If you are looking for a portfolio that is balanced between risk mitigation, stable income, and diversification, Bonds are the most reliable tools that you can include in your strategy. Stability, predictable income, and even long-term security are what bonds offer to every investor, which is the reason they are an essential part of a diversified portfolio.

In this guide, we’ll break down what bonds are, how they work, the different types of bonds, and why they matter, using simple explanations and practical examples. Whether you’re a beginner or a growing investor, this in-depth guide will help you confidently understand bonds and how to use them to reach your financial goals.

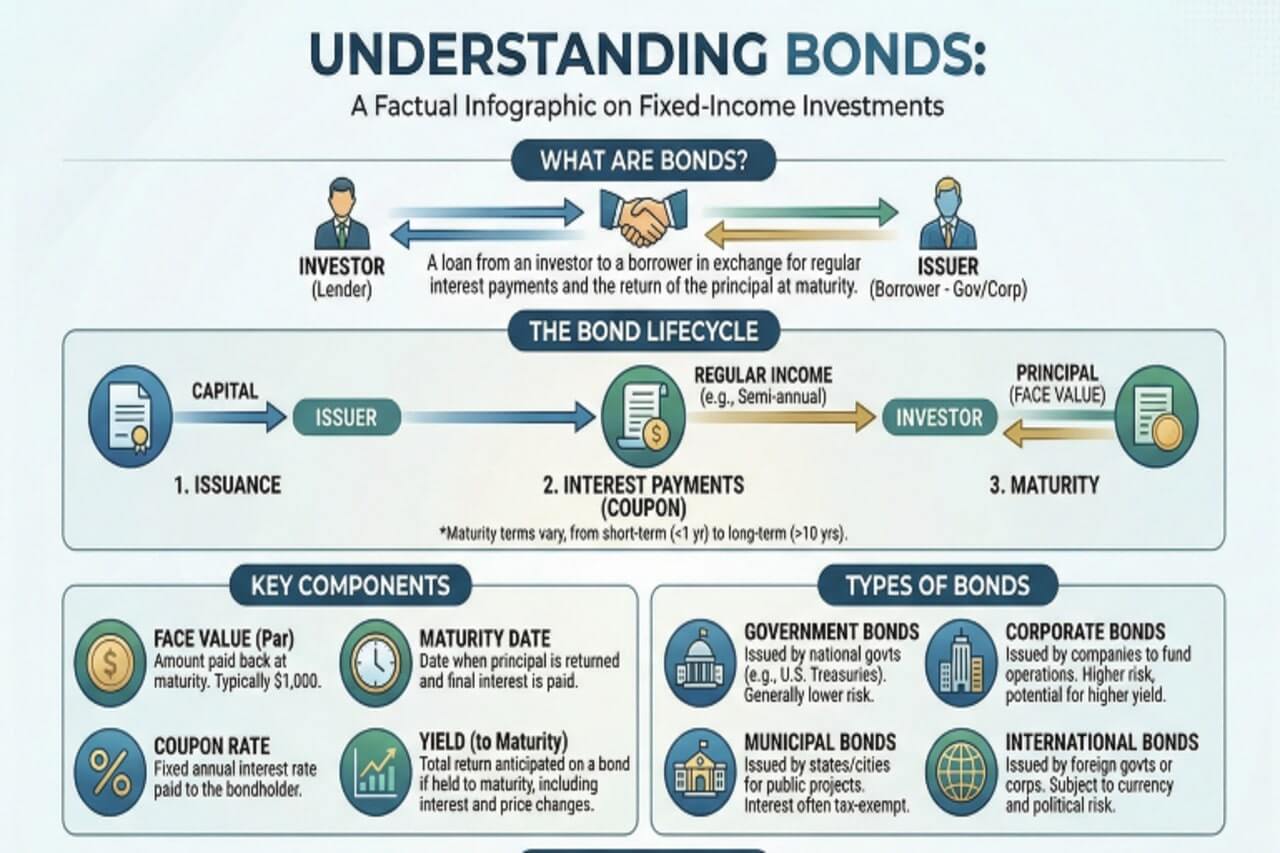

What Are Bonds? (Simple Definition)

A bond is a type of investment where you lend money to a government, corporation, or organization. In return, they promise to pay you:

- Fixed interest (called coupon payments)

- Your initial money back (the principal) on a future date (called maturity)

Basically, it can be considered as an IOU made by the government or some organization to us investors. It is safer than stocks, gives fixed income, so it’s for conservative investment strategies or people building wealth for the long term.

How Do Bonds Work? (Explained in Simple Terms)

To understand the role of bonds, you must first understand the fundamental components of this debt instrument. Every bond transaction revolves around a few core, non-negotiable terms:

- Face Value (Par Value): The amount the borrower promises to repay the investor on the maturity date. This is typically \$1,000.

- Coupon Rate: The fixed annual interest rate the issuer pays the bondholder. It’s usually expressed as a percentage of the face value.

- Coupon Payment: The dollar amount of the interest payment. Most bonds pay interest semi-annually.

- Maturity Date: The specific date on which the issuer repays the face value (principal) to the bondholder, and the bond ceases to exist.

- Yield: The rate of return an investor earns on the bond, taking into account the purchase price. Current Yield is the annual interest payment divided by the bond’s current market price.

Relationship Between Bond Prices and Interest Rates

This is the single most important concept in bond investing.

When Market Interest Rates Rise: Newly issued bonds will carry higher coupon rates; this makes older, existing bonds that pay lower fixed coupon rates unattractive. Hence, to sell the old bonds, their price must drop in the secondary market until their current yield is in line with or competitive with the new, higher-rate bonds.

When Market Interest Rates Fall: Newly issued bonds will have lower coupon rates, making older, existing bonds with higher fixed coupon rates more attractive. Investors are willing to pay more for that better income stream, causing the price of the existing bond to rise.

The Rule: Bond prices and prevailing interest rates move in opposite (inverse) directions.

Why do investors buy Bonds?

Here’s why millions of people invest in bonds:

- Stable and predictable income

- Lower risk than stocks

- Protection during market downturns

- Helps diversify your portfolio

- Ideal for retirement planning

- Preserves capital while still earning returns

If you’re building a balanced investment strategy, bonds are essential.

Main Types of Bonds for Investment

The bond market is huge and ranges from the most trusted governments to the most high-risk corporations. Understanding the issuer, and this will help you determine the risk and potential return.

1. Government Bonds: The Safest Fixed Income Securities

These are the issuances of national governments and are regarded as the standard of low-risk investments.

U.S. Treasury Bonds: These are long-term bonds issued by the U.S. government. They are considered virtually risk-free because they carry the “full faith and credit” of the U.S. government, and they have maturities from 10 to 30 years.

Treasury Bills (T-Bills): Short-term government debts that mature in one year or less.

Treasury Inflation-Protected Securities: The principal of these bonds is adjusted by CPI changes twice a year, freeing the investors from inflation risk.

2. Corporate Bonds: It is the Middle Way for Risk and the Much Higher Yield

When companies issue bonds to raise capital for expanding their businesses, refinancing their debts, or funding their operations.

Credit Risk: These come with credit risk (or default risk˜the risk that the company will fail to make payments). This level of risk is measured by credit rating agencies (Moody’s, S&P, etc.).

Investment Grade: Bonds rated BBB- or higher have an investment grade and are much safer, leading to lower yields.

High-Yield Bonds (Junk Bonds): Rated below investment grade, these are at a higher risk of default and, therefore, need to offer coupon rates much higher to compensate investors for that increased risk.

3. Municipal Bonds (Munis): The Tax-Aware Option

Bond issues are sold by state and local governments, such as cities, counties, and school districts, to finance public works projects, like those to build schools, hospitals, or roads.

Tax Advantage: Interest earned on municipal bonds is usually exempt from federal income tax and may be exempt from state and local taxes. Thus, these are very attractive to high-income investors.

Revenue versus General Obligation: Revenue bonds are a type that is repaid only from the revenue generated by the specific project (for example, a toll road); General Obligation (GO) bonds are backed by the full taxing power of the government that issues them.

4. Savings Bonds

Easy, low-risk government-backed bonds purchased by individuals. Examples: Series I Bonds (inflation-protected) and Series EE Bonds. Best for: long-term savers and beginners.

Advanced Bond Types and Portfolio Strategy

Beyond these major categories, specialty bonds and strategic considerations govern how fixed income fits into a diversified portfolio.

Special Bond Formations

Zero-Coupon Bonds: There are no coupons with these bonds, which means no interest payments at intervals. They are priced deep under par and pay back the entire sum due at maturity. Hence, the entire par is the income of the investor.

Callable Bonds: These bonds are entered into between the borrower and the issuer, giving the borrower the right to buy back the bond before maturity. Generally speaking, issuers redeem trade bonds when the level of interest rates decreases, allowing them to refinance at cheaper pretax rates. The remaining percentage is usually offered at fairly higher coupon rates than a normal bond to cushion the investors from the early call risk.

Convertible Bonds: A hybrid security that offers the holder an option to trade the bonds held for certain quantities of common stock of the issuer. They combine the foundational property of bonds and the upside potential of equity.

Strategic Role of Bonds in Portfolio Diversification

Bonds can serve at least two major functions in an investment portfolio, especially when they are matched with stocks.

Income creation: They normally give a steady, consistent cash flow of interest payments, therefore being suited to retirement or for anyone in need of a regular inflow of cash.

Risk Damping: Bonds are usually seen to have direct or inverse correlations with stocks in a downward move (when stocks fall, high-quality bonds often rise or hold steady), so at that point they are ballast within the portfolio as a buffer for stabilizing the overall portfolio against loss when the stock market undergoes a downturn.

Asset Allocation: The ideal percentage of bonds increases in a portfolio in general because the investor gets older-a traditional 100 minus your age rule typically suggests more bonds for older people.

Invest in Bonds: Individual Bonds vs. Bond Funds

Investing in bonds can actually be achieved through two main avenues:

Through Individual Bonds: You actually just buy one specific bond and keep it until it matures. This way, the return of your principal (except in case of default) and a quite predictable income are assured. It hardly requires any research, yet high minimum investments are often a constraint.

Bond Funds (Mutuals or ETFs): Here, you actually purchase shares of a fund that contains a diversified portfolio, whereby hundreds or thousands of different bonds are held. Thus, it gives instant diversity and very-highly professional management but does not guarantee return of principal since, due to continual buying and selling of the underlying bonds, the NAV of the fund fluctuates.

Pros and Cons of Bonds

Learn about both sides and invest wisely.

Advantages of Bond

- Safe investment compared with stocks

- Consistent income

- Excellent for diversification

- Excellent buffer for your portfolio during recessions

- Excellent for retirement and future planning

Disadvantages of Bonds

- Less returns than stocks

- Interest rate affects the price of bonds

- Inflation reduces real value

- There is riska of default in corporate bonds

Bonds Vs. Stocks: The Difference

| Feature | Bonds | Stocks |

| Risk | Low | Medium High |

| Return | Moderate | High |

| Ownership | You’re a lender | You’re an owner |

| Income | Fixed | Different |

| Best for | Stability | Growth |

Most professional portfolios include both for balance.

How to Start Investing in Bonds (in Simple Steps)

Relatively simple for early learners:

1. Choose Your Investment Method

You can buy bonds via:

- Brokerage accounts

- Banks

- Government websites (like TreasuryDirect)

- Bond ETFs and Mutual Funds

2. Select the Type of Bond

Ask yourself:

- Do I want low risk? (Choose government bonds)

- Do I want more significant returns? (Corporate bonds)

- Do I want tax-free income? (Municipal bonds)

3. Define Your Time Horizon

Short-term, medium-term, and long-term maturities or lengths affect the risk and their corresponding returns.

4. Diversify Your Bond Portfolio

Create a combination of different kinds to minimize risks.

5. Monitor Interest Rates

When interest rates rise, bond prices tumble — and vice versa. Smart investors pay attention to rate trends.

Whom Should Invest in Bonds?

Bonds are great for:

- Safe investment for beginners

- Retired ones requiring a steady income

- Balanced long-term investors

- Dedicated to the diversification of one’s portfolio

- Folks preparing for future goals (college, retirement, house buying)

Last Words: Are bonds worth it?

Definitely, especially for one looking at better ways of making their money grow steadily in lesser risk. Bonds protect the portfolio, provide stable income and balance out finances. Even though the returns are usually much lower than those of stocks, the surety with which bonds pay makes them a wise part of any long-term financial plan.

Understanding Bonds is critical for building any effective diversified investment scheme. Much safety, much income, and no growth potential of stocks will complete a very strong, rounded approach to long-term wealth management.

FAQ: Investing in Bonds

Here are quick responses to the typical questions most frequently asked about Bonds and Fixed Income investment.

Q1: What is the risk involved with bonds?

The most important risk is Interest Rate Risk.

Nature: This is the risk that if interest rates rise after you’ve purchased a bond, the price of your existing bond will fall in the secondary market due to newer bonds being issued with higher coupon rates, thus making your current bond less attractive.

Damage: Such risk increases with maturity for most of the bonds; such risk is higher in 30-year bonds as compared with short maturities.

Q2: What’s default risk, and how can I evaluate it?

Default risk or credit risk refers to the possibility that the bond issuer, i.e. the borrower, will not be able to make the interest payments or repay the principal (face value) at the maturity of the bond.

Assessment: The assessment of this risk is usually carried out by independent agencies like Moody’s, Standard & Poor’s (S&P), and Fitch. These agencies assign credit ratings (AAA, BB) to bond issuers.

Rating Tiers:

- Investment Grade: Generally rated BBB- or better; considered lower risk.

- High Yield (Junk Bonds): Rated below BBB-; carry significantly higher default risk and have to pay higher yields to compensate.

Q3: Why do high-income investors invest in Munis?

High-income investors prefer the Munis due to their tax advantage. Interest paid on Munis is generally exempt from federal income tax and mostly exempt from state and local taxes if the bond is issued in the investor’s home state. Hence, this tax advantage could give the Muni a better after-tax yield than the yield on a comparable corporate or government bond.

Q4: What are the main differences between the primary classes of government bonds?

Differences arise among the major classes of U.S. government bonds mainly in terms of maturity and inflation protection:

- T-Bills: Short-term maturity (less than 1 year).

- T-Notes: Medium term (2 to 10 years).

- T-Bonds: Long-term (10 to 30 years).

- TIPS (Treasury Inflation-Protected Securities): Their principal value is adjusted against inflation (CPI) to protect their purchasing power.

Q5: Am I guaranteed my principal at maturity if I hold a Bond Fund (ETF or Mutual Fund)?

No, the principal is not guaranteed when investing in a Bond Fund.

Individual Bond: If you hold a bond until its maturity, you will get back the principal amount, barring default.

Bond Fund: A fund is never truly “mature.” The fund manager keeps on buying and selling the underlying bonds, and the net asset value (NAV) of the fund fluctuates on a daily basis due to the current interest rates and market value of its holdings. Hence, when you sell your shares, you might end up doing so for a price lower than what you actually paid.