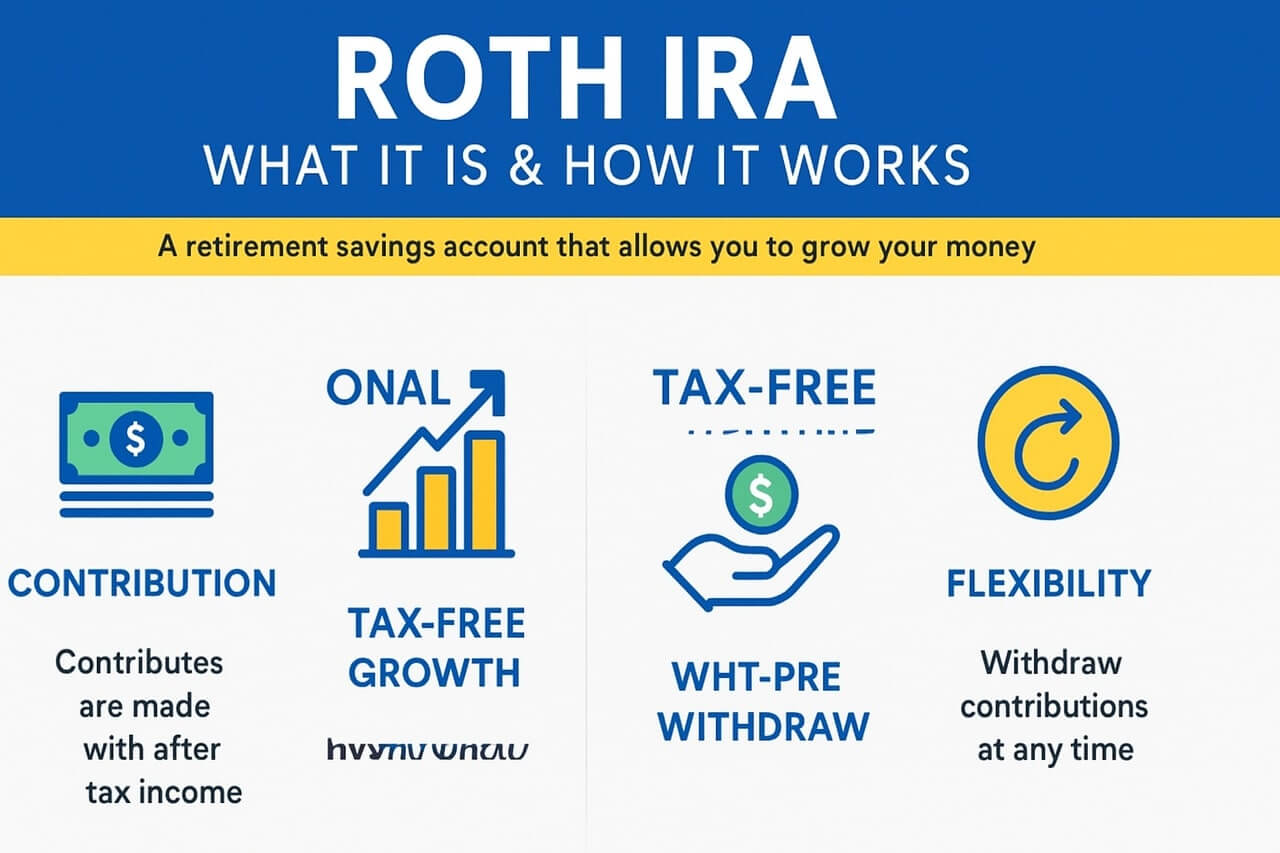

If you’ve been researching ways to save for retirement, you’ve probably come across the term Roth IRA. But you don’t know what exactly it is, or how it works? Simply put, a Roth IRA (Individual Retirement Account) is a type of retirement savings account that allows your money to grow tax-free. Unlike traditional IRAs, you contribute after-tax income — which means you don’t get a tax deduction now, but your withdrawals in retirement are 100% tax-free.

In all, Roth accounts are arguably the most powerful way of creating wealth over the long term: in your early earning years or if you expect to be in a higher tax bracket during retirement. We’ll break each of those down in the rest of our comprehensive discussion about how Roth IRAs work, their perks, rules for contributions, and some clever ways to boost your savings in them.

What Is a Roth IRA?

A Roth IRA is a retirement savings account created to enable individuals to build wealth for their future while remaining tax-free on growth and tax-free on withdrawals. Unlike the 401(k), a Roth IRA account is not a vehicle offered by an employer. Instead, you must establish one for yourself; one or more holding institutions, like a bank, a brokerage, or both, could do just that for you.

The initial contribution to a Roth IRA is made with after-tax money, meaning:

No immediate deduction for tax: You use your after-tax money to fund your Roth IRA. Your initial contributions to this type of IRA are not tax-deductible.

Tax-free growth and withdrawal: The investments within the account grow tax-free, and most importantly, after you satisfy the withdrawal requirements, each dollar taken can be 100% income tax-free—from first principal contributions to compound interest.

This tax-free nature in the future is the prime draw card for a Roth IRA in the first place, to be honestly listed alongside the incredible potential for retirees to build immense wealth in the long run.

How the Roth IRA Works?

These put Roth IRAs into action based on prospective contributions that are subject to different ceilings and income levels set by the IRS. Understandably, the primary consideration is that you have paid eternally for these savings.

Roth IRA Contribution Limits (2025)

The IRS has prescribed how much you may contribute to Roth and traditional IRAs, combined, in a given year.

Under Age 50: The limit is \$7,000 for the 2025 tax year.

Age 50 and Older: You can make an additional catch-up contribution of \$1,000, bringing your total limit to \$8,000 for 2025.

You must have taxable compensation (earned income from a job, self-employment, etc.) equal to or greater than your contribution amount.

Modified Adjusted Gross Income (MAGI) Limits for a Roth IRA

In contrast to Traditional IRAs, not everyone will be eligible for a Roth IRA. The government creates limits based on the individual’s Modified Adjusted Gross Income (MAGI), phasing out contributions as an individual’s income climbs.

| Filing Status | MAGI Phase-Out Range | Ineligible Above |

| Single, Head of Household | \$150,000 – \$165,000 | \$165,000 |

| Married Filing Jointly | \$236,000 – \$246,000 | \$246,000 |

| Married Filing Separately | \$0 – \$10,000 | \$10,000 |

If your MAGI falls within the phase-out range, your allowed contribution is reduced. If your MAGI is above the ineligible limit, you cannot make a direct contribution. (There are advanced strategies like the “Backdoor Roth IRA” for higher earners, but this often requires consulting a tax professional.)

Key Benefits of a Roth IRA for Long-Term Savers

Why is the Roth IRA considered such an integral part of a healthy retirement portfolio? Its benefits extend well beyond the simple tax-free withdrawals in retirement.

1. Tax-Free Income in Retirement

This is the main selling point. Imagine you contribute \$70,000 over your working life, and your investments grow to \$500,000. With a qualified Roth withdrawal, you pay zero tax on that \$500,000. This is a massive advantage for managing your tax exposure in your golden years.

2. No RMD (Required Minimum Distributions)

With a Traditional IRA or 401(k), the government eventually forces you to start taking money out, even if you don’t need it (RMDs usually start at age 73). This is because the money has never been taxed.

A Roth IRA, however, has no RMDs for the original owner. This allows your money to continue growing tax-free for your entire life, providing unparalleled flexibility for estate planning and wealth transfer to heirs.

3. Flexibility with Withdrawing Contributions Penalty-Free

Here is a unique feature that offers a safety net for younger savers. You can withdraw your contributions (the principal you put in, not the earnings) from a Roth IRA at any time, for any reason, without paying taxes or penalties.

It’s important to remember that the Roth IRA is a retirement vehicle first. Still, this access to your principal offers a great layer of liquidity in an emergency, making it a less restrictive savings option than a traditional 401(k) or IRA.

Roth IRA Withdrawal Rules

Withdrawing money can be somewhat complicated with the existence of a Roth IRA, and the regulations essentially require it to be this way.

The Two Rules for Qualified (Tax- and Penalty-Free) Withdrawals

To withdraw both contributions and earnings without Federal tax or penalties, two conditions must first be attained:

1. The 5-Year Rule: The Roth IRA account must have been open for at least five full tax years (starting January 1 of the year you made your very first contribution).

2. A Qualifying Event: You must meet one of the following criteria:

- Age 59½ or older.

- Total and permanent disability.

- Using the withdrawal for a qualified first-time home purchase (up to a \$10,000 lifetime limit).

- Distribution to a beneficiary after the original account owner’s death.

If you meet both rules, your withdrawal is qualified, meaning it’s 100% tax-free.

The Contribution Withdrawal Order

If you have yet to meet a 5-year requirement or are not yet 59½, how are distributions treated by the IRS? The IRS actually has a specific order:

- Contributions: They always come out first. They are tax-free and penalty-free at any time.

- Conversions: These come out second.

- Earnings: These come out last. If you withdraw earnings before meeting the qualified withdrawal criteria (5-year rule and qualifying event), they will generally be subject to income tax and a 10% early withdrawal penalty.

In other words, the original Roth IRA contributions can be withdrawn anytime, but earnings must be left to compound until you can satisfy the requirements for a qualified withdrawal.

Roth IRA vs. Traditional IRA: Which is Right for You?

The choice between a Roth IRA and a Traditional IRA depends on when you feel you will be taxed more.

| Feature | Roth IRA | Traditional IRA |

| Tax Treatment of Contributions | After-tax dollars (No deduction now) | Pre-tax dollars (Deduction now) |

| Tax Treatment of Withdrawals | Tax-Free in retirement | Taxable as ordinary income in retirement |

| Income Limits on Contributions | Yes, high earners are phased out | No, anyone with earned income can contribute |

| RMDs for Original Owner | No | Yes, generally starting at age 73 |

| Ideal For | Those who expect a higher tax bracket in retirement | Those who expect a lower tax bracket in retirement |

The Roth IRA is typically a better choice if you suspect higher tax rates will await you in your future. This is generally true for young professionals early in their careers, whose income is about to experience significant rises.

How to Open and Fund Your Roth IRA

Setting up a Roth IRA is a surprisingly simple process. You don’t get the account from the IRS; you open it through a financial institution.

1. Choose a Brokerage or Financial Institution

Popular options include major brokerage firms, robo-advisors, and even some banks. When choosing, look for:

- Low fees: Preferably zero commission fees for trading stocks and ETFs.

- A wide range of investment options: Stocks, bonds, mutual funds, and ETFs.

- Ease of use: A user-friendly mobile app and website.

2. Open the Account

The process usually takes just 10–15 minutes online. You’ll need to provide personal information like your Social Security Number and employment details. Be sure to select the Roth IRA as the account type.

3. Fund Your Account and Invest

Once the account is open, you can link your bank account to transfer funds. A Roth IRA is merely a vehicle; after that, the money needs to be invested in assets like index funds or stocks for it to grow in value. It won’t earn any tax-free growth while sitting in cash, thus squandering the value of a Roth IRA.

Final Thoughts

The Roth IRA stands as one of the most powerful and flexible retirement vehicles available today. By sacrificing a small tax break now, you receive a huge future benefit of tax-free growth and tax-free income, ensuring that when you finally retire, every dollar you withdraw is truly yours.

Roth IRA: Frequently Asked Questions (FAQ)

Q1: What is a Roth IRA, and how does it work?

A: A Roth IRA (Individual Retirement Arrangement) is a retirement savings account that allows for tax-free growth and tax-free withdrawal in retirement, if one adheres to its provisions. You contribute money that has already been taxed (after-tax dollars), and your investments grow tax-free.

Q2: What are the main benefits of a Roth IRA?

A: The most significant advantages include:

Tax-Free Withdrawals in Retirement: All qualified withdrawals (contributions and earnings) after age 59½ are completely tax-free, provided the account has existed for at least five years.

No Required Minimum Distributions: Unlike Traditional IRAs or 401(k)s, the original owner is never forced to take funds out during their lifetime.

Flexible Access to Contributions: You can withdraw your contributions (the money you put in) at any time, for any reason, without taxes or penalties.

Q3: How much can I contribute to a Roth IRA?

A: The annual contribution limit is set by the IRS and can change yearly. For example, the combined limit for Traditional and Roth IRAs for 2024 and 2025 is \$7,000 (or \$8,000 if you are age 50 or older). This limit applies across all of your Roth and Traditional IRA accounts combined.

Q4: Are there income limits for contributing to a Roth IRA?

A: Yes, there are. If your Modified Adjusted Gross Income (MAGI) exceeds certain thresholds, the direct contributions to Roth IRAs are phased out and eliminated.

For single filers, the MAGI limit for full contribution begins phasing out at about \$146,000 for the year 2024 and at \$150,000 in the year 2025, with complete phase-out above certain levels.

For married couples filing jointly, contribution limits begin phase-out at about \$230,000 (2024) and \$236,000 (2025) for full contribution and are eliminated above certain thresholds.

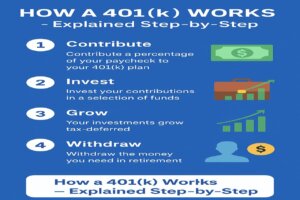

Q5: Can I have a Roth IRA and a 401(k) at the same time?

A: Yes, if you meet the income restrictions for the Roth IRA, you can contribute to both the 401(k) or employer-sponsored plan and the Roth IRA. Each type of plan counts separately toward that year’s contribution limit.

Q6: Is a Roth IRA better than a Traditional IRA for young people?

A: Yes, at times. Their income at present is usually quite low, placing young investors starting their careers in a very low tax bracket. Funding the current tax liabilities at a low rate (Roth IRA) and enjoying tax-free withdrawals later are generally more beneficial, given that the investors will likely retire at a higher tax bracket.