When Maria turned 35, she received a wake-up call at her cousin’s retirement party. Watching her cousin enjoy financial freedom after decades of planning made Maria realize she’d never seriously thought about her retirement. Sound familiar? According to the Employee Benefit Research Institute, nearly 40% of Americans feel they are not on track for retirement savings. But the good news is it’s never too late—or too early—to start planning for your golden years, Save for Retirement.

Why Saving for Retirement is Crucial

Retirement savings ensure that you can maintain your lifestyle when you’re no longer earning a regular paycheck. With rising costs of living and healthcare, the average retiree spends around $50,000 annually, according to U.S. Bureau of Labor Statistics data. This is highly importance of starting early and saving consistently.

How to Save for Retirement

Financial security in retirement doesn’t just happen, it takes commitment and planning. Here are the top 10 ways to prepare for financial security for a retirement plan:

1 . Start saving and stick to your goals

If you are already saving for retirement or another goal, keep going. You know that saving is a rewarding habit for human beings. If you are not, it’s time to get started on your financial goal and security. Starting is the first step for your goal start with a small amount if you have to, and try to increase the amount each month. As soon as you start saving the more time your money has to grow.

2. Know your retirement needs

Retirement is expensive, it depends on your needs and your lifestyle. Experts estimate that you will need 70 to 90 percent of your preretirement income to maintain your standard of living when you are unemployed and stop working.

3. Consider basic investment

How you can save is as much important as how much you save. Investment plans are important in how much you will save for your retirement. Learn about your investment plan and invest your savings in different investments. By diversifying your investment, you are more likely to reduce risk and improve return. Your investment may change factors such as age, goals, and financial circumstances.

4. Dont touch your retirement savings

If you withdraw your savings, you will lose principal and interest. If you change jobs, leave your savings investment in your current retirement plan, or roll them over to an IRA or your new employer’s plan.

5. Open an individual retirement account

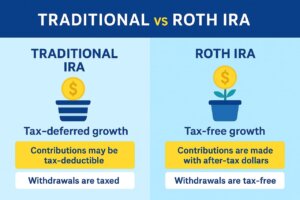

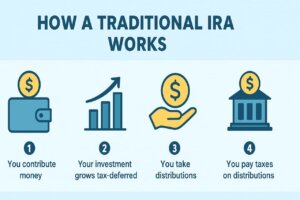

Put your money into an individual retirement account like a Roth or Traditional Individual Retirement Account (IRA). Roth IRAs allow you to grow your investments tax-free, while Traditional IRAs offer upfront tax deductions.

6. Start with Employer-Sponsored Plans

If your company offers a 401(k), take advantage of it. Contribute enough to at least get the company match—it’s essentially free money. In 2024, the IRS allows employees to contribute up to $23,000 annually if you’re under 50, and $30,000 if you’re over 50.

7. Automate Your Savings

To ensure consistent saving, set up automatic contributions to your retirement account. Even small, regular deposits grow significantly over time due to compound interest.

8. Diversify Your Investments

A diversified portfolio of stocks, bonds, and index funds can help grow your retirement savings while managing risk. Tools like target-date funds automatically adjust your investment mix as you approach retirement.

9. Cut Unnecessary Expenses

Reducing discretionary spending today—like dining out or unused subscriptions—can free up extra cash for retirement savings.

10. Benefit from getting older

If you are over age 50, the government rewards you with the opportunity to contribute an additional $7500 to the employer-sponsored retirement plan 401(k), 403(b), and 457 for a maximum amount of $30,000 in 2023. This contribution amounts up to $30,500. Retirement plan limits are raised, giving the older investor a chance to accelerate their retirement savings. You are allowed to increase contributions to both traditional IRAs and Roth IRAs.

Real Numbers for Motivation

Starting at 25 and saving $500 monthly at a 7% return could grow to over $1.2 million by age 65. Waiting until 35 to start saving requires nearly double that amount—$950 monthly—to reach the same goal.

FAQs About Saving for Retirement

1. How much should I save for retirement?

A general rule is to aim for 15% of your income annually, including any employer match. Many experts suggest saving enough to replace 70-80% of your pre-retirement income.

2. When should I start saving for retirement?

The sooner, the better! Starting early allows compound interest to work in your favor, growing your savings significantly over time.

3. Can I save for retirement without an employer-sponsored plan?

Absolutely, you can open an IRA, invest in a taxable brokerage account, or use specialized accounts like a solo 401(k) if you’re self-employed.

4. What is the difference between a Roth IRA and a Traditional IRA?

Traditional IRAs offer immediate tax deductions but require you to pay taxes on withdrawals in retirement. Roth IRAs use after-tax dollars but allow tax-free withdrawals later.

5. What happens if I can’t save much now?

Even small amounts can add up over time. Focus on consistent contributions, and gradually increase them as your financial situation improves.

6. Should I pay off debt before saving for retirement?

It depends. Prioritize high-interest debt, like credit cards, but don’t skip retirement savings entirely. Balancing both is often the best strategy.

Conclusion

Saving for retirement doesn’t have to feel overwhelming. By starting early, taking advantage of employer-sponsored plans, and making small, consistent changes, you can set yourself up for financial independence. Maria began saving after her cousin’s party, and while she wished she’d started sooner, she was relieved to have a plan in place.

What steps will you take today to secure your financial future tomorrow?