In uncertain times, it’s no surprise that more and more people are asking: What low-risk investments still offer decent returns? Whether you’re just starting or nearing retirement, finding the ‘best low-risk investments’ is key to preserving your capital while earning a little extra.

Let’s dive into the ‘best low-risk high-yield investments’ you can explore in 2026.

What Are Low-Risk Investments?

Low-risk investments are like the seatbelts of your financial journey—they keep you safe when the road gets bumpy. They prioritize capital preservation over sky-high returns, making them ideal for:

- Short-term goals (buying a home in 2 years).

- Emergency funds (because life loves surprises).

- Risk-averse investors (no FOMO here).

Key traits:

- Minimal volatility.

- Predictable returns.

- Backed by stable entities (governments, FDIC-insured banks).

Why Low-Risk Investments Matter More Than Ever

In today’s rollercoaster market, preserving your hard-earned cash is just as important as growing it. Whether you’re saving for a rainy day, planning retirement, or just hate sleepless nights worrying about stock crashes, low-risk investments offer peace of mind. Let’s break down how to earn steady returns without the heartburn.

Not everyone is built for the rollercoaster of the stock market. Low-risk investments provide stability. They’re not about massive returns overnight — they’re about steady, reliable growth with less chance of loss. These options are ideal for:

- Retirees or near-retirees

- Emergency fund holders

- Risk-averse investors

- Beginners looking to start slow

And let’s be honest — in a world where financial markets can swing wildly with a tweet or global event, a little safety can go a long way.

What are some low-risk investments you can trust?

Low risk doesn’t mean no return. Some of the best low-risk, high-yield investments combine solid safety with a competitive interest rate. Let’s look at some proven options.

The Best Low-Risk Investments to Consider Today

Here’s the best low-risk investment list for safety-first investing in 2026. Each offers liquidity, safety, and potential returns at a higher rate.

1. High-Yield savings accounts

If you’re looking for the best low-risk investment accounts, this is a great place to start. High-yield savings accounts offer far better returns than traditional savings or checking accounts. These high-yield accounts are ideal for short-term saving goals where you want to earn a little more interest than a savings account with safety.

- Federal Deposit Insurance Corp (FDIC)-insured up to \$250,000

- Easy access to funds

- No market risk

- Typical APY: 4.00% – 5.25%

2. Certificates of deposit (CDs)

A CD is a time deposit — you lock in your money for a fixed period (usually 6 months to 5 years), and the bank pays you interest in return. Longer terms usually come with higher interest. To find the best rates, you will search online and compare what banks offer.

A short-term CD account offers better returns than a long-term CD account. Short-term CD has no penalty, which gives you chances for early withdrawal. You can withdraw your money and transfer it to a higher-paying account without incurring any usual costs.

- FDIC insured

- Guaranteed return

- Higher rates than savings accounts

Pro tip: Consider a ‘CD ladder’ — investing in CDs with staggered maturity dates so you always have one coming due.

Best CD rates: 5.50% – 6.00%

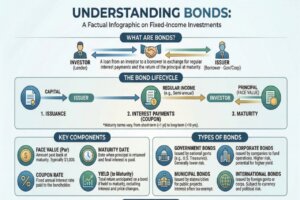

3. Treasury bonds and T-bills

If you’re researching the best low-risk investments right now, U.S. government bonds should be on your radar. They’re backed by the U.S. Treasury, making them among the safest investments in the world. The U.S. Treasury offers Treasury bills, Treasury bonds, Treasury notes, and Treasury Inflation-Protected Securities (TIPS).

Types:

- T-Bills are Short-term; they mature in a few weeks to a year.

- T- Notes stretch out up to ten years.

- T-Bonds are Medium to long-term; they mature in up to 30 years.

Why invest:

- Virtually no default risk

- Exempt from state and local taxes

- Can be bought directly from TreasuryDirect.gov

- Current yields: 4.5% – 5.2%

4. Money market accounts (MMAs)

A money market account feels much like a savings account with many offers of benefits, including a debit card and interest payments. MMAs combine the best of both worlds, like savings and investment features. They usually offer better rates than traditional savings accounts, along with check-writing privileges. This account is best for conservative investors with short-term goals.

- FDIC insured, with guarantees up to $250,000 per deposit

- Higher returns than standard savings

- Great for parking cash temporarily

- APY range: 4.00% – 5.00%

5. I Bonds (inflation-protected bonds)

Worried about inflation eating away at your savings? I Bonds are a top pick for 2026 and beyond.

- Backed by the U.S. government

- Interest adjusts with inflation

- Tax-deferred until redemption

- Yield in 2026: 4.30% (variable)

Limitations:

- \$10,000 annual purchase limit

- Must hold for at least one year

Best for: Long-term inflation hedging

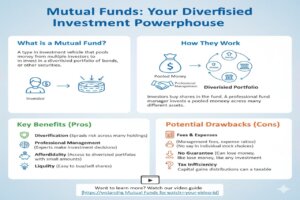

6. Short-term bond funds

These are mutual funds or ETFs comprising short-duration government or corporate bonds. They don’t lock up your money and carry relatively low risk compared to stock funds.

- Higher yield than savings or CDs

- Short duration = less interest rate sensitivity

- Professional management

- Yields in 2026: 3.5% – 5.5% (varies)

- Risk level: Low to medium (depends on the fund)

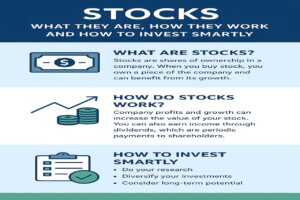

7. Dividend-paying blue chip stocks (for moderate risk tolerance)

This one’s a bit of a curveball — not entirely low-risk, but for those with a slightly higher risk appetite, investing in stable, dividend-paying companies (think: Coca-Cola, Johnson & Johnson) can be a safe middle ground.

- Consistent dividend income

- Less volatility than growth stocks

- Potential capital appreciation

- Average dividend yield in 2026: 2.5% – 4.0%

- Best for: Conservative stock investors

8. Corporate bonds

Corporate bonds are issued by large companies, which offer low-risk investments. Interest rates can change when the market value of the bond fluctuates. When market rates fall, bond values move up, and when market rates rise, bond values move down. Investors can select high-quality bonds from reputable and large companies for lower risk and higher returns. Generally, bonds are lower risk than stock investments.

9. Dividend-paying stocks

Stocks are not as safe as savings accounts or government bonds. Dividend stocks are safer than high-growth stocks because they offer a cash dividend and a stock dividend. Dividend-paying companies are more stable and mature; they offer dividends, as well as appreciation in stock price.

Best low-risk investments 2026 – Quick comparison table

| Investment Option | Risk Level | Yield Range | Liquidity | Best For |

| High-Yield Savings | Very Low | 4.00–5.25% | High | Emergency funds |

| CDs | Very Low | 5.00–6.00% | Low | Short-to-mid-term savings |

| Treasury Bonds/T-Bills | Very Low | 4.5–5.2% | Medium | Long-term safety |

| Money Market Accounts | Very Low | 4.00–5.00% | High | Short-term parking |

| I Bonds | Low | 4.3% (adjustable) | Low | Inflation protection |

| Short-Term Bond Funds | Low–Medium | 3.5–5.5% | High | Passive income |

| Dividend Stocks | Medium | 2.5–4.0% + growth | Medium | Long-term conservative growth |

Hunting for Yield: Best Low-Risk, High-Yield Investments

Want a little extra zip without the risk? Try these:

Series I Savings Bonds

- Adjusts for inflation every 6 months.

- Current rate: [Check TreasuryDirect.gov for the latest].

- No state/local taxes; federal tax deferred.

Investment-Grade Corporate Bonds

- Rated BBB or higher (Apple, Microsoft).

- Yields: 3–5% annually.

- Dividend Aristocrats

- Stocks with 25+ years of dividend hikes (Johnson & Johnson).

Note: Still subject to market dips—handle with care!

What Are Some Low-Risk Investments? Expand Your Portfolio

Diversify with these underrated options:

TIPS (Treasury Inflation-Protected Securities)

- Principal adjusts with inflation.

- Pays fixed interest twice a year.

Fixed Annuities

- Guaranteed income stream for a set period.

- Shop for highly-rated insurers (A.M. Best ratings).

Short-Term Bond ETFs

- Low-cost funds like Vanguard Short-Term Bond ETF (BSV).

- Diversified exposure with minimal interest rate risk.

The Best Low-Risk Investments Right Now (2026)

2026’s rising interest rates have boosted yields on:

- 6 Month to 1 Year CDs: Snag 5%+ APY before rates dip.

- T-Bills: Skip state taxes on 4–5% returns.

- Money Market Funds: Institutions like Vanguard offer 5 %+ yields.

Pro Tip: Use the laddering strategy—spread investments across different CD/bond terms to maximize liquidity and rates.

Looking Ahead: Best Low-Risk Investments for 2026

Planning for 2026? Consider these forward-thinking moves:

- Lock in Long-Term Bonds Now: If rates drop by 2026, today’s 10–30-year Treasuries could become golden.

- TIPS: Hedge against prolonged inflation.

- Municipal Bonds: Tax efficiency shines in uncertain tax climates.

- Robo-Advisors: Use algorithms to auto-adjust your portfolio’s risk as 2026 nears.

Exploring the Best Low-Risk Investment Options

Mix and match these strategies for bulletproof results:

- Diversification: Split funds between CDs, bonds, and savings accounts.

- Laddering: Stagger CD/bond maturity dates to access cash annually.

- Automatic Reinvesting: Compound interest by rolling over matured investments.

Where to Park Your Cash: Best Low-Risk Investment Accounts

Safety isn’t just about ‘what’ you invest in—it’s also where. Top accounts include:

- High-Yield Savings Accounts (Ally, Marcus by Goldman Sachs).

- Roth IRA: Tax-free growth for retirement savings.

- 401(k) with Employer Match: Free money + tax deferral.

- Brokerage Accounts (Fidelity, Vanguard): Buy bonds/ETFs commission-free.

- HSAs: Triple tax benefits for medical expenses.

Low-risk investing isn’t about getting rich overnight—it’s about steady, stress-free growth. Start with your goals (emergency fund? house down payment?), pick the right mix of tools, and revisit your plan yearly. And remember: even safe investments carry risks (looking at you, inflation), so stay informed and flexible!

Ready to take the next step? Consult a fiduciary financial advisor to tailor this guide to your unique needs.

Tips for choosing the best low-risk investment options

Choosing the ‘best low-risk investments’ depends on your financial goals. Here are some quick tips to help you decide:

- Match your time horizon: If you need the money soon, prioritize liquidity (like savings accounts or MMAs).

- Diversify: Don’t put all your funds in one place. Spread across a few of the above.

- Check fees and terms: Especially for CDs and mutual funds — fees can eat into your returns.

- Stay informed: Yields change, especially in a shifting interest rate environment like 2026.

What’s the best low-risk investment right now?

There’s no one-size-fits-all answer, but the ‘best low-risk investments right now’ in 2026 combine safety, steady yield, and accessibility. Whether you’re parking cash temporarily or seeking a stable, inflation-protected income, the options we’ve discussed are smart, responsible choices.

Remember: low risk doesn’t have to mean low reward — it means ‘peace of mind’. And in today’s market, that’s priceless.

Start by evaluating your financial goals and choosing a mix of ‘the best low-risk investment accounts’ that fit your timeline. Whether it’s high-yield savings or I Bonds, there’s a safe and effective way to grow your money in 2026.

FAQs: Your Low-Risk Investment Questions, Answered

1. What are some low-risk investments with good returns in 2026?

Some of the best low-risk investments with competitive returns this year include:

- High-yield savings accounts (4.00–5.25% APY)

- Certificates of Deposit (CDs) (up to 6.00% APY)

- Treasury bonds and T-bills

- I Bonds (inflation-protected and government-backed)

- Money market accounts

- Short-term bond funds

These options provide a healthy balance between safety and yield, making them ideal for conservative investors.

2. What are the best low-risk, high-yield investments for beginners?

If you’re just starting, these options are great, low-risk choices:

- High-yield savings accounts – Simple, safe, and highly liquid.

- CDs– Lock your money in for higher returns with zero market risk.

- I Bonds – Government-backed and inflation-protected.

- Money market accounts – Flexible with decent yields.

All of these are beginner-friendly and require little to no investment knowledge.

3. Are treasury bonds still a good, low-risk investment in 2026?

Yes, Treasury bonds remain one of the best low-risk investments in 2026. Backed by the U.S. government, they carry virtually zero default risk. With interest rates still elevated, short- and long-term Treasury yields are attractive and safe for long-term savers.

4. What’s the best low-risk investment right now for short-term savings?

For short-term goals, stick with:

- High-yield savings accounts

- Money market accounts

- 3- to 6-month CDs

- T-Bills (Treasury Bills)

These provide easy access and flexibility while still offering better returns than traditional savings accounts.

5. Can I lose money in low-risk investments?

While low-risk investments are designed to minimize the chance of loss, no investment is entirely risk-free. That said, options like FDIC-insured accounts (savings, CDs, MMAs) and government bonds are considered extremely safe. Market-based options like short-term bond funds or dividend stocks may have slight fluctuations, but generally carry much lower volatility than stocks or crypto.

6. How can I compare the best low-risk investment options?

Use the following criteria:

- Risk level – Government-backed or FDIC-insured is safest.

- Return (APY/Yield) – Look for the best interest rates.

- Term length – Match your timeline.

- Fees – Watch out for account or fund management fees.

You can also use our comparison table above to quickly review the ‘best low-risk investments 2026’ side by side.

8. What are the best low-risk investment accounts I can open today?

Top platforms offering great low-risk investment accounts include:

- Ally Bank: High-yield savings & CDs

- Marcus by Goldman Sachs: Competitive CD rates

- Fidelity / Vanguard: Low-cost bond funds & MMAs

- TreasuryDirect.gov: For buying I Bonds and T-Bills

- SoFi / Discover: Excellent online money market and savings options

Make sure the institution is FDIC-insured and transparent with fees.

9. Is now a good time to invest in low-risk assets?

Absolutely. With interest rates still relatively high in 2026, many low-risk investment options are offering better yields than we’ve seen in years. It’s now a good time to take advantage of:

- High CD rates

- Inflation-protected I Bonds

- Solid Treasury yields

You can earn meaningful, stable returns without having to take big risks — a win-win.

10. What’s the difference between a CD and a high-yield savings account?

- CDs: lock your money at a fixed rate for a set term (6 months, 5 years). Withdraw early? Pay a penalty.

- High-yield savings accounts: offer flexibility (withdraw anytime) and competitive rates, but no fixed term.

11. Are low-risk investments completely safe?

Nothing is 100% safe, but options like Treasuries and FDIC-insured accounts are as close as it gets. The main risks are inflation outpacing returns or needing cash before a CD/bond matures.

12. How much should I put into low-risk investments?

Depends on your goals and timeline:

- Emergency fund: 3–6 months of expenses in cash (savings/MMAs).

- Short-term goals:(1–3 years) CDs, T-Bills.

- Long-term goals: Mix with growth assets like stocks.

13. Can I lose money on Treasury bonds?

Only if you sell them before maturity, hold until the end, and you get your principal + interest.

14. Are there low-risk investments with higher returns than savings accounts?

Yes! Series I Bonds and TIPS adjust for inflation. Investment-grade corporate bonds also pay more than savings accounts but carry slightly more risk.

15. When should I start investing for 2026?

Now! Locking in today’s rates (especially for CDs or long-term bonds) can hedge against future rate drops.

16. What’s the best account for my emergency fund?

A high-yield savings account or money market account—easy access, FDIC insurance, and decent interest.

17. Are dividend stocks considered low-risk?

They’re lower risk than growth stocks, but still subject to market swings. Stick to “Dividend Aristocrats” (Coca-Cola, Procter & Gamble) for stability.

18. Can I invest in low-risk options through my retirement account?

Absolutely! Many IRAs and 401(k)s offer bond funds, CDs, or money market funds.

19. What’s the biggest mistake people make with low-risk investing?

Letting cash sit in a traditional savings account earns 0.01% interest. Even small interest rate differences add up over time.

Conclusion: Your Path to Financial Serenity

Low-risk investing is like building a financial safety net—it’s not glamorous, but it’ll catch you when life throws curveballs. Use this guide to craft a strategy that fits your goals, and don’t forget to revisit it yearly. After all, your future self will thank you for playing it smart today.

Low-risk investments aren’t just for the cautious—they’re for anyone who values stability in an unpredictable world. Whether you’re stashing cash for a short-term goal, building an emergency fund, or safeguarding retirement savings, the strategies and tools we’ve covered can help you grow your wealth without losing sleep. Remember, the key to success lies in:

- Diversification: Don’t put all your investment in one place.

- Patience: Slow and steady wins the race.

- Adaptability: Adjust your portfolio as rates, inflation, and goals evolve.

While no investment is 100% risk-free (thanks, inflation!), the options we’ve explored—from Treasury bonds to high-yield savings accounts—offer a balance of safety and growth potential. Start with small, and stay consistent, your money will work for your future security. And hey, if you’re overwhelmed, you’re not alone. Even Warren Buffett keeps a stash of cash!