If you’ve started exploring retirement savings beyond an employer’s 401(k), you’ve likely come across the term Roth IRA. But what exactly is a Roth IRA, and why do so many financial experts consider it? A Roth IRA is one of the most powerful wealth-building tools available, especially for young investors. A Roth IRA (Individual Retirement Arrangement) is an investment account that offers a unique and incredibly valuable tax advantage: tax-free withdrawals in retirement. Unlike a Traditional IRA, where you get a tax break now but pay taxes later, the Roth flips the script. This comprehensive guide will break down how a Roth IRA works, its strict eligibility rules, its unmatched benefits, and whether it’s the right choice for your financial future.

What Is a Roth IRA?

A Roth IRA is a type of retirement savings account that lets you contribute after-tax dollars — meaning you pay taxes now, but not later. The greatest benefit? When you retire and start withdrawing funds, you won’t pay taxes on the investment gains or qualified withdrawals. In other words: pay taxes today, enjoy tax-free income tomorrow. Some Key Highlights of Roth IRA

- Tax-free growth on investments

- Tax-free withdrawals during retirement (after age 59½)

- No required minimum distributions (RMDs)

- Flexible withdrawal rules for contributions

This makes a Roth IRA one of the most flexible and powerful retirement tools available to Americans today.

How Does a Roth IRA Work?

The fundamental principle of the Roth IRA is the upfront tax treatment. This single factor determines all the unique benefits the account offers.

The Key Difference: After-Tax Contributions

Contributions to a Roth IRA relate to “after-tax” because the taxes have already been paid on the cash (you earned them in a year where you already counted them as part of your taxable income), and you paid any federal and state income taxes on it. No Upfront Tax Deduction: You have already paid tax on that amount, so you don’t get to have it taxed on the amount that you deposited in your Roth, nor will you see a tax deduction in the year you made that contribution. Tax-Free Growth & Withdrawals: The trade-off is huge: your money grows, compounds, and compounds again over decades entirely tax-free. When you eventually withdraw the funds in retirement (as a qualified distribution), both your original contributions and all the investment earnings are 100% tax-free. This is particularly beneficial if you think you will be in a higher tax bracket during your retirement years than you are right now.

Roth IRA Rules and Limits: What You Need to Know

While the tax benefits are attractive, the Roth IRA comes with strict contribution rules set by the IRS, the most notable of which concerns the requirement that contributions be made from earned income.

Annual Contribution Limits and Catch-Up Contributions

The IRS sets a limit on how much you can collectively contribute to all your IRAs (Roth and Traditional). Generally, this limit is adjusted for inflation. Current Limit (Example: 2025): The maximum annual contribution is $\$7,000$. Catch-Up Contributions: If you are age 50 or older, you are generally allowed an additional catch-up contribution (Example: $\$1,000$ in 2025), raising your total limit to $\$8,000$. The Earned Income Rule: You can only contribute up to 100% of your earned income for the year. For example, if you earned only \$5,000 from a part-time job, your maximum contribution will be \$5,000, even if the IRS limit is higher.

Modified Adjusted Gross Income (MAGI) Limits

This is the most challenging aspect of eligibility. The IRS restricts who can contribute directly to a Roth IRA based on their income level, specifically their Modified Adjusted Gross Income (MAGI). If your income is too high, your ability to contribute is either reduced or eliminated.

| Filing Status | MAGI for Full Contribution (Example: 2025) | MAGI for Phase-Out Range (Example: 2025) |

| Single, Head of Household | Less than $\$150,000$ | $\$150,000$ to less than $\$165,000$ | |

| Married Filing Jointly | Less than $\$236,000$ | $\$236,000$ to less than $\$246,000$ |

- If your MAGI falls within the phase-out range, you can only make a partial contribution.

- If your MAGI is above the phase-out limit (for example, \$165,000 for single filers), you cannot make a direct contribution.

Benefits of Investing with a Roth IRA

Apart from its core tax-free nature, the Roth IRA provides several key advantages that make it a favorite among investors, particularly those just starting.

The Power of Tax-Free Compounding for Young Investors

The biggest gain would be the time available to grow tax-free. Suppose a young person contributes \$7,000 a year for 30 years, earning an average of 8% a year-after 40 or 50 years before retirement; huge amounts could be realized from tax-free compounding in a Roth IRA over a period of time compared to other retirement vehicles. You are locking in your current low tax rate on your contributions to several decades of future tax-free growth.

Flexibility: Accessing Contributions Penalty-Free

Unlike most retirement accounts, a Roth IRA offers incredible flexibility that can ease the minds of younger savers. You can withdraw your original contributions (the money you put in, not the investment earnings) at any time, for any reason, without paying taxes or an early withdrawal penalty.

- It means your Roth IRA can serve as a final-tier emergency fund without having to worry about losing 10% to the IRS on the money you contributed.

- It removes the fear of locking up your money until retirement, making it easier for you to start saving early.

No Required Minimum Distributions (RMDs)

Traditional IRAs and 401(k)s force you to withdraw money and pay taxes on it—when you reach age 73 (or 75, depending on your birth year). These are called Required Minimum Distributions (RMDs). The Roth IRA is different: There are no RMDs during the original owner’s lifetime. Your money will continuously grow, tax-free, for as long as you live. This makes the Roth IRA an exceptional tool for estate planning, allowing you to pass on a potentially massive, tax-free nest egg to your heirs.

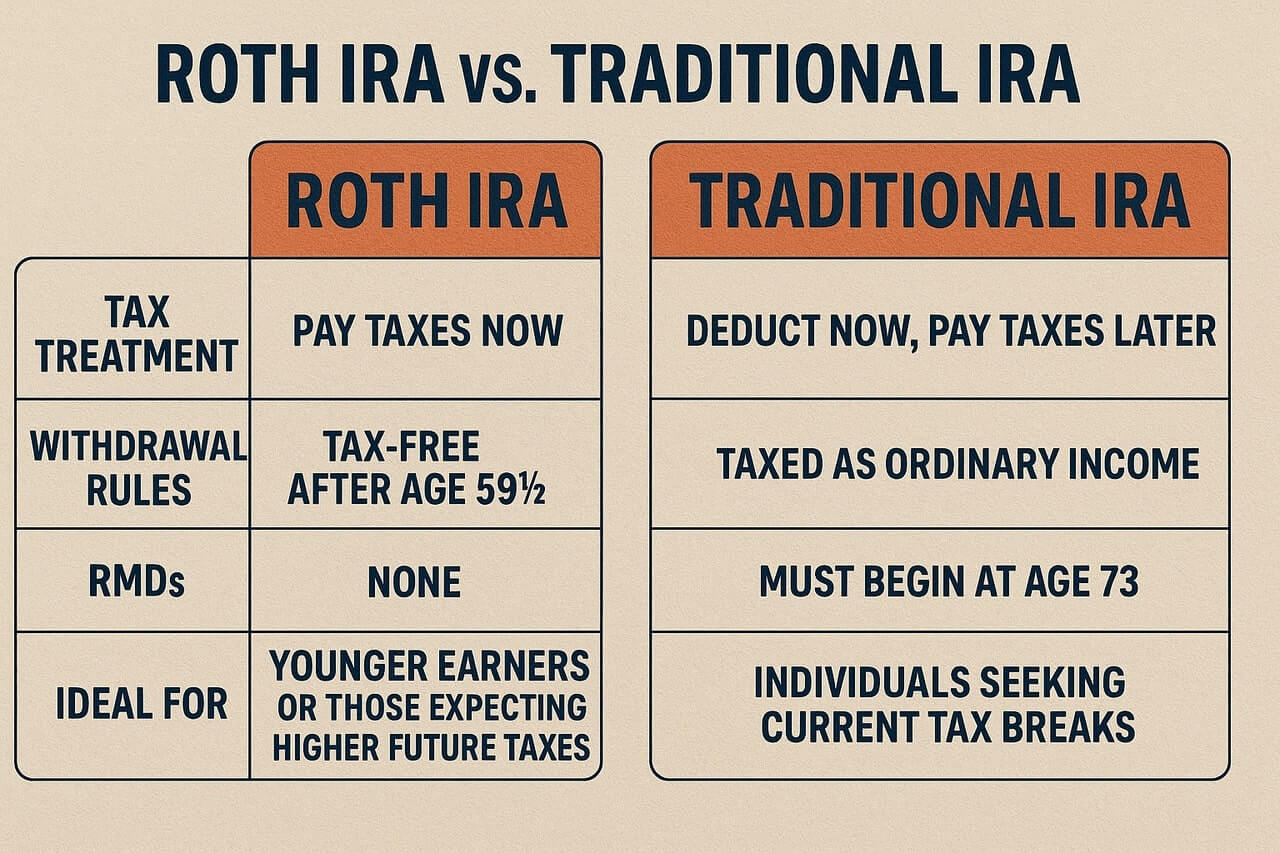

Roth vs. Traditional IRA: Which One Is Right for You?

Choosing between the two primary types of IRAs comes down to a simple question: Do you want the tax break now or later?

| Feature | Roth IRA | Traditional IRA |

| Tax Break | Later (Tax-free withdrawals in retirement) | Now (Contributions may be tax-deductible) |

| Contributions | Made with After-Tax dollars | Made with Pre-Tax (or deductible After-Tax) dollars |

| Withdrawals in Retirement | 100% Tax-Free | Taxed as ordinary income |

| Income Limit | Yes (Strict MAGI phase-outs) | No (But deductibility phases out with a workplace plan) |

| RMDs | No (During the original owner’s lifetime) | Yes (Must start withdrawing at age 73/75) |

Who should choose the Roth IRA?

Young people are now at a low tax bracket who expect to be earning more (and thus be in a higher tax bracket) later in their career. For High Earners seeking tax diversification in retirement, even if it means they can only make contributions via the “Backdoor Roth”. For anyone seeking the flexibility of penalty-free access to contributions.

Who should consider the Traditional IRA?

High-income earners are typically at a high tax bracket and require a tax deduction right now to get tax-deferred for their current tax bill. People who typically look forward to retirement at a lower bracket.

Best Investments for a Roth IRA

When investing in a Roth IRA, think long-term. Some great options include:

- Index funds and ETFs for broad market exposure

- Dividend-paying stocks for compounding growth

- Target-date funds for hands-off retirement investing

Tip: Avoid overly conservative investments like CDs-roth IRAs are built for growth, not just preservation.

How to Open a Roth IRA?

Getting started with a Roth IRA is easy and can be done entirely online in minutes.

1. Choose a Brokerage: Select a reputable financial institution (brokerage firm, mutual fund company, or robo-advisor). Look for low or $\$0$ transaction fees and a wide selection of investment options.

2. Open the Account: Open an IRA and select a Roth IRA. You will need to provide personal details, including your Social Security number and bank account information for funding.

3. Fund the Account: Transfer money from your checking or savings account into the new Roth IRA. Don’t forget to stay within the annual contribution limit.

4. Invest the Funds: This is the most crucial step! Money sitting as cash in the Roth IRA does not grow. You need to invest it in assets like stocks, bonds, or mutual funds. One of the common strategy for long-term growth is investing in low-cost index funds or target-date retirement funds. So, open your account and start making those tax-free payments as soon as possible, and enjoy the incomparable power of compounding interest toward a comfortable and tax-free retirement.

Frequently Asked Questions (FAQ) about Roth IRAs

1. What is the Roth IRA 5-Year Rule?

The earnings from your Roth account can be eliminated from taxes when you withdraw them using the Roth IRA 5-year rule. Qualified distributions of earnings will be tax-free and penalty-free if the Roth IRA has been established and funded (first contribution) for at least five tax years, in addition to meeting one or more other similar requirements (age 59½, disability, first-time home purchase). The clock starts on January 1 of the tax year in which your first contribution was made.

2. Can I withdraw my contributions without tax or penalty?

Yes. You can always withdraw your direct contributions (the money you put into the Roth IRA) tax-free and penalty-free at any time because they are not subject to any age or time limit. Withdrawals are taken in a specific order: 1) Contributions, 2) Converted or rollover amounts, 3) Earnings.

3. Can I contribute to both a Roth IRA and a 401(k)?

Yes, you can also have a Roth IRA and an employer-sponsored plan like a 401(k) (traditional or Roth 401(k)). Each account will have its own contribution limit, which may allow you to save more overall for retirement. Note: Your eligibility to contribute to a Roth IRA is subject to income limits (MAGI). The 401(k) contribution limit is, however, not subject to MAGI restrictions for employee contributions.

4. What happens if I contribute too much (make an excess contribution) to my Roth IRA?

Any excess contributions are subject to a 6% penalty tax for as long as they are kept in the account. To fix an excess contribution, you usually need to withdraw the excess contribution itself and any earnings it generated by tax filing time (including extensions). The earnings taken out on the excess contribution are usually taxable as ordinary income in the year of contribution and likely subject to a 10% early withdrawal penalty (except for cases in which an exception applies).

5. Can I use my Roth IRA for a first-time home purchase?

Yes. Withdrawals up to \$10,000 of penalties from earnings (lifetime limit) for a qualified first-time home purchase are penalty-free. However, withdrawal of the earnings has to meet the 5-year rule, and that withdrawal of earnings needs to go through the 5-year rule for tax-free and penalty-free benefits. The withdrawal might still be subject to income tax if the account is younger than five years, but up to the \$10,000 limit, the 10% penalty is waived. Remember, your contributions can be withdrawn at any time without taxes or penalties for any reason, including a house purchase. A first-time home buyer refers to any person (and their spouse) who has not owned a principal residence in the previous two years.