When planning for retirement, one question always comes up: Roth IRA vs. 401(k) — which is better? While both are powerful tools for building a secure future, they operate under different rules, primarily concerning when you pay your taxes. Understanding how each plan functions, its tax advantages, and its long-term benefits can help you make the right decision for your financial future.

The choice between a Roth IRA and a 401(k) involves analyzing your current income, your expected income in retirement, and the desire for flexibility. This in-depth guide will break down everything a beginner needs to know to confidently build a rock-solid retirement plan.

What is a 401(k)?

A 401(k) is an employer-sponsored retirement plan, in which the employees are allowed to contribute a percentage of their salary, before tax deduction, into the plan. This makes it a tax-deferred investment, meaning you pay taxes later, usually when you withdraw the money in retirement.

How a 401(k) Works

- Automatically save a part of your salary to the 401k account through paycheck deductions.

- The employer may match a certain percentage of employees’ contributions, typically between 50% and 100% of their first 3-6% of their income.

- The funds grow tax-deferred until you start taking withdrawals in retirement.

Example: If you earn $60,000 a year and contribute 10% ($6,000), your taxable income drops to $54,000. That’s an immediate tax advantage while your money grows over time.

What Is a Roth IRA?

A Roth IRA (Individual Retirement Account) is a retirement savings account that you directly open through a bank or brokerage, or financial app. Contributions to a Roth IRA are after taxes, meaning that the investor pays taxes now but enjoys tax-free growth and future withdrawals.

How does a Roth IRA work?

- Investments grow tax-free.

- You can withdraw all your contributions and earnings tax-free after age 59½, as long as the account is at least five years old.

That’s ideal for younger investors or anyone expecting to be in a higher tax bracket later in life.

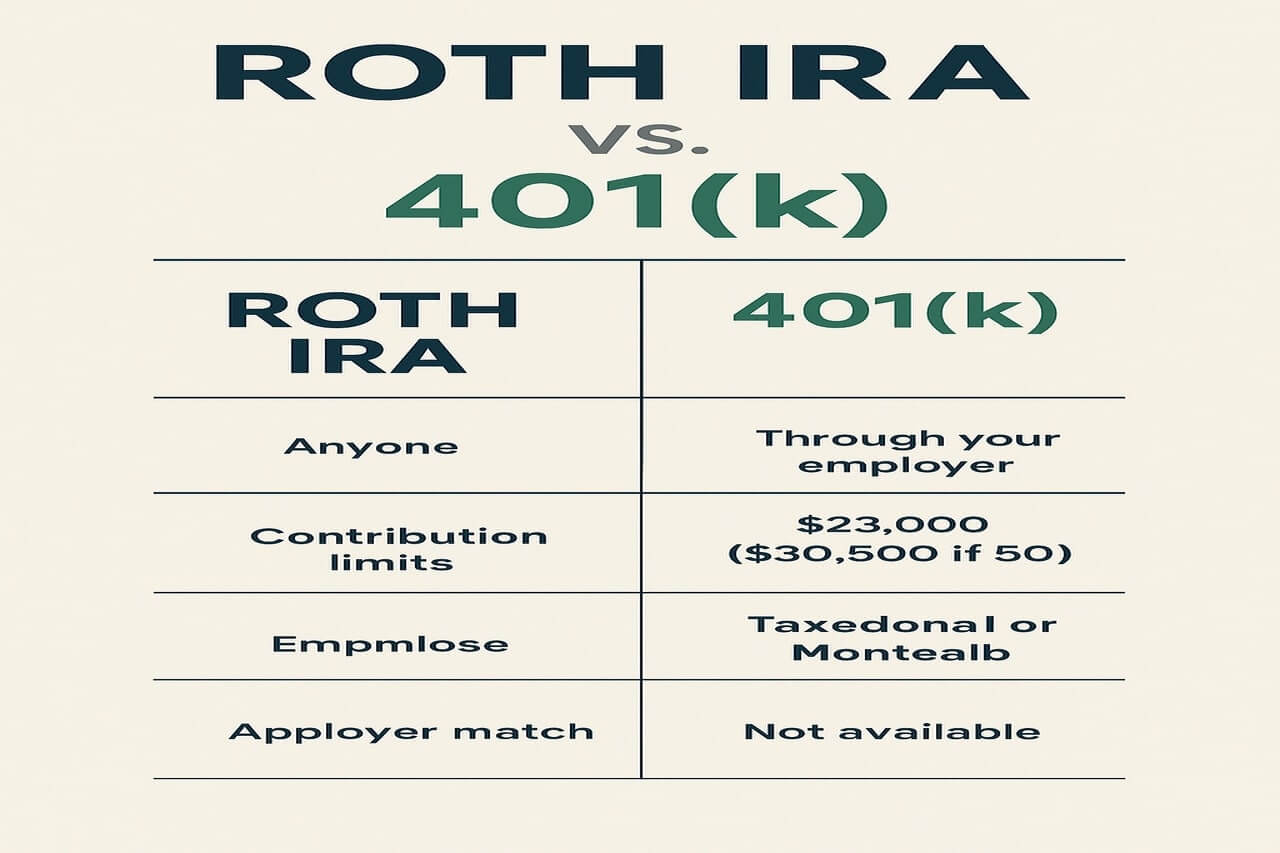

Key differences between Roth IRA vs. 401(k)

| Feature | Roth IRA | 401(k) |

| Who can open it? | Anyone with earned income under IRS limits | Only through your employer |

| Contribution limits | $7,000 ($8,000 if 50+) | $23,000 ($30,500 if 50+) |

| Tax treatment | Pay taxes now, withdraw tax-free later | Tax-deferred contributions, taxed on withdrawal |

| Employer match | Not available | Often available |

| Withdrawal rules | Contributions anytime, earnings after 59½ | Withdrawals after 59½, penalty before that |

| Investment options | Wide range (stocks, ETFs, mutual funds) | Limited to employer plan options |

The Core Difference: Tax Timing is Everything

This is the largest difference between these types of accounts. The simplest and most fundamental of such features is the classic Pay Tax Now vs. Pay Tax Later debate.

The 401(k): Tax Break Today (The Traditional Path)

A Typical 401k is an employer-sponsored plan where the contributions are usually made using pre-tax dollars, meaning the money goes into the account before income taxes are calculated.

How it works: Your contribution is deducted from your paycheck, lowering your taxable income right now. You are getting an immediate tax break in the present.

Disadvantage: Money grows tax-deferred, but every dollar withdrawn in retirement (contributions and earnings) will be taxed as ordinary income at your tax rate prevailing at that time.

Traditional 401(k) Snapshot :—

- Contributions: Pre-tax dollars (Tax Deduction Today)

- Growth: Tax-deferred

- Withdrawals in Retirement: Taxed as ordinary income

The Roth IRA: Tax-Free Retirement

The Roth IRA (Individual Retirement Arrangement) is not tied to an employer. All contributions come from after-tax dollars because income taxes are paid today

before investing the money.

How it works: You receive no immediate tax deduction for a contribution. Later, however, the magic happens: It grows tax-free, and all distributions meet the qualified withdrawal test for retirement and are 100% tax-free—including all of its investment earnings!

Disadvantage: You are paying the bill for taxes now and therefore have a smaller paycheck in the current year.

Roth IRA Snapshot:—

- Contributions: After-tax dollars (No Deduction Today)

- Growth: Tax-free

- Withdrawals in Retirement: Tax-free (for qualified distributions) |

Contribution Limits and Employer Matching

Beyond the tax structure, the rules governing how much you can contribute and whether you get free money from your job are major deciding factors in the Roth IRA vs. 401(k) comparison.

Maximum Contributions: Volume vs. Flexibility

The 401(k) generally allows you to stash away significantly more money each year, but the Roth IRA has unique income restrictions.

| Feature | 401(k) (Employee Contribution Limit) | Roth IRA (Contribution Limit) |

| Annual Limit | \$23,000 | \$7,000 |

| Catch-Up (Age 50+) | \$7,500 (\$30,500 total) | \$1,000 (\$8,000 total) |

| Income Restrictions? | No. Available to all employees regardless of income. | Yes. Eligibility phases out at higher income levels. |

The High-Earner Challenge: Your income may be too high to enable you to make direct contributions to a Roth IRA; however, you are free to contribute to a 401(k) no matter what.

The Golden Rule: Never Miss the Company Match

The single most powerful feature of a 401(k) is the employer match.

This match is, quite literally, 100% free money (an immediate, guaranteed return on your investment).

CRUCIAL NOTE: Contributions to either a Traditional 401(k) or Roth 401(k) (where applicable) create an account where funds will be placed in a Traditional/Pre-Tax account and taxed on withdrawal.

Except for IRAs, Roth, or Otherwise-they do not have employer matches.

Action Item: Put the maximum allowable amount into that 401(k) to get the full employer match before you start putting away dollars elsewhere!

Investment Flexibility and Withdrawal Rules

These accounts will differ again when it comes to getting access to your funds and selecting investments. These two items will be important considerations in early financial responsibility and self-directed savings.

Investment Choices: More Control with an IRA

401(k): Limited to the funds selected by the employer’s plan administrator (principally a limited list of mutual funds).

Roth IRA: This account can be opened at any brokerage (like Fidelity, Vanguard, or Schwab) and opens up maximum investment flexibility to buy into a broad range of individual stocks, Exchange-Traded Funds (ETFs), bonds, and mutual funds.

Early Withdrawal Flexibility

This is where the Roth IRA truly shines for those who prioritize access to their money.

| Withdrawal Feature | 401(k) (Traditional/Roth) | Roth IRA |

| Contributions | Generally taxed + 10% penalty before age 59.5 | Tax- and penalty-free at any time. |

| Earnings | Always taxed + 10% penalty before age 59.5 | Taxed + 10% penalty before age 59.5 |

| Loan Option | Some plans allow you to take a loan against the balance. | No loan option. |

The Roth Exception: The fact that you can withdraw contributions (but not earnings) penalty-free- and tax-free at any time makes the Roth IRA a pretty good emergency fund, even though one really should not be using retirement funds this way.

Which Account is Right for You?

The question is not which one is better, but which one is better for you right now. The best way to construct a retirement plan is often to have both accounts to achieve tax diversification.

Choose the 401(k) If You:

- Need a Tax Break Today: You are currently in a high tax bracket and want to lower your current taxable income.

- Expect a Lower Tax Rate in Retirement: You will have less income during retirement (you are planning to earn less money in retirement, or your expectations of dropping tax rates).

- Have an Employer Match: This is non-negotiable! Contribute enough to get the full match.

Choose the Roth IRA If You:

- Expect a Higher Tax Rate in Retirement: You are younger, early in your career, and expect to be in a significantly higher tax bracket when you retire.

- Value Tax-Free Growth: You want the peace of mind that comes from knowing all your future earnings will be 100% tax-free. This is a huge factor in the long-term compounding.

- Desire Investment Flexibility: You want to have more control over where you invest your money than what your company’s 401(k) has to offer.

- Want Flexible Access to Contributions: You like having that safety net from knowing you can withdraw your Roth contributions penalty-free if a true emergency strikes.

Pros and Cons at a Glance

Roth IRA Pros:

- Tax-free withdrawals

- Flexible investment options

- No required minimum distributions (RMDs)

Roth IRA Cons:

- Lower contribution limits

- Income restrictions apply

401(k) Pros:

- Higher contribution limits

- Employer match available

- Automatic payroll deductions

401(k) Cons:

- Limited investment options

- Required minimum distributions after age 73

Final Thoughts

There is no one-size-fits-all comparison when choosing between Roth IRA vs. 401(k) options. If we had to choose, consider one that fits your income, tax situation, and retirement goals.

It is wise to go with both. Get the 401(k) for the employer match, and then the Roth IRA for peace of mind, with tax-free growth. That balance equips you for the good and the bad of financial demands for the future.

Roth IRA vs. 401(k) then assures a “balanced mix” of pre- and post-tax money in retirement to give you the maximum flexibility to run your tax bill for the following decades.

FAQ on Roth IRA vs. 401(k)

Here is a general FAQ based on common inquiries:

Q: What is the main difference between a Roth IRA and a traditional 401(k)?

A: The main difference is the tax treatment:

Traditional 401(k) / IRA: Contributions are often pre-tax (tax-deductible), and money growth is deferred. You would pay ordinary income tax on withdrawals in retirement. This essentially gives you a tax break now.

Roth IRA / Roth 401(k): Contributions are made with after-tax dollars (not tax-deductible), but they grow tax-free, and qualified withdrawals in retirement are tax-free. This essentially provides you with a tax break later.

Q: Which one should I contribute to first?

A: A common strategy is to contribute enough into your 401(k) to get the full employer match, which would be free money. Then, contribute to your Roth IRA for tax-free growth and flexible withdrawal rules (for contributions).

If any money remains, return to top up your 401(k).

Note: There is also a Roth 401(k), which combines the higher contribution limits of a 401(k) with the tax-free withdrawals of a Roth.

Q: When can I withdraw money from my retirement accounts without penalty?

A: For both accounts, you can typically take qualified distributions of your earnings tax-free and penalty-free once you are age 59½ and the account has met a five-year holding period.

Q: Can I withdraw my Roth IRA contributions early?

A: Yes. One unique feature of the Roth IRA is that you can withdraw your contributions (the money you put in) at any time, for any reason, without taxes or an early withdrawal penalty, since you already paid taxes on that money. This does not apply to the earnings on those contributions.

Q: What are Required Minimum Distributions (RMDs)?

A: RMDs are the minimum amounts that you must withdraw from certain retirement accounts each year, generally starting at age 73.