If you have ever wondered how to start investing in the stock market, you are not alone. Investing isn’t just for Wall Street insiders anymore — it’s accessible, affordable, and a key step toward building long-term wealth. Whether you’re saving for retirement, planning for a big purchase, or just want to grow your money, this guide will walk you through the essentials of just starting your stock market journey with confidence.

With the right knowledge and taking things step by step, you can confidently enter into the world of investments and start growing wealth for your future. This guide is a clear path forward for actually doing things out there, right from acknowledging the basics to opening the right brokerage account and developing a viable investment strategy.

Why Invest in the Stock Market?

Let’s tackle the “why” before we begin. The stock market has historically brought 7–10% average annual returns (after inflation, U.S. Securities and Exchange Commission, 2023). Compared with savings accounts or doing nothing, it wins. And so you let your money work for you and grow through compounding. Some crucial principles must be understood before delving into the details of buying and selling stocks.

Key reasons to invest:

- Long-term wealth building

- Beating inflation

- Funding retirement through 401(k)s and IRAs

- Diversifying income beyond a paycheck

What is the Stock Market?

The stock market is a place where buyers and sellers exchange shares of publicly owned companies. When you buy a share of stock, you become a part-owner of that company.

Why Invest in the Stock Market?

Growth: Comparatively, historically, the stock market has been a better option for long-term investments with potential returns than conservative investments such as savings accounts or bonds.

Combating Inflation: Cash’s value is reduced due to inflation over time. Therefore, money in the stock market will earn at a rate higher than inflation.

Building Long-Term Wealth: Investing in the stock market is a key step in realizing long-term financial objectives such as retirement.

Understanding Risk and Return

All investments are risky to a certain extent. Higher returns are generally associated with higher risks. The stock market can be volatile, meaning your investment’s value may change from going up to going down all within a few months, but historically, a diversified stock portfolio makes a decent return in the long run.

Step-by-Step Guide: how to start investing in stock market

Here’s a clear, actionable plan to help you start investing in the stock market in the USA.

Step 1: Understand the Basics of Stock Market Investing

Before you invest, you need to understand the foundation.

- Stocks = Ownership in a company.

- Bonds = Loans you give to companies/governments.

- ETFs (Exchange-Traded Funds) = Baskets of stocks/bonds traded like a stock.

- Mutual Funds = Professionally managed groups of assets.

Note: If you are a beginner, ETFs or index funds are often the easiest and safest to enter into.

Step 2. Define Your Financial Goals and Risk Tolerance

Take a moment to think about your goals before investing a single dollar. What are your goals? Are you saving for retirement or a down payment on a house? Your time horizon can affect your investment strategy.

What does your risk appetite look like? Are you comfortable risking losses to attain higher long-term returns, or would you prefer a stable investment with lower risk?

Step 3: Set Clear Financial Goals

Ask yourself: Why am I investing?

- Short-term goals (1–3 years): Save in cash or high-yield savings (the stock market is too volatile).

- Medium-term goals (3–10 years): Mix of stocks and bonds.

- Long-term goals (10+ years): Higher stock exposure for growth.

Write down the risk you are willing to take and your timeline for the investments for both a clearer vision and better accountability.

Step 4: Open a Brokerage Account

Before you start investing in the stock market, you have to open a brokerage account to buy or sell stocks and other investment instruments. Among the types of brokerage accounts available in the USA are:

Taxable Brokerage Accounts: With ordinary investment accounts, realized capital gains are subject to tax.

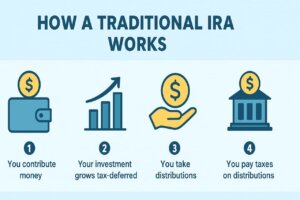

Retirement Accounts (IRAs and 401(k)s): As previously mentioned, these accounts offer tax benefits to long-term savers. If investments are aimed at retirement, it is best to maximize contributions into these accounts first.

Choosing a Brokerage Firm: Many top-notch online brokers serve neophytes in the USA with user-friendly platforms and educational resources with low or no commission charges. The popular choices are:

- Fidelity

- Charles Schwab

- Vanguard

- TD Ameritrade (now part of Schwab)

- Robinhood

- Webull

Important Points to Keep in Mind While Choosing a Broker:

Fees and Commissions: Most brokers currently charge no commission to trade stocks and ETFs. However, note that maintenance may incur other fees.

Minimum Account Balances: Some brokers require a certain minimum amount in order to see an account opened, but the majority of widely chosen structures have none.

Investment Options: Make sure the broker you choose has the types of investments you’re interested in (stocks, ETFs, mutual funds, etc.).

Platform and User Experience: Look for an easy-to-use and interpret platform, particularly for beginners. Most brokers boast a mobile app for convenient trading.

Educational Resources and Customer Support: Seek brokers that provide learning materials, webinars, and responsive customer support to help you through this journey in investing.

Step 5: Fund Your Brokerage Account

After you open an account, you need to deposit money into it. Brokers usually offer various ways to fund the accounts. These are:

Electronic Funds Transfer (EFT): Linking your bank account for direct transfers.

Wire Transfers: For larger amounts that need to be deposited.

Check Deposits: Some brokers may allow you to deposit checks.

Step 6: Pick a Trusted Brokerage Platform

For newbies, it should be quite easy and without high charges. Here are a few of the best-suited brokerages for beginners in the USA:

- Fidelity (great research + retirement tools)

- Charles Schwab (low fees + beginner-friendly)

- Vanguard (best for index funds + long-term investors)

- Robinhood (simple, app-based, but limited advanced features)

When choosing, consider: fees, account minimums, research tools, and educational resources.

Step 7: Build a Beginner-Friendly Portfolio

Your portfolio = your collection of investments. Diversification is key.

Sample Beginner Portfolio:

- 60% in a U.S. stock index fund (S&P 500 ETF like VOO)

- 20% in an international stock index fund

- 20% in a bond index fund

This balance spreads risk across markets while keeping growth potential strong.

Step 8: Decide What to Invest In

As a beginner, it’s often wise to start with simple, diversified investments.

Exchange-Traded Funds (ETFs): ETFs are baskets of stocks or bonds that track a specific index (like the S&P 500) or sector. They offer instant diversification and typically have low expense ratios (annual fees). Examples include:

- SPY (SPDR S&P 500 ETF Trust)

- IVV (iShares Core S&P 500 ETF)

- VTI (Vanguard Total Stock Market ETF)

Mutual Funds: Same with ETFs. Pool money from many different investors to buy a cost-effective diversified portfolio of securities, but usually, with higher expense ratios than ETFs.

Individual Stocks: After gaining some understanding of the market, you may choose to put your money in the individual stocks of companies that you believe in, but this is riskier than diversifying funds.

Step 9: Learn the Power of Dollar-Cost Averaging (DCA)

Instead of attempting to time the market, invest a fixed amount regularly, for example, $200 each month. It will smooth out volatility so that you are not emotionally invested and making mistakes.

Ways for Beginners to Invest:

Dollar Cost Averaging: Invest a fixed amount of money at regular intervals (e.g., $100 per month) regardless of the perf of the market. They should help to minimize the risk of buying high and should average out the price over time.

Buy and Hold: Have a long-term perspective and resist the temptation to buy and sell frequently based on short-term market blips.

Step 10: Place Your First Trade

Once you’ve chosen what you want to invest in, you can place a trade through your brokerage platform. You’ll typically need to specify:

The ticker symbol: The unique identifier for the stock or ETF (AAPL for Apple, SPY for the S&P 500 ETF).

The type of order:

Market Order: Executes your trade at the best available current price.

Limit Order: Allows you to specify the maximum price you’re willing to pay (for buying) or the minimum price you’re willing to accept (for selling).

The number of shares or the dollar amount you want to invest in.

Step 11: Monitor Your Investments and Stay Informed

Keep Learning and Stay Patient

The stock market rewards the person who holds and waits. Even small investment amounts compound massively. Case in point, an investment of $300 on a monthly basis at returns of eight percent annually amounts to approximately $450,000 after 30 years.

Resources for continuous learning:

- Investopedia (educational articles)

- SEC’s Investor.gov (official U.S. guidance)

- Podcasts like BiggerPockets Money or The Motley Fool

Once you’ve made your first investment, it’s important to monitor its performance.

Do not Panic Sell: The Stock market sees ups and downs, and there will be fluctuations over a time period in its affairs. Avoid conjectural purchase or sale due to such business fluctuations. Stick to your long-term strategy.

Review Your Portfolio Regularly: Take time off to peer into your portfolio, assuring that what is in it is still in line with your goals and risk tolerance.

Stay Updated: Discover the latest buzzwords in the financial world and familiarize yourself even more with the companies and sectors associated with your investments.

Common Mistakes to Avoid for New Investors

- Chasing hot stocks (like meme stocks).

- Investing without an emergency fund — always have 3–6 months’ expenses in cash.

- Ignoring fees — even 1% in annual fees can eat up thousands over time.

- Selling in panic — markets fluctuate; patience wins.

Investing Money You Can’t Afford to Lose: Only invest money that you won’t need for immediate expenses.

Trying to “Time the Market”: Predicting market highs and lows is extremely difficult, even for professionals. Focus on long-term investing.

Not Diversifying: Putting all your eggs in one basket (investing in only one stock) significantly increases your risk.

Letting Emotions Drive Your Decisions: Fear and greed can lead to poor investment choices. Stick to your plan.

Tools & Multimedia to Help You Invest

- Apps: Fidelity, Vanguard, Robinhood, M1 Finance

- Videos: YouTube channels like Graham Stephan or Andrei Jikh

- Books: The Little Book of Common Sense Investing by John Bogle

Visual learners can benefit from charts and infographics comparing investment growth, tax accounts, and diversification strategies.

Conclusion: Taking Your First Step Towards Financial Growth

Learning how to start investing in the stock market is the preparation you need for the long journey towards wealth. Take it slow. Make it consistent. In the USA, the learning process includes taking time to learn the basics, getting a brokerage account, having diversified investments, and remaining informed. With time, confidence will grow alongside the bank account. Take that first step today, and let the exciting journey of growing your financial future begin.

Frequently Asked Questions (FAQs)

Here are answers to some of the most common questions new investors ask about getting started in the US stock market.

1. What is the minimum amount of money I need to start investing in the stock market?

Today, there’s pretty much no baby requirement to start investing in the USA with regard to most of the big online brokerage houses. Commission-free trading and fractional shares allow you to invest as little as $5 or $10 of capital. Make consistency-involvement regularly at low amounts, rather than a big initial sum, the name of the game.

2. Should I invest in individual stocks or ETFs as a beginner?

You should invest in ETFs (Exchange-Traded Funds) initially. ETFs provide diversification because they bundle dozens or hundreds of different stocks under one fund, which enormously decreases your risk. Individual Stocks are pretty risky as they require thorough research because the decline of a single company means that your investment is at stake.

Start with broad market-ETFs first (S&P 500), and later on, gain more experience; you may consider small positions in individual stocks.

3. What does “commission-free trading” actually mean?

The brokerage has not charged a fee or commission when you buy or sell stocks or ETFs. For investors, especially beginners, this is a real boon, as it allows one to trade in small amounts of money without high costs taking away potential upward returns. Most of the major US brokers do this with their standard stock and ETF trades.

4. How often should I check my investment portfolio?

The “buy and hold” investor does not need to check their portfolio daily or even weekly, but that doesn’t mean that any of these won’t be harmful. Initially, one can plan to do it quarterly or biannually. It is all too easy to make emotional decisions (like selling in a panic during a downward movement) that will undercut your long-term strategy. The main point of the activity is to keep your contributions coming.

5. What is the tax difference between a retirement account and a taxable brokerage account?

Retirement Accounts (401(k), IRA): The benefits are “tax advantages.” Either you get a tax break at present (Traditional) or you will not pay tax on the future growth and withdrawals (Roth). These accounts are set up for long-term savings with strict withdrawal rules.

Taxable Brokerage Accounts could just as well not give any tax advantages to the taxpayer at the time of contribution. But any profit realized while selling an investment is subject to capital gains tax; if held for less than one year, it is treated as ordinary income; otherwise, it qualifies the investment for lower long-term capital gains tax rates.

6. If the market is volatile, should I stop contributing?

The answer to this is no. Volatility is normal and unpreventable in the market with regard to dollar cost averaging investing. Declines in the market should be viewed as a plus. A consistent investment buys more shares for that fixed amount; hence, increased returns when the market recovers. Staying the course, particularly in market downturns, is one of the most powerful ways.