benefits, and budgeting based on this figure will create shortfalls in the budget.

Q: What is the most common mistake people make when creating a budget?

A: The most common mistake is failing to account for irregular or non-monthly expenses, such as annual insurance premiums, holiday shopping, or car maintenance. These “surprise” costs can completely derail a monthly budget. The fix is to use a “sinking fund”—calculate the annual cost of these items, divide by 12, and set that small amount each month.

Q: How many categories should I include in my simple budget?

A: The best number of categories is the number that keeps you from feeling overwhelmed. Start simple with broad categories like housing, transportation, food, debt, savings, and fun/miscellaneous. You can always simplify further using the 50/30/20 rule (50% needs, 30% wants, 20% savings) if the Zero-Based Budget feels too detailed at first.

Q: What is the 50/30/20 budget rule?

A: The 50/30/20 rule is a simple allocation method where your after-tax income is divided into three buckets:

- 50% for Needs (Housing, Utilities, Groceries, Minimum Debt Payments).

- 30% for Wants (Entertainment, Dining Out, Hobbies).

- 20% for Savings (Emergency Fund, Retirement) and extra debt payments.

Q: What should I do if I overspent one month?

A: Don’t give up! A budget is a living tool. If you overspent, then examine your spending with honesty. Identify the categories where you overspent specifically (Eating Out) and reduce those limits for next month. Use the experience to make your budget stronger, not to punish yourself.

Q: How to Start a Budget?

- Write down your monthly income.

- Track your current expenses for 30 days.

- Categorize your spending into needs, wants, and savings/debt.

- Adjust where necessary (cut back on wants, boost savings).

- Review regularly and tweak as life changes.