Do you struggle to track where your money is going each month or find yourself consistently falling short of your savings goals? Budgeting can often feel restrictive and complicated, filled with endless categories and intricate tracking. That’s where the 50/30/20 budget comes in as a breath of fresh air. This simple yet powerful rule offers a clear and straightforward framework for managing your finances effectively. This in-depth, complete guide will walk you through exactly how to use the 50/30/20 budget, providing actionable steps, practical tips, and real-world examples to help you implement this popular budgeting method and gain control over your financial life.

What is the 50/30/20 Budget rule?

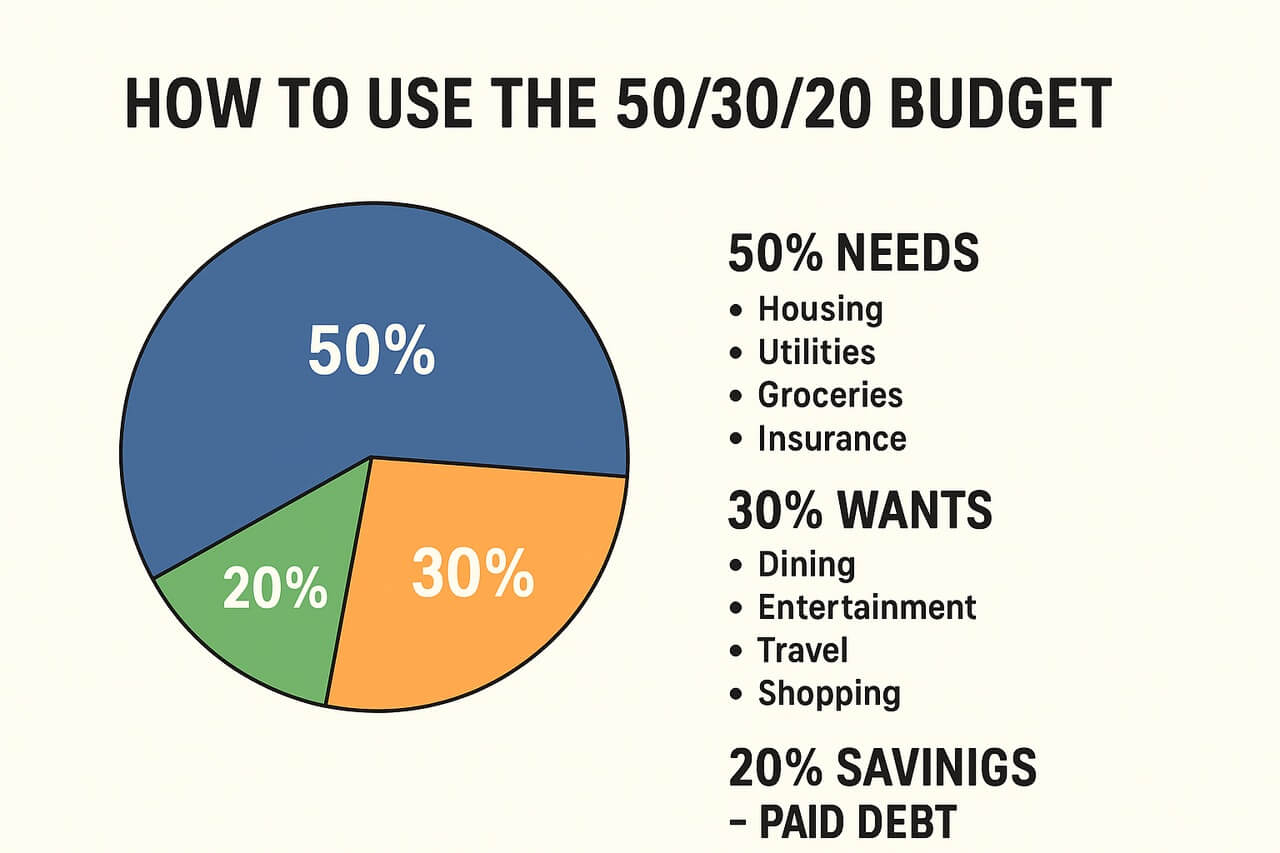

The 50/30/20 rule is a budgeting method popularized by Elizabeth Warren in her book, ”All Your Worth: The Ultimate Lifetime Money Plan.” The 50/30/20 rule is a straightforward way to divide your after-tax income into three main categories:

50% for Needs: These are your essential expenses – the things you absolutely must pay for to live and work.

30% for Wants: These are your non-essential expenses – things you enjoy but could technically live without.

20% for Savings and Debt Repayment: This portion is dedicated to securing your financial future and eliminating debt.

Let’s break down each category in more detail:

50% for Needs: The Essentials

These are your recurring expenses that you absolutely must pay and purchases that are necessary for your survival and well-being. Examples include:

- Housing: Homeowner’s insurance, property taxes, Rent or mortgage payments.

- Transportation: Car payments, car insurance, gas, essential maintenance, and public transportation costs.

- Food: Groceries (not eating out excessively), basic household supplies.

- Utilities: Electricity, water, gas, and internet (often a necessity for work).

- Healthcare: Health insurance premiums, necessary medications, and doctor visits.

- Minimum Debt Payments: The minimum required payments on loans and credit cards.

30% for Wants: Enjoying Life (Within Reason)

This category is where you have more flexibility and can spend on things that enhance your quality of life but aren’t necessary. This extra spending makes your life more enjoyable and entertaining. Examples include:

- Entertainment: Eating out, movies, concerts, hobbies, streaming services.

- Travel: Vacations, weekend getaways.

- Shopping: Clothes beyond the essentials, electronics, and home decor.

- Upgraded Services: Premium subscriptions, higher-tier memberships.

- More Expensive Food Choices: Frequent takeout or gourmet food items.

This 30% allows you to enjoy your money and avoid feeling deprived. However, it’s crucial to be mindful of overspending in this category.

20% for Savings and Debt Repayment: Securing Your Future

Everyone should allocate 20% of net income for savings and investments. This crucial portion is dedicated to building your future financial security and eliminating financial burdens. It should be allocated as follows:

- Savings: Emergency fund (aim for 3-6 months of living expenses), retirement savings (401(k), IRA, etc.), savings for future goals (down payment on a house, education, etc.).

- Debt Repayment: Paying more than the minimum on high-interest debts like credit cards and personal loans. Once those are paid off, you can allocate more to savings or other financial goals.

First, build an emergency fund before further debt repayment beyond the minimum payment. This provides a safety net and can prevent you from going back into debt for unexpected expenses.

Implementing the 50/30/20 Budget: Practical Steps

Now you understand the principles, here’s how to put the 50/30/20 budget into action in your own life:

1. Calculate Your After-Tax Income

Start by determining your net monthly income – the money that hits your bank account after taxes and other deductions (like health insurance premiums) are taken out. This is the base amount you’ll be dividing.

2. Track Your Least Month’s Spending

Use budgeting apps, spreadsheets, or even a notebook to track every dollar you spend for a month. This will give you a clear picture of where your money is currently going and help you identify which category each expense falls into.

3. Categorize Your Expenses

Review your tracked spending and assign each expense to one of the three categories: Needs (50%), Wants (30%), or Savings/Debt (20%). Be honest with yourself!

4. Calculate Your Target Spending Limits

- Multiply your after-tax income by 0.50 to determine your target for “Needs.”

- Multiply your after-tax income by 0.30 for “Wants.”

- Multiply your after-tax income by 0.20 for “Savings and Debt Repayment.”

5. Adjust Your Spending to Align with Your Targets

Compare your current spending with target limits in each category.

If you’re over in “Needs”: Look for areas to potentially reduce essential expenses (For example, refinancing your mortgage, finding cheaper car insurance, and meal prepping to lower grocery costs).

If you’re over in “Wants”: This is usually the easiest area to adjust. Identify non-essential spending you can cut back on.

If you’re under in “Savings”: This is a great opportunity to increase your contributions to your emergency fund, retirement accounts, or accelerate your debt payoff.

6. Track Your Progress and Make Adjustments

Continue tracking your spending regularly (weekly or even daily initially) to ensure you’re staying within your target percentages. The 50/30/20 budget rule is a guideline, not a rigid rule. You may need to make slight adjustments based on your individual circumstances and financial goals. For example, if you have high-interest debt, you might temporarily allocate more than 20% to debt repayment.

Benefits of Using the 50/30/20 Budget in the USA

- Simplicity: It’s easy to understand and implement compared to more complex budgeting methods.

- Flexibility: It allows for discretionary spending (“wants”) so you don’t feel deprived.

- Prioritization: It automatically prioritizes saving and debt repayment.

- Financial security: It allows you to prioritize your financial future by continuously saving 20% of your salary. These savings can help you grow wealth and achieve your financial objectives.

- Adaptability: It can be adjusted to fit different income levels and financial goals.

- Provides a Framework: It gives you a clear structure to guide your spending decisions.

Best Tools to Track the 50/30/20 Budget

- Mint – Free app that automatically categorizes spending.

- YNAB (You Need A Budget) – Great for goal-setting and intentional spending.

- Personal Capital – Strong investment and retirement tracking features.

- Excel/Google Sheets – Customizable for DIY budgeters.

Common Challenges and How to Overcome Them

- Variable Income: If your income fluctuates, calculate your percentages based on your average income over the past few months. You may need to make adjustments every month.

- High Cost of Living in Certain Areas: In expensive cities in the USA, 50% of the needs might feel tight. You may need to find creative ways to reduce essential expenses or adjust the percentages slightly while still prioritizing savings and debt repayment.

Pros and Cons of the 50/30/20 Budget

Pros:

- Simple and easy to follow

- Encourages savings discipline

- Leaves room for enjoyment

Cons:

- May not fit high-cost areas perfectly

- Doesn’t account for irregular income well

- Requires adjustments for unique financial goals

Tips for Success with the 50/30/20 Budget

- Review your budget monthly.

- Automate savings to reduce temptation.

- Use cash envelopes for wants if you overspend.

- Revisit allocations when income or expenses change.

Conclusion: Take Control with the 50/30/20 Budget

The 50/30/20 budget offers a practical and sustainable approach to managing your money effectively in the USA. By understanding its core principles, implementing it step by step, and making necessary adjustments, you can take control over your finances, achieve your savings goals, and build a more secure financial future without feeling overly restricted. Start today, track your progress, and enjoy the peace of mind that comes with knowing where your money is going and working towards your financial well-being.

Frequently Asked Questions (FAQs) About the 50/30/20 Budget

1. Does the 50/30/20 rule use gross income or net income?

The 50/30/20 budget rule uses your net income, also known as your after-tax income. This is the amount of money that actually hits your bank account after all deductions have been taken out (federal and state taxes, Social Security, etc.). Your percentages (50%, 30%, 20%) should only be applied to this available amount.

2. Where should debt payments go in the budget?

This is the most common point of confusion! Debt payments are split across two categories:

Minimum Payments (the lowest amount you must pay to avoid fees/defaults) go under 50% Needs. Extra Payments (any amount you pay above the minimum to accelerate payoff) go under 20% Savings & Debt Repayment.

This ensures your goal of getting out of debt is prioritized in the savings bucket.

3. What if my “Needs” are currently over 50%?

If your essential expenses (50% Needs) exceed 50% of your income, you have two primary options:

- Reduce Your Needs: This is often the hardest, but most effective, route. Look at your biggest “Need” expenses like housing or transportation and see if you can lower them (For example: downsizing your home, refinancing your car loan, finding a cheaper insurance plan).

- Increase Your Income: A temporary side hustle or seeking a raise can help bring the 50% back into alignment with your income level.

You must reduce the “Needs” or increase income before you can successfully implement the 50/30/20 rule long-term.

4. Should retirement contributions go under the 50% (Deductions) or 20% (Savings)?

They should primarily be counted toward the 20% Savings. The 50/30/20 budget works best when applied to your net pay. If your retirement contributions (like 401(k) or IRA) are taken out before taxes (pre-tax), they effectively never show up in your take-home pay, but you should still mentally or practically account for them in the 20% savings goal. You are already hitting that goal with pre-tax contributions.

5. Is the 50/30/20 rule set in stone?

No, the 50/30/20 rule is a flexible guideline, not a rigid mandate. It is designed to be a starting point. For example:

- If you have very high-interest debt, you might temporarily use a 45/30/25 split to accelerate payoff.

- If you are rapidly saving for a down payment, you might use a 50/20/30 split.

The key is to always maintain a strong focus on the 20% for Savings and Debt Repayment.