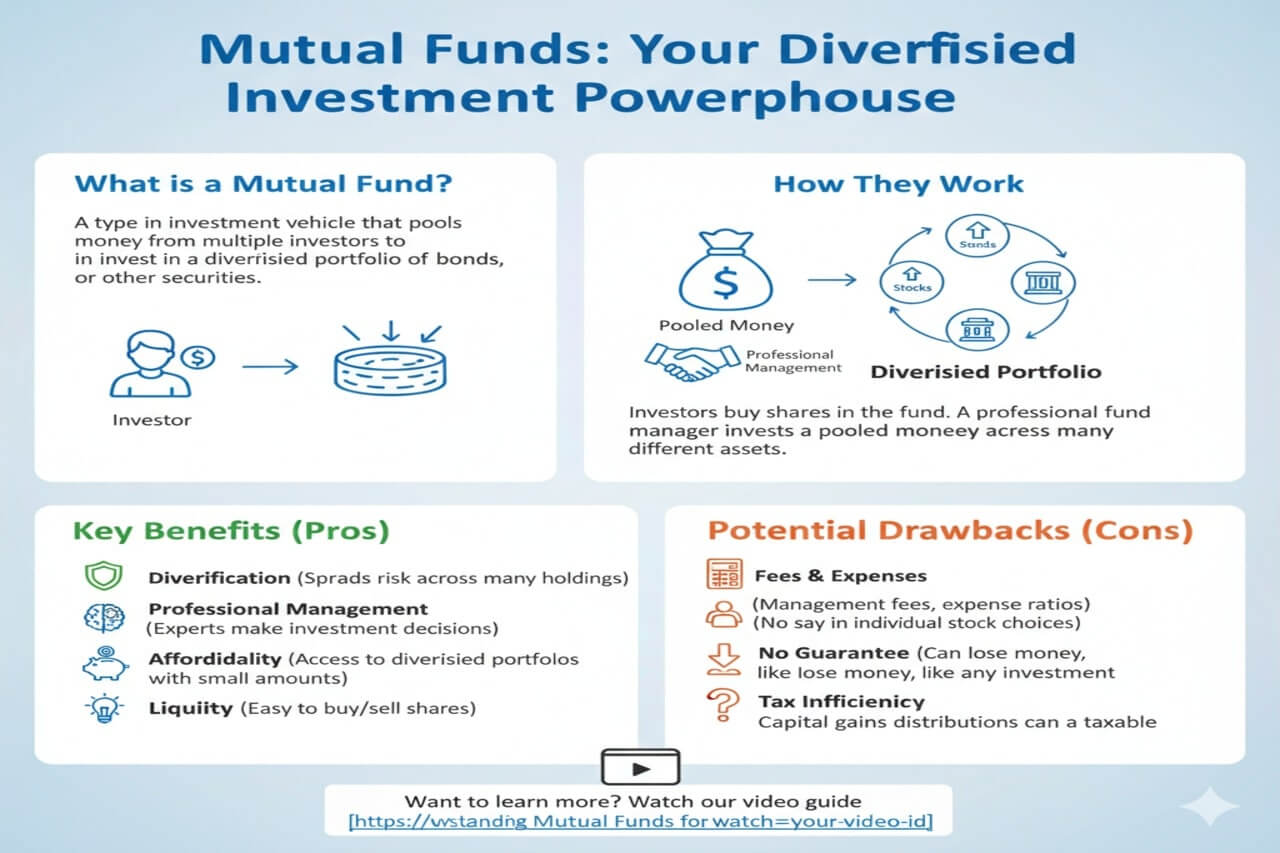

If you are looking to diversify your portfolio without the complexity of picking individual stocks or bonds, Mutual Funds offer an accessible and popular solution. These are investment options in which money from different investors is pooled in an account and is utilized to buy various assets, thereby providing investors with instant diversification and professional management.

Understanding mutual funds: what they are, how they work, and their distinct advantages and disadvantages is crucial for anyone seeking a streamlined approach to long-term wealth building. In this in-depth guide, we will break down the core components of mutual funds, from their operational structure to their fee implications, empowering you to make informed decisions about integrating them into your investment strategy.

What are mutual funds?

A Mutual Fund is essentially a company that brings money together from many people and invests it in stocks, bonds, short-term money market instruments, or other securities. Those investments are together called the portfolio of the mutual fund.

Type of Mutual Funds by investment focus

Mutual funds are classified based on the types of assets they predominantly invest in.

- Stock (Equity) Funds: Invest primarily in stocks. Can be further categorized by company size (small-cap, mid-cap, large-cap), growth vs. value, or geographical focus (U.S., international).

- Bond Funds: Invest in fixed-income securities (bonds). Can be categorized by bond type (government, corporate, municipal), credit quality, or maturity length.

- Balanced Funds: Invest in a mix of stocks and bonds, aiming for both growth and income.

- Money Market Funds: Invest in very short-term, highly liquid debt instruments. Primarily used for cash management due to their stability.

- Target-Date Funds: A “fund of funds” that changes its asset allocation automatically (more stocks when one is younger, more bonds as one ages) to become more conservative as the target retirement date approaches.

Core Definition and Purpose

Think of a mutual fund as a large “basket” of investments.

- Pooled Money: Investors buy shares in the mutual fund, and their money is combined with that of other investors.

- Diversified Portfolio: The pooled money is used by the fund to buy various types of assets, thereby creating a diversified portfolio that the individual, by himself, may not be able to afford or manage.

- Professional Management: An assigned manager and a team of decision-makers will manage the fund by buying/selling securities in accordance with the fund’s stated investment objective.

- Net Asset Value (NAV): The value of each share in a mutual fund is defined as the Net Asset Value (NAV). This is calculated daily at the close of the market and is the total value of the fund’s assets less liabilities, divided by the number of outstanding shares.

Conception of Mutual Funds and Their Formation

Mutual funds are highly regulated entities, primarily by the U.S. Securities and Exchange Commission (SEC).

- Investment Objective: Every mutual fund has a clearly defined investment objective (“growth,” “income,” “balanced,” “international equity”) that dictates the types of securities it will invest in.

- Prospectus: Before investing, you receive a prospectus, which is a legal document detailing the fund’s objectives, investment strategy, risks, fees, and past performance. This is essential reading.

- Types of Funds:

Open-End Funds: The most common type. They continuously issue new shares and redeem existing shares directly with the fund company.

Closed-End Funds: Issue a fixed number of shares that trade on stock exchanges like individual stocks.

How Mutual Funds Work and Their Classification

Understanding the different ways mutual funds are managed and categorized is key to selecting the right fund for your goals.

Active vs. Passive Management: Management Styles

Mutual funds are either actively or passively managed. Each type has different cost and performance implications.

- Actively Managed Funds: A fund manager actively researches, selects, and monitors individual securities to outperform a specific market index (the S&P 500).

Pros: They have the potential for higher returns if the manager is successful.

Cons: Higher fees (because of active trading and research) and many actively managed funds consistently fail to beat their benchmarks over the long term.

- Passively Managed (Index) Funds: These funds aim to mimic the performance of a specific market index by holding all or a representative sample of the securities in that index.

Pros: Significantly lower fees (less research/trading needed), consistent market returns.

Cons: Will not exceed the market index they follow.

Much like any investment, investing in mutual funds has its plus and minus points that the investors actually need to weigh in before investing.

Basic Pros of Mutual Funds

- Diversification: Instant diversification across many securities, thus averting much of the risk tied to investing in one stock.

- Professional Management: Those with investment know-how complete the research, selection, and watching of investments.

- Affordability: Accessible to the common folks, thus gaining a diverse, professionally managed portfolio, even at small amounts.

- Liquidity: Fund shares can generally be bought or sold at their NAV every day.

- Convenience: Easily invested via employer plans (such as 401(k)s) or through brokerages.

Possible Drawbacks (Cons) and Risks

- No Fees and Expenses: Mutual funds have a huge variety of fees; management, administrative, sometimes sales loads (commissions to be paid), and expense ratios (annual percentage deducted from assets). Thus, it becomes important to take a closer look at the expense ratio, as it will directly play a role in modifying your net returns.

- Lack of Control: Individual investors cannot tell which securities exist in the fund, or when they were bought or sold.

- No Guarantee: Like all kinds of investments, the fluctuation in market value makes it likely to lose money. The principal is not guaranteed.

- Tax Inefficiency: Particularly among actively managed funds, capital gains distributions (for profit selling securities) usually hit investors square inside the tax net, even if they have not sold their shares in the fund. However, such cases are less prevalent in IRAs and 401(k)-type accounts where investments enjoy favorable tax treatment.

- Hidden Costs: There are times 401(k)-or brokerage-materials accounts offer different “share classes” of funds with different fee structures; thus, scrutiny and comparison would entail.

How to buy mutual funds

- Vanguard, Fidelity, or Schwab accounts open (free at all those places).

- Fund (bank link or rollover).

- Use the ticker (+VTSAX).

- Set up for automatic investing ($50-$500 every month).

- Forget about it for 10 plus years.

That’s it. You’re done. Trading fees are nonexistent, and most funds have no minimums now. This is not some kind of personal genius stock code; this is owning tiny nuggets of thousands of great names. Let time do the work.

Bottom line

Mutual Funds are great instruments that can be invested in for investor diversification and professional management in an investor portfolio. It understands the different types of mutual funds, the differences between active and passive management, and the fees involved, such that they are put into a long-term financial strategy with confidence that they help meet investment goals.

FAQ on Mutual Funds

Hereby, fast-track answers to the most frequently asked questions about investment formats and how to make the most effective use of them in managing often hefty costs that setup entails.

Q1: What is the most important fee to watch out for when buying a mutual fund?

By far, the most critical fee to watch, however, is the Expense Ratio.

Expense Ratio: Annually, to fund assets, funds take some percentage of them to cover management, administration, and operating expenses. That portion will be deducted from the fund’s returns before all are calculated for the investor.

Impact: In fact, citing a small difference in expense ratio (from 1.0% to 0.10%) could cost you tens of thousands of dollars over a 30-year investment time frame, especially at large balances. Always choose an index fund as opposed to other, more actively managed funds with higher expense ratios.

Q2: What is the difference between a Mutual Fund and an ETF?

They are pooled vehicles in investment, but they trade differently:

| Feature | Mutual Fund | Exchange Traded Fund (ETF) |

| Trading Time | It is only traded once a day, and that is usually at the closing Net Asset Value (NAV). | All-day trading via stock exchanges is just like any stock. |

| Minimum Investment | Usually has a high minimum initial investment, such as $1,000 to $3,000. | Usually, one shares afford entry (lower barrier to entry). |

| Fees | Often have higher fees (higher expense ratios) | Generally have a lower expense ratio |

Amongst several reasons that fuel the popularity of ETFs, these are their liquidity and low cost.

Q3: Why do most actively managed mutual funds tend to underperform their benchmark indices?

There are two main reasons why actively managed funds are most of the time unable to outperform their benchmark index (like the S&P 500):

- High Fees: The higher expense ratio and trading costs immediately put the actively managed fund at a disadvantage. The manager needs in excess of that amount to outperform the market and break even with the fund’s low-cost index fund.

- Market Efficiency: These highly efficient markets in the U.S. make it really hard to find undervalued stocks, a key element in beating the market with consistency through decades of proof.

Q4: Are capital gains distributions from mutual funds always taxable?

It depends on where the mutual fund is held.

In a Taxable Brokerage Account: Yes. Taxes would be due for appreciation on securities sold inside the portfolio and passed through to shareholders. This is a taxable event, whether or not you reinvest the distribution.

In a Tax-Advantaged Account (IRA, 401(k)): No. Any distributions or gains generated within these accounts are sheltered from immediate taxation.

Q5: How does a Target-Date Fund operate?

The operation would be a Target-Date Fund generally termed via simplifying investing through automatic management of risk exposures concerning retirement years, such as the “2050 Fund”.

Glide Path: The fund is on a “glide path” whereby the asset allocation is modified automatically over time:

Early Years: Heavily weighted into stocks early (higher-associated risk with growth potential).

Later Years (Closer to Retirement): Automatically shifts to holding more bonds and cash (less risky, preserving capital).

Advantage: Does not need any active management or rebalancing from the investor.