Let’s be honest: managing money can be really complicated. When it comes to investing and retirement accounts, taxes and planning for major life changes, trying to handle your finances alone can feel like building a spaceship with just a hand tool kit. This is exactly why a personal financial consultant can be your best partner. They can provide advice, structure, and personalized strategies that turn your financial goals into reality.

In this guide, we’ll discuss what a good consultant offers, how they can boost your financial well-being, and the steps to find the right consultant for you.

What is a Personal Financial Consultant?

A personal financial consultant, also known as a financial advisor or financial planner, is a certified professional who helps you with financial advice and services according to your specific needs. They don’t just pick stocks; they look at your entire financial picture—from income and debt to long-term wealth building and legacy planning.

Their main goal is to help you make your money work for you, ensuring that your everyday choices line up with your current and future goals.

Here are some key services they provide:

Your consultant serves as both a strategist and a behavioral coach.

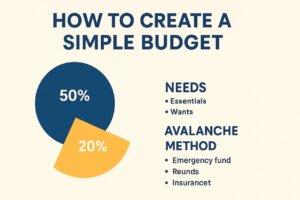

- Budgeting Support: Helping you create a practical spending plan.

- Debt Management: Setting up a plan to pay off loans, credit cards, and other debts quickly.

- Investment Guidance: Suggesting portfolio options based on your risk tolerance and goals.

- Retirement Planning: Making sure you save enough money to support your lifestyle dreams for the future.

- Tax Planning: Reducing tax burdens with smart strategies.

- Estate Planning: Establishing wills, trusts, and inheritance plans.

- Financial Strategist: They design a detailed, personalized plan that covers all areas of your finances.

- Behavioral Coach: They help you avoid emotional decisions, especially during market fluctuations, ensuring you stick to your long-term strategy.

The Benefits of Hiring a Personal Financial Consultant

Consultative assistance is indeed within reach of the elite- it is an inch ahead of those who are conscious about moving towards positive financials.

Personalized Financial Planning

Generic online or manual advice will get you only so far. A consultant gives both a personalized plan, which can be adjusted as life changes.

- Retirement Planning: They calculate how much you should save and set up the best accounts (401k, IRA, Roth, etc.).

- Tax Optimization: They manage your investments and income to minimize your taxes. Most are not CPAs, but they closely coordinate with your tax expert.

- Estate Planning: They ensure the distribution of your assets according to your wishes and as tax-efficiently as possible for your heirs.

- Risk Management: They evaluate your need for insurance (life, disability, long-term care) to protect your wealth from unexpected events.

Gaining an Objective Perspective

Emotion is one of the major forces impeding wealth generation. Fear and greed can lead to poor decisions, like buying high and selling low.

- Removes Emotion: All decisions are substantiated by data and logic, and they help ensure you don’t let emotions get the better of you just because the market changes prompt you to do otherwise.

- Accountability Partner: They serve as your accountability partner and have regular check-ins to evaluate your progress with your savings and investment objectives.

- Saves Time: They handle tedious tasks like research and asset management, allowing you more time for other priorities.

Key Factors in Choosing Your Financial Partner

Your choice of personal financial consultant directly affects your chances for success and for your financial future. This is a relationship based on trust, so choose with care.

Fiduciary Duty: The Key to Trust

This is the most important question to ask.

- What Is A Fiduciary? A fiduciary has legal and ethical obligations to act in your interests always regarding finances. They will sell you only the products that are really best for you, even if these are less remunerative for them.

- Why This Matters: Non-fiduciary consultants, who also go by the term “advisors under the suitability standard”, only have to suggest suitable products. This may create a conflict of interest, where they recommend products simply because they are higher-paying.

- Never forget to ask: “Are you a Fiduciary?” and request a written confirmation.

Understanding Consultant Compensation Models

How your consultant gets paid can greatly affect their advice. The main payment structures include:

| Model | How They Are Paid | Potential Conflict | Best For |

| Fee-Only | You pay a direct fee (hourly, flat retainer, or percentage of assets). | They earn no commissions. None; their advice is completely objective. | Clients who want unbiased, detailed planning. |

| Commission-Based | They earn commissions based on financial products (insurance or mutual funds) that you. | They may suggest a product based on commission rather than what’s best for you. | Clients needing a single purchase (like life insurance). |

| Fee-Based | A hybrid model where they charge a fee and can earn commissions on certain products. | Potential for conflict, similar to commission-based. | Varies; needs careful investigation. |

Essential Questions to Ask Your Potential Consultant

Treat your first meeting like an interview. A good consultant will welcome your questions.

- “What are your qualifications and certifications?” Look for the CFP (Certified Financial Planner); this shows they have trained rigorously in financial planning and follow a strict code of ethics.

- “Can you explain your investment approach?” Their strategy (aggressive, conservative, index-focused) should match your risk tolerance and timeline.

- “How often do we meet, and how do you communicate during tough market times?” You want to be assured they will proactively support you, not just when things are easy.

Why Should You Hire a Personal Financial Consultant?

Not everyone needs a financial consultant, but for many people in the USA, it can be a significant advantage. According to a 2022 Northwestern Mutual study, nearly 62% of Americans say they need better financial planning. Those who work with advisors tend to save more, invest wisely, and feel less stressed about money.

Advantages:

- Gain clarity about your financial situation.

- Build a customized financial plan.

- Avoid costly mistakes with taxes, investments, or debt.

- Save time by letting an expert guide your next steps.

- Feel more confident in achieving long-term goals.

Personal Financial Consultant vs. Financial Advisor

These terms are often used interchangeably, but there are slight differences.

- Personal Financial Consultant: Mostly focuses on short- to medium-term financial needs such as budgeting, management of debt, and saving goals.

- Financial Advisor: Mostly concentrates on long-term issues such as wealth management, investment portfolios, and retirement planning.

Both can be beneficial, but the best one for you will depend on your personal circumstances.

Do You Need a Personal Financial Consultant?

Consider these questions:

- Do I live paycheck to paycheck?

- Am I unsure how to save for retirement?

- Do I have high-interest debt that seems unmanageable?

- Do I feel overwhelmed by financial decisions?

If you answered yes to any of these, working with a personal financial consultant might be a smart choice.

How to Choose the Right Personal Financial Consultant

Choosing the right personal financial consultant can make a huge difference. Follow these steps to help you decide:

1. Check Credentials

Look for certifications like CFP (Certified Financial Planner) or CPA (Certified Public Accountant). These show professional training and ethics.

2. Understand Their Services

Consultants may not offer the same services. Some might focus on retirement planning, while others focus on debt or taxes.

3. Ask About Fees

Consultants may charge in three ways:

- Flat Fee: One-time or monthly payment.

- Hourly Rate: Pay for the time spent.

- Percentage of Assets: Common with advisors who manage investments.

4. Look for Transparency

A reliable consultant will clearly explain their fees and prioritize your interests.

5. Read Reviews & Ask for Referrals

Hearing from other clients can provide insight into how effective and trustworthy they are.

The Process of Working with a Financial Consultant

Do you want to learn more about how it feels to work with a consultant? Here’s a brief overview:

- The first consultation: You talk about your financial situation and goals.

- Assessment: They will evaluate your income, expenses, debts, and investments.

- A customized plan: They will formulate a plan that includes budgeting, saving, and investing.

- The implementation step: Together, you set the plan in motion.

- Ongoing support: Many consultants regularly check in to modify strategies as necessary due to changes in your life.

Costs of Hiring a Personal Financial Consultant

Costs can vary significantly. In the USA, personal financial consultants often charge:

- Hourly: $150–$400

- Flat Fee: $2,000–$7,500 for a complete financial plan

- Ongoing Retainer: $100–$300 per month

While it might seem like an added cost, think of it as an investment in your financial future.

Personal Financial Consultant: Pros and Cons

Pros:

- Expert help with complex financial issues

- Customized strategies to meet your needs

- Lower financial stress

- Long-term financial growth

Cons:

- Professional fees can be high

- Quality can vary by consultant

- Not everyone needs one if their finances are simple

Self-Guided vs. Hiring a Consultant

Although many try to go it alone with their money using apps such as Mint, YNAB (You Need a Budget), and Personal Capital, keep in mind that while these tools may assist in some ways, they do not provide the kind of personalization an experienced consultant can offer—particularly where debts, entrepreneurial income, or great financial goals are involved.

The Path Forward with Your Personal Financial Consultant

Hiring a personal financial consultant is an investment in your peace of mind and your future viability. It is about working together as partners, pursuing the financial goals of your dreams: perhaps buying a first home, putting a child through college, living a comfortable work-optional retirement.

Seek assistance as early as possible; the earlier you get professional help, the longer the plan can benefit from the strategic planning process and compounding ability. Take the first step: research, apply the fiduciary standard, and hire the guide that will help you plot the course toward financial independence.

FAQs on Personal Financial Consultant

To provide quick answers to the most common questions about working with a financial professional, we’ve compiled this list of frequently asked questions.

Q1: What is the difference between a Financial Advisor, a Financial Planner, and a Financial Consultant?

Though these terms are often interchangeable, there are some delicate distinctions between the descriptions, and the titles themselves are generally unregulated.

Financial consultants or advisors: Broad-based terms used for anybody engaging in the chosen fields of investments, retirement accounts, or insurance. Check out their qualifications, such as CFP, to know their full range of expertise along fiduciary lines.

Financial planners (mostly certified financial planners or CFPs): A designation that indicates a much more comprehensive approach. A CFP is trained to address your entire financial life: budgeting, taxes, insurance, retirement, and estate planning; not only your investments.

Q2: How much money do I need to have before I hire a personal financial consultant?

You do not need to be wealthy to benefit from a financial consultant; in fact, many people wind up benefiting the most from their knowledge when they are just starting and trying to lay down a solid foundation.

For the New Investors/Savers: Look for a consultant that charges a flat fee as well as hourly rates. These professionals are excellent for one-time advice on budgeting, debt payoff, and finding out where to begin investing for one without assets.

For Established Investors: Many consultants charging a percentage of Assets Under Management have typically minimum asset requirements (\$100,000 to \$500,000).

Q3: What should I bring to my first meeting with a consultant?

To make your first consultation productive, gather your key financial documents:

- Goals: A list of your short-term (buying a house) and long-term goals (retirement age).

- Income & Expenses: Recent pay stubs, tax returns (last 1-2 years), and a summary of your monthly spending/budget.

- Investments: Statements for all investment, savings, and retirement accounts (401k, IRA, brokerage accounts).

- Debts: Statements for mortgages, credit cards, student loans, and car loans.

- Insurance: Current policies for life, disability, and long-term care insurance.

Q4: How often will I communicate with my financial consultant?

How often you will communicate will depend upon the service model and your stage in life, but generally will be:

- Initial Phase: Expect more contact as the consultant gathers data, assesses your situation, and makes your first plan (weekly or bi-weekly).

- Ongoing Maintenance: Most consultants will have you in for formal review meetings once or half a year for consultations regarding portfolio performance, asset rebalancing, and adjustment of your plan against life changes (new jobs, marriage, the birth of a child, etc.).

- Market Events: An exceptional consultant will ensure their proactive reach during market swings or life events to make sure you stay calm and are on track.

Q5: Can a financial consultant do my taxes?

Generally, a personal financial consultant does not prepare your tax returns. They are primarily strategists.

- Tax Planning: Their role is to provide year-round tax-efficient strategies (like advising on Roth vs. traditional contributions, or using tax-loss harvesting).

- Tax Preparation: For filing your returns, they will coordinate and work closely with your Certified Public Accountant (CPA) or tax preparer to ensure the overall plan is executed correctly.